Ethereum Price Forecast: ETH continues recovery as BitMine expands treasury by 202K ETH

Ethereum price today: $4,220

- Ethereum treasury BitMine scooped up over 202,000 ETH following the crypto market crash last week.

- The firm has now achieved more than half of its vision to acquire 5% of the entire ETH circulating supply.

- ETH is facing resistance near $4,270 as it continues its recovery march.

Ethereum (ETH) trades above $4,200 on Monday following BitMine's (BMNR) latest update that it bought over 202,000 ETH during last week's crypto market crash.

BitMine holdings cross 3 million ETH, over 2.5% of circulating supply

Ethereum treasury firm BitMine Immersion scooped up 202,037 ETH following the market dip last week.

The latest purchase has expanded the company's Ethereum stash to 3.03 million tokens, bringing it more than halfway closer to its vision of acquiring 5% of the entire ETH circulation, according to a Monday statement.

"The crypto liquidation over the past few days created a price decline in ETH, which BitMine took advantage of," wrote BitMine Chairman Thomas Lee.

The Nevada-based firm also reported holdings of 192 Bitcoin (BTC), a $135 million stake in Worldcoin (WLD) treasury, Eightco Holdings, and unencumbered cash of $104 million.

BitMine ranks as the largest ETH treasury, leading its closest competitor, SharpLink Gaming (SBET), by over 3.5x. The company also claims it was the twenty-second most traded stock in the US last week, with an average trading volume of $3.5 billion.

BMNR is up over 3% at the time of publication on Monday.

Last week, investment management firm Kerrisdale Capital disclosed a short position on BitMine, highlighting declining net asset value (NAV) premiums and waning interest in the crypto treasury "playbook."

Ethereum Price Forecast: ETH faces resistance near $4,270 en route to recovery

Ethereum is seeing a recovery on Monday after the $19.1 billion crypto leverage wipeout on Friday, where ETH liquidations comprised over $4.3 billion.

"Volatility creates deleveraging and this can cause assets to trade at substantial discounts to fundamentals, or as we say, 'substantial discount to the future' and this creates advantage for investors, at the expense of traders," added Lee.

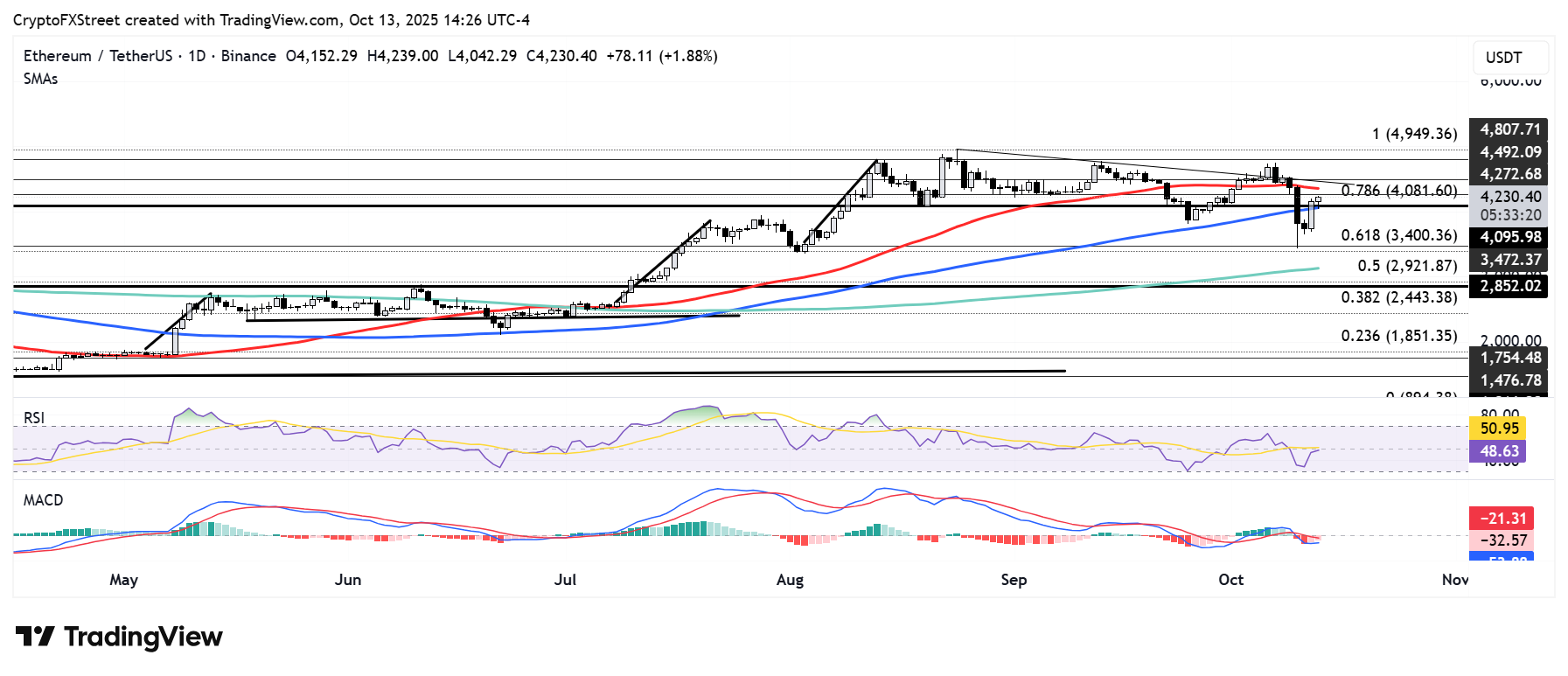

ETH faces resistance near the $4,270 level, after recovering the $4,100-$4,000 support range, which is strengthened by the 100-day Simple Moving Average (SMA).

ETH/USDT daily chart

The recovery above $4,000 comes after bulls defended the support near $3,470 during the crypto market's flash crash on Friday. This level could prove crucial if the market tilts downward again.

The Relative Strength Index (RSI) is trending upward toward its neutral level, while the Moving Average Convergence Divergence (MACD) is posting receding red histogram bars. A firm crossover in both indicators will validate a resumption of bullish momentum.