Kadena drops 70% as blockchain announces shutdown and exchanges begin delisting

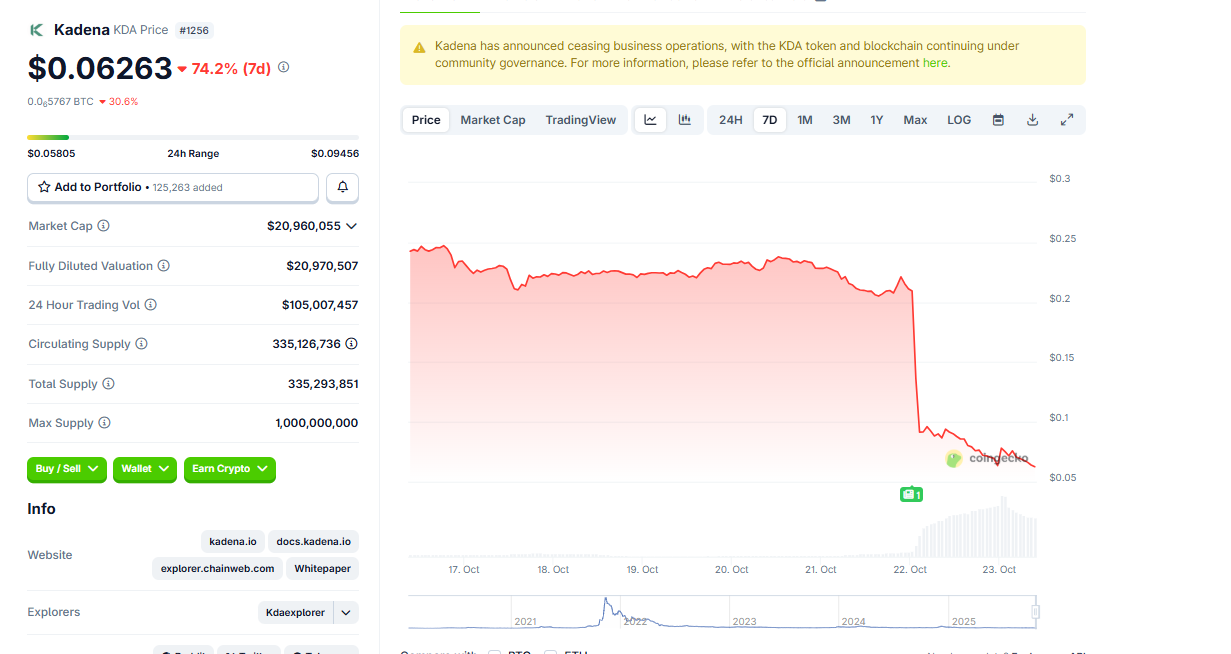

- Kadena price trades below $0.065 on Thursday after dropping more than 70% so far this week.

- KDA announces that the organization can no longer continue business operations and will cease all business activities.

- Crypto exchanges are starting to delist the KDA token.

Kadena (KDA) price drops below $0.065 at the time of writing on Thursday after crashing more than 70% so far this week. This price drop comes as the company behind the Kadena network announced that it's closing down due to market conditions. Adding to the bearish outlook, the token is being removed from prominent crypto exchanges.

Why is Kadena's price falling?

