Pi Network Price Forecast: Why PI could repeat Consensus 2025 crash during Token 2049 event

- Pi Network extends the consolidation phase for the fifth straight day.

- PI registered a 42% decline during the Consensus 2025 event attended by Pi Network’s co-founder, Nicolas Kokkalis.

- The upcoming Token 2049 conference will have PI co-founder Chengdiao Fan as a speaker, risking a similar correction in the token.

Pi Network (PI) price edges lower by 1% at the time of writing on Tuesday, ahead of the Token 2049 event in Singapore, which PI co-founder Chengdiao Fan will attend. However, the public appearances of Pi Network’s co-founders have met with significant pushback, suggesting that Chengdiao Fan's visit to Token 2049 could result in a PI pullback similar to the crash seen at Consensus 2025 in Toronto.

Pi Network remains vulnerable ahead of the Token 2049

Pi Network’s co-founder, Chengdiao Fan, will make a public appearance at the Token 2049 event in Singapore on Wednesday. Fan will give a talk on “Crypto’s Future: From Liquidity to Utility - Web3 Pathways to Innovation,” which aligns with the ongoing Pi Network Hackathon, boosting development and the ongoing protocol shift to Stellar version 23.

However, public appearances of PI co-founders carry the risk of a potential sell-off wave, as seen previously at the first-ever event visit by Nicolas Kokkalis to Consensus 2025, which took place in Toronto between May 14 and May 16, coinciding with a 42% decline in the PI price. A more recent example of this was the visit of Kokkalis and Fan to the community meetup in Seoul on September 22, which resulted in a nearly 20% pullback.

With Fan coming to the Token 2049 stage on Wednesday, PI could face another correction.

Pi Network holds steady at a crucial crossroad

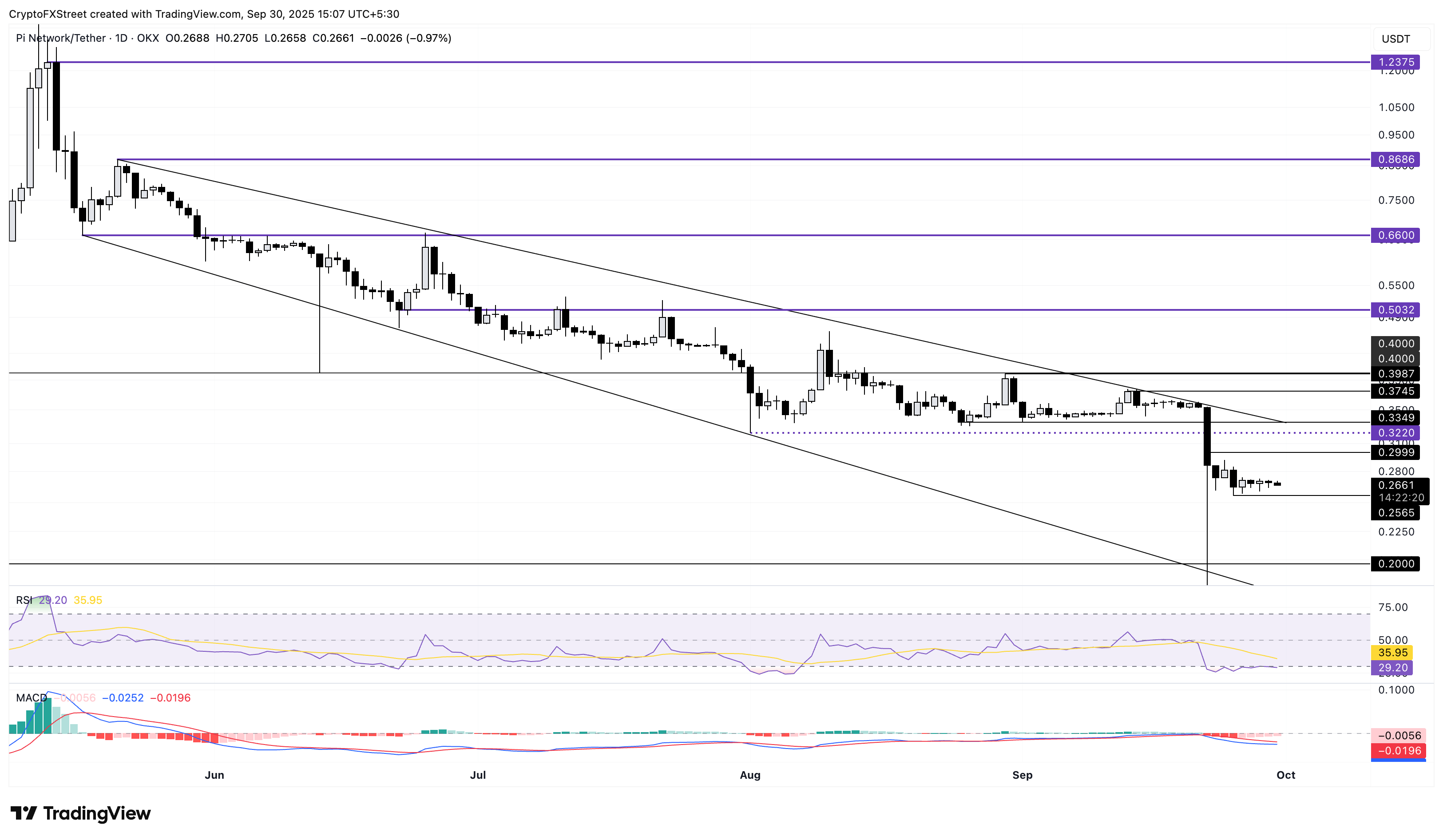

Pi Network trades above $0.2600 at press time on Tuesday, holding steady after the 6% crash on Thursday. A potential drop below Thursday’s low at $0.2565 could provide an early signal of a steeper correction as PI remains vulnerable.

Still, the Relative Strength Index (RSI) reads 29 on the daily chart, hovering near the oversold boundary line, which indicates a saturation in bearish pressure. Additionally, the Moving Average Convergence Divergence (MACD) moves closer to its signal line, indicating a potential crossover that would suggest a rise in bullish momentum.

PI/USDT daily price chart.

If the PI token rebounds from the $0.2565 support floor, the crucial areas of resistance would be the $0.3000 psychological level, followed by the overhead trendline at $0.3349.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.