Will Trump’s $2,000 Tariff Stimulus Checks Impact the Crypto Market?

The Trump administration’s plan to issue tariff-funded “dividend” payments has triggered debate across financial markets, including crypto.

The White House said President Trump remains committed to offering $2,000 per person, funded by tariff revenue.

Past Stimulus Checks Show a Bullish Scenario For Crypto Markets

As of now, officials are still discussing income limits. Treasury Secretary Scott Bessent indicated that households earning under $100,000 may be eligible.

However, the structure remains unclear. The administration has not confirmed whether payments would arrive as direct checks or as tax relief. Economists warn that both options face revenue and legislative hurdles.

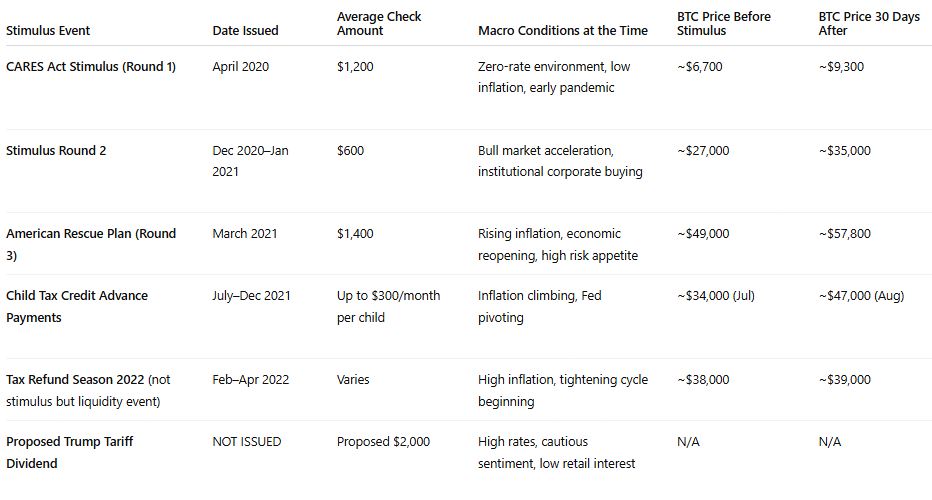

Still, the crypto industry is watching closely. Past stimulus cycles show that direct payments often increase liquidity in risk assets like Bitcoin.

During 2020 and 2021, exchanges reported higher small-ticket Bitcoin purchases immediately after stimulus deposits. Bitcoin also gained sharply in the 30 days following earlier checks.

How Past US Stimulus Payments Correlated With Bitcoin Price Moves

How Past US Stimulus Payments Correlated With Bitcoin Price Moves

Yet today’s environment is different. Crypto sentiment is weak, retail participation is low, and volumes have thinned. Bitcoin has traded mostly sideways for a week, slipping from the $107,000 range on profit-taking.

Because of this, analysts say any new liquidity could influence short-term behaviour. Direct checks would likely boost retail buying more than tax credits.

Even a modest increase in risk appetite could spark volatility in a market already showing reduced momentum.

However, the broader cycle hinges on macro conditions. High interest rates, inflation pressure, and fragile sentiment may limit the impact of any payout.

Prior examples, such as the 2022 tax refund season, show that liquidity injections fail to lift crypto when the macro backdrop is restrictive.

Overall, the relevance of Trump’s proposal depends on its final form. Immediate cash payments may create a short-term upside, but they are unlikely to reset the long-term trend unless broader economic conditions shift.

The policy remains under discussion, and its effect on crypto will depend on speed, scale, and delivery.