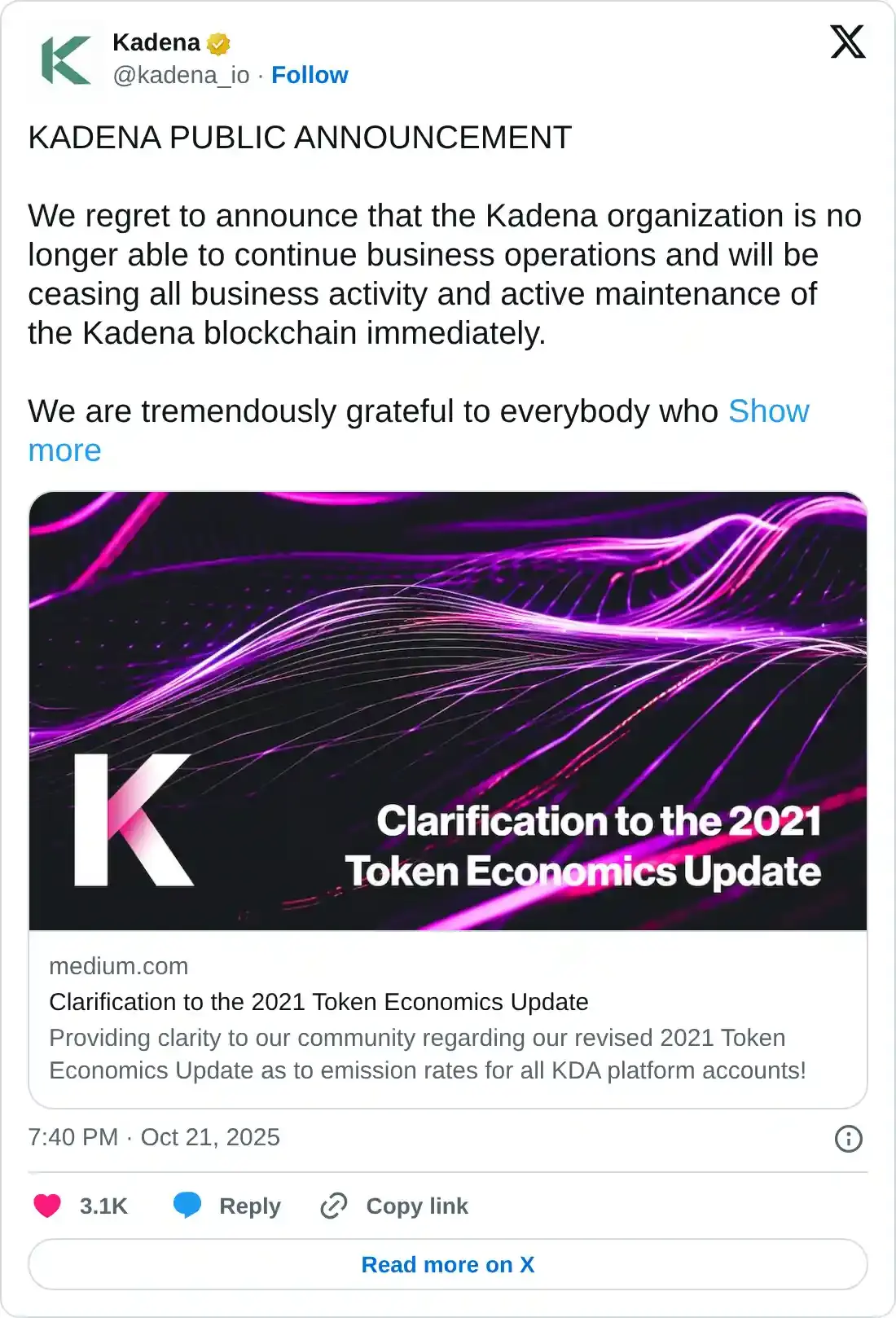

Kadena announced on Tuesday through its official X post that it can no longer continue business operations and will immediately cease all business activity and active maintenance of the Kadena blockchain.

This announcement led to a sharp drop in the Kadena native token KDA price, which has fallen nearly 70% so far this week. Adding to this bearish outlook, many centralized crypto exchanges, such as Bybit and OKX, both said on Wednesday that KDA trading services are starting to be removed from their respective exchanges.

The delisting of the token from exchanges further supports the bearish outlook as it reduces liquidity and investor access, accelerating the sell-off pressure on KDA.

Apart from this, the Kadena team said that the Kadena blockchain operates independently through decentralized proof-of-work mining and smart contracts governed by individual maintainers, meaning the company's shutdown won't halt network operations. Developers plan to release an updated binary to ensure uninterrupted service without their involvement.