Ethereum Price Forecast: ETH recovers $3,100 as Account Abstraction team outlines plan to unify L2s

Ethereum price today: $3,100

- The Account Abstraction team aims to enable users to perform cross-chain actions within a single wallet through Ethereum Interop Layer.

- Like what HTTP did for the early internet, EIL will enable wallets to function like browsers.

- ETH is attempting to hold a recovery above $3,100.

The Ethereum Foundation Account Abstraction team has outlined its objectives for the Ethereum Interop Layer (EIL), aiming to make all rollups "feel like" a single chain from a user experience angle.

"What if all the L2s felt like a single, unified Ethereum? No bridges to think about, no chain names to recognize, no fragmented balances or assets," the team wrote in a blog post on Tuesday. "That's the vision of the Ethereum Interop Layer (EIL): making Ethereum feel like one chain again — while preserving the trust-minimized, decentralized foundations we all care about."

While Ethereum has significantly scaled throughput and reduced costs through Layer 2 (L2) networks, it has also introduced new challenges, including the technical burden of managing multiple chains, friction, extra trust assumptions, and bridge hacks. According to Chainalysis, users lost over $2 billion to cross-chain bridge hacks in 2022, with the majority of those hacks occurring via L2 bridges.

The current cross-L2 environment functions like centralized exchanges, "with bridge operators, relayers, solvers, and opaque off-chain infrastructure," noted Ethereum researcher Yoav Weiss.

EIL will do for Ethereum what HTTP did for the internet

Based on the ERC-4337 account abstraction, which introduced smart wallet functionality, EIL enables users to perform cross-chain actions within a single wallet transaction while abstracting away the complexities.

"Users transact directly on all chains; trustless liquidity providers supply funds but never interact directly with users, nor see their transactions," wrote Weiss.

The post states that EIL will do for Ethereum what HTTP did for the early internet, making wallets function similarly to browsers, and "the network feels like one seamless experience than a patchwork of islands."

The EF's Account Abstraction team highlighted several potential benefits from its wallet-centric cross-chain roadmap, including UX simplicity, easy compatibility with new rollups, default multichain-native dapps and wallets, reduced developer workload and a trust-minimized environment.

The post coincides with the ongoing Ethereum Devconnect in Buenos Aires, Argentina.

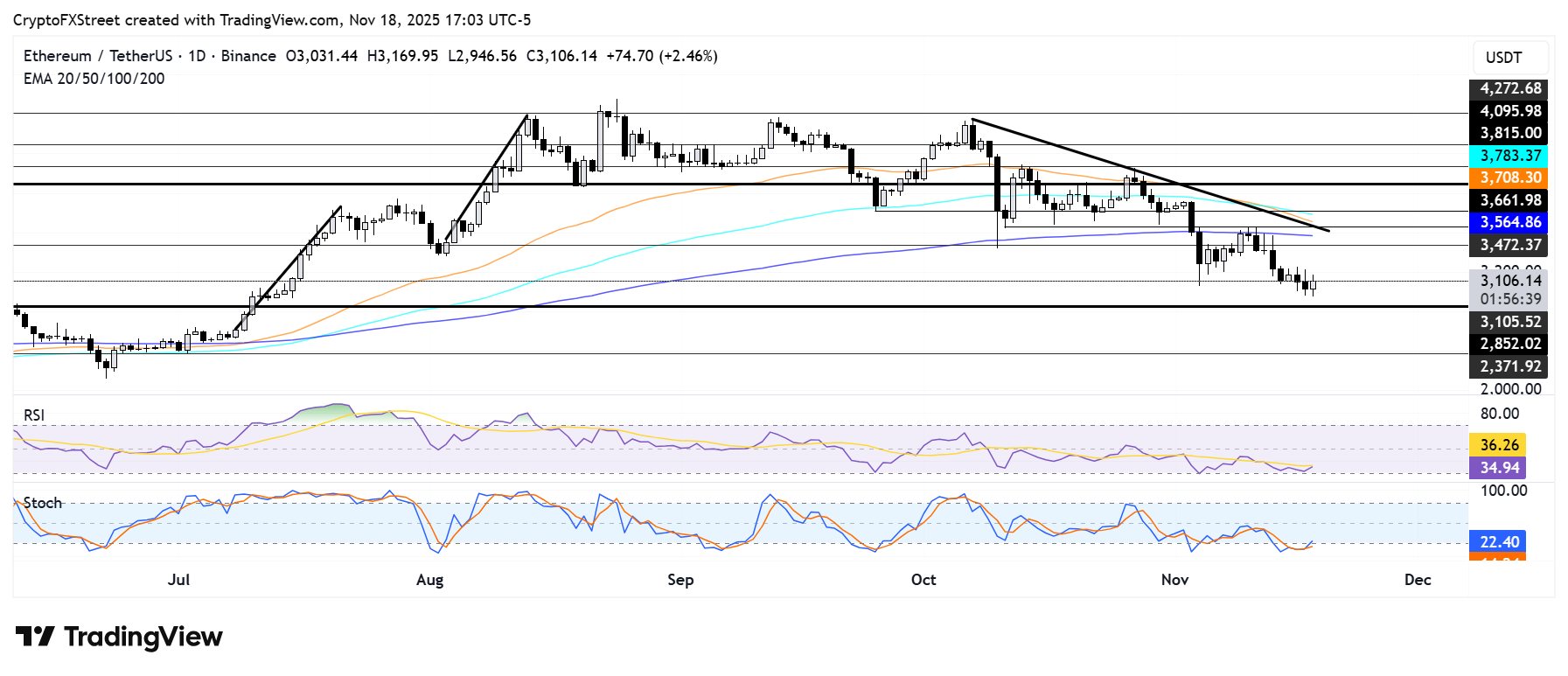

Ethereum Price Forecast: ETH attempts to hold a recovery above the $3,100 support

Ethereum saw $98 million in liquidations over the past 24 hours, led by $49.7 million in long liquidations, per Coinglass data.

After establishing a low just below $2,950, ETH is attempting to hold a recovery above the support near $3,100. If bulls defend this level, ETH could rise to test the resistance around $3,470.

However, a failure to hold $3,100 could push the top altcoin toward the support near $2,850. Further down is the $2,380 support level.

The Relative Strength Index (RSI) is below its neutral level but showing signs of ticking upward, while the Stochastic Oscillator (Stoch) has recovered from the oversold region. The move indicates a slight weakness in bearish momentum.