FalconX Acquires 21Shares, Expanding Into Crypto ETFs Market

FalconX has announced an acquisition of 21Shares, combining prime brokerage infrastructure with the world’s largest crypto ETP platform.

FalconX Pushes Into Crypto ETFs & ETPs With 21Shares Acquisition

As announced in a press release, FalconX has agreed to acquire 21Shares. FalconX is an institutional crypto prime brokerage that provides large clients with deep global liquidity, derivatives, financing, custody, and settlement across digital asset markets. It has facilitated over $2 trillion in trading volume and hosts a global client base of more than 2,000 institutions.

Meanwhile, 21Shares is the largest issuer of crypto exchange-traded funds and products (ETFs/ETPs). ETFs/ETPs refer to investment vehicles that allow investors to gain exposure to an underlying asset without directly having to own it. When a trader invests into one of these vehicles, the provider buys and custodies the asset on their behalf.

Some investors may be wary of navigating crypto exchanges and wallets, so products like ETFs and ETPs provide for a more regulated means of investment into digital assets, in a mode that’s more familiar.

21Shares has 55 of these products listed currently, across which it manages over $11 billion in assets. With the acquisition, its asset management product development and distribution capabilities will be combined with FalconX’s institutional-grade infrastructure.

The press release noted:

Together, the two firms will accelerate the creation of tailored investment products that meet growing institutional and retail demand for regulated digital asset exposure.

While FalconX is acquiring 21Shares, the latter will continue to operate independently, with Russell Barlow, its current CEO, remaining in charge. Barlow will work closely with FalconX leadership to advance a shared vision for the digital asset ecosystem. “No changes to the construction or investment objectives of the existing 21shares ETPs (Europe) or ETFs (US) are planned,” said the press release.

In some other news, the Bitcoin derivatives landscape has been changing recently, as on-chain analytics firm Glassnode has highlighted in an X post. Previously, the Futures market was dominant, but now the Options market is beginning to rival it in terms of Open Interest.

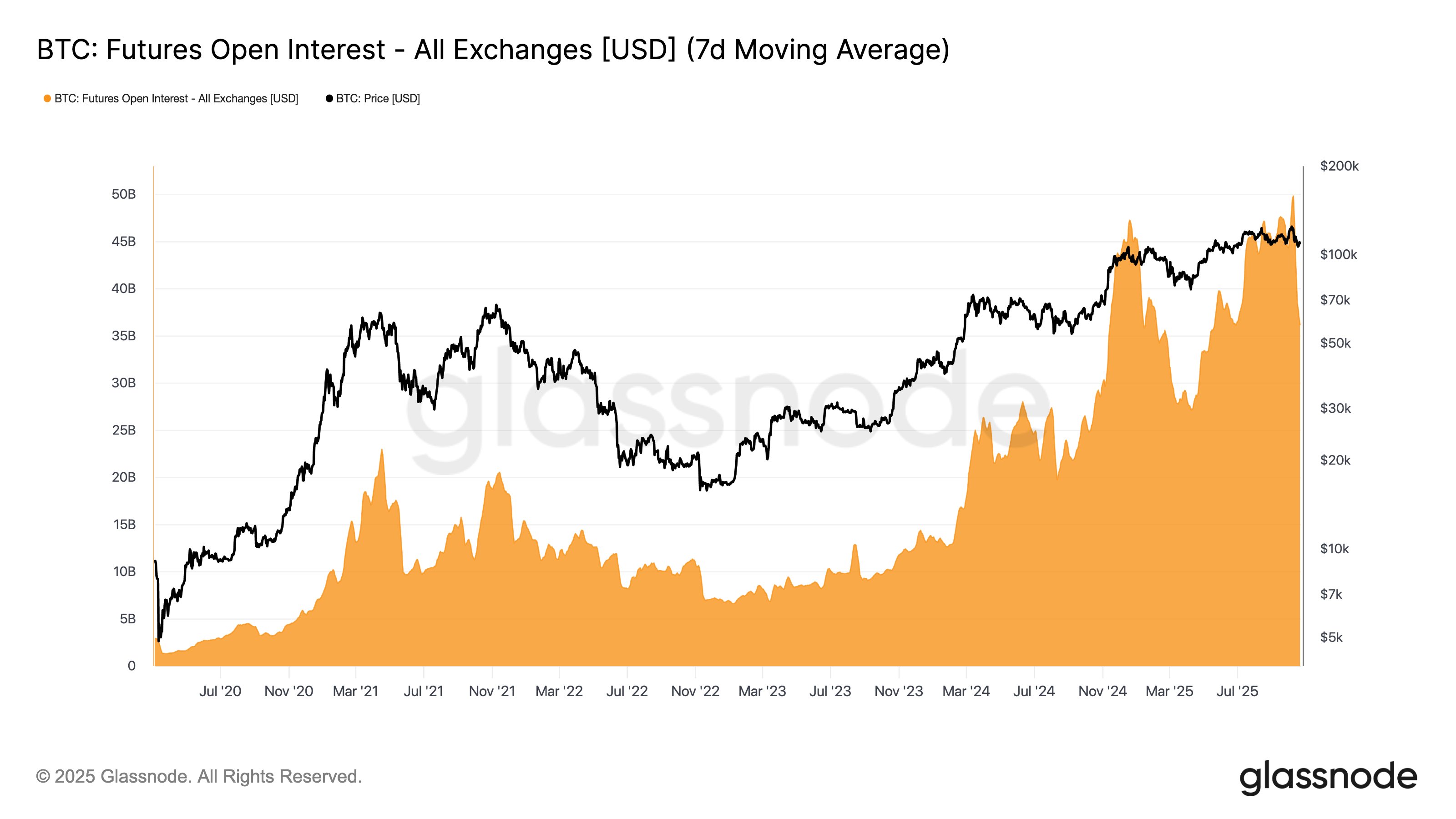

The Open Interest here is naturally a measure of the total amount of positions related to the crypto that are currently open on all derivatives exchanges. First, here is a chart that shows the trend in this metric for the Futures market:

