Goldbug Peter Schiff Calls MSTR a ‘Fraud’—Analysts Say It Could Still Outperform Bitcoin

MicroStrategy (MSTR) is at the center of a heated debate, as Peter Schiff labels the company’s business model a fraud. Schiff warns that MSTR’s reliance on high-yield preferred shares and income-oriented funds is unsustainable, predicting that the company could eventually go bankrupt.

Yet analysts and traders argue that MSTR’s strategy may still offer unique leveraged Bitcoin exposure, fueling a split in market sentiment.

Schiff Slams MSTR as ‘Fraud’ but Analysts Argue It May Outrun Bitcoin

According to Schiff, MicroStrategy’s preferred-share financing model could trigger a “death spiral,” with the goldbug terming the firm’s entire business model a fraud.

Schiff’s sentiment stems from concerns over MicroStrategy’s business model, which relies on income-oriented funds buying its “high-yield” preferred shares. According to Schiff, those published yields may never actually be paid.

“Once fund managers realize this, they’ll dump the preferreds & MSTR won’t be able to issue any more, setting off a death spiral,” he noted.

MicroStrategy stopped issuing new convertible bonds in February 2025, shifting instead to preferred share offerings (the STR series), which commenced in September 2025.

These preferred shares carry significantly higher interest rates, suggesting investors now demand stronger incentives amid tightening market conditions.

Schiff’s broader argument emphasizes the structural risks inherent in the company’s approach. His bone of contention is that even if Bitcoin rises, MSTR’s debt-fueled model could fail, putting the firm at risk of insolvency.

Crypto trader KillaXBT highlighted a potential Black Swan scenario. According to the analyst, a 50–60% drop in BTC could lead to tighter loan rules, collateral calls, and forced Bitcoin sales, especially if liquidity dries up.

He likened MicroStrategy to a stack of cards built on Bitcoin, noting that leverage amplifies both gains and losses, and a major market correction could strain the company’s financing.

Analysts Defend MSTR’s Leverage Model

Despite the warnings, some investors view MSTR as a leveraged play on Bitcoin that outperforms standard ETFs (exchange-traded funds). Adam Livingstone argued that MSTR combines 1:1 Bitcoin exposure with annual increases in BTC per share, a form of convexity that compounds returns without liquidation risk.

He illustrated a decade-long hypothetical: $100,000 in IBIT could grow to $1.38 million, whereas the same investment in MSTR could reach $3.56 million. This translates to a 158% outperformance.

Another popular user on X (Twitter), Rohan Hirani, added that MSTR’s premium exists because investors are buying a management team with global capital access capable of acquiring additional BTC efficiently. This is in contrast to simply buying Bitcoin.

He emphasized that MSTR’s 2025 preferred stock offerings represent a pivot toward more sustainable financing, striking a balance between execution risk and long-term upside.

Financing Momentum and Market Dynamics

MicroStrategy has gradually shifted from convertible bonds to higher-interest preferred shares (STR series) since September 2025, reflecting cautious investor sentiment amid tightening markets.

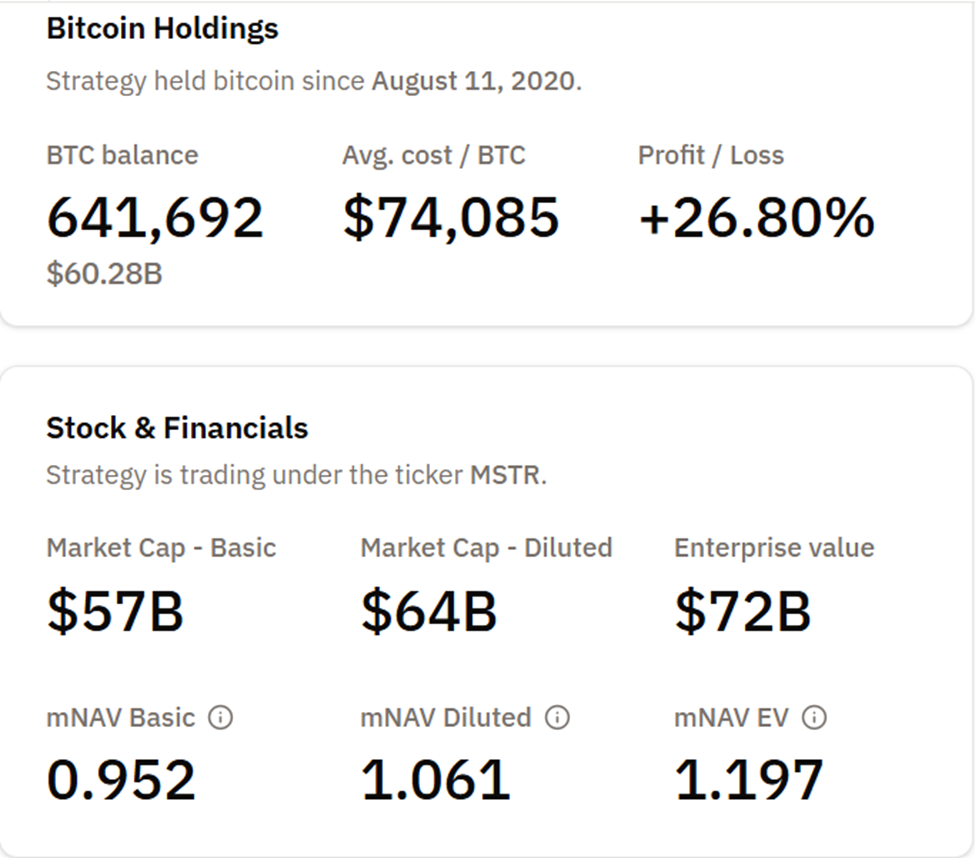

As of this writing, the firm holds 641,692 BTC at an average cost of $74,085 per coin, retaining roughly 26% unrealized gains even if BTC retraces sharply.

MicroStrategy BTC Holdings. Source: Bitcoin Treasuries

MicroStrategy BTC Holdings. Source: Bitcoin Treasuries

Analysts note that MSTR functions as a de facto leveraged Bitcoin ETF, where share value depends heavily on both Bitcoin prices and successful financing.

Despite temporary setbacks, such as the loss of the MSTR Bitcoin premium last week, investors highlight the company’s strategic positioning in digital credit markets as a driver of long-term value. MSTR’s model, while risky, provides double exposure:

- Bitcoin price appreciation, and

- Incremental BTC per share.

MicroStrategy’s hybrid strategy must weather volatility, maintain financing momentum, and continue outpacing Bitcoin exposure to assuage skeptical concerns. Nonetheless, the company remains a notable example in corporate Bitcoin strategy, striking a balance between leveraged opportunities and systemic risk.