As displayed in the above graph, the Bitcoin Futures Open Interest saw peaks above $20 billion in the 2021 bull market and recently reached a high of about $50 billion.

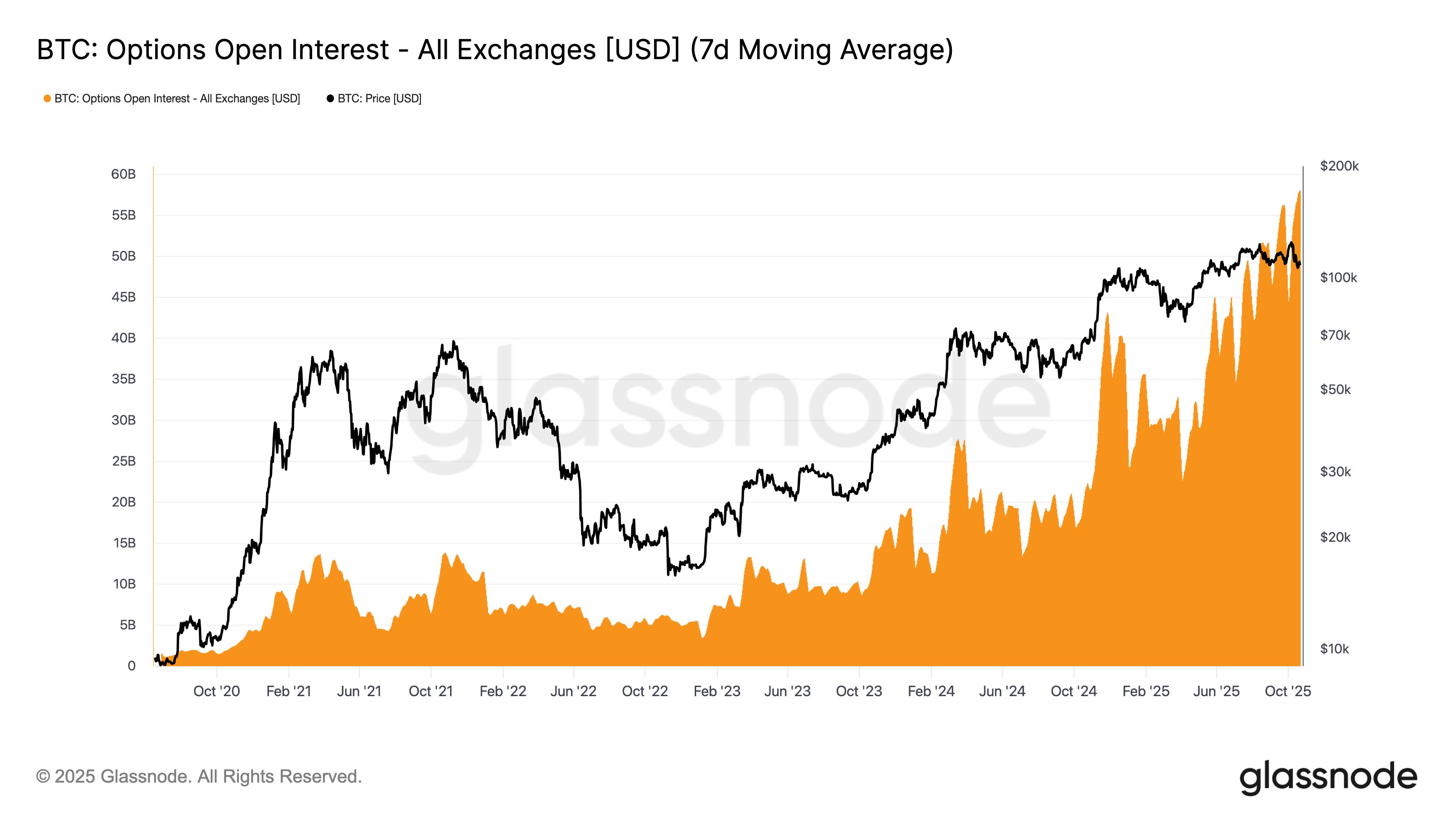

The Options Open Interest couldn’t even break $15 billion in the last cycle, but today its 7-day moving average (MA) value is floating around a new all-time high (ATH) of more than $55 billion.

As the analytics firm has explained,

Markets are shifting toward defined-risk and volatility strategies, meaning options flows, rather than futures liquidations, are becoming a more influential force in shaping price action.

Bitcoin Price

At the time of writing, Bitcoin is floating around $107,800, down over 4% in the last 24 hours.