Binance-backed Aster surges 15% with perp DEX volume exceeding $11 billion

- Aster soars to a new all-time high of $2.14 despite volatility capping recovery in the broader crypto market.

- Aster perp DEX trading volume tops $11 billion in 24 hours, signaling growing adoption.

- Aster is a decentralised perpetual contract exchange backed by YZi Labs, formerly Binance Lab.

Aster (ASTER) price surged to a new all-time high of $2.14 and retreated slightly, trading below $2.00 at the time of writing on Tuesday. The token native to Aster, a decentralized exchange (DEX) dedicated to trading perpetual contracts (perps) on Binance, is backed by YZi Labs, formerly known as Binance Labs.

Aster DEX volume tops $11 billion

Aster perp DEX volume has surged, exceeding $11 billion within a few days of launching, underscoring growing adoption. According to the exchange’s official website, the cumulative trading volume currently stands at $544 billion, with over 524,000 users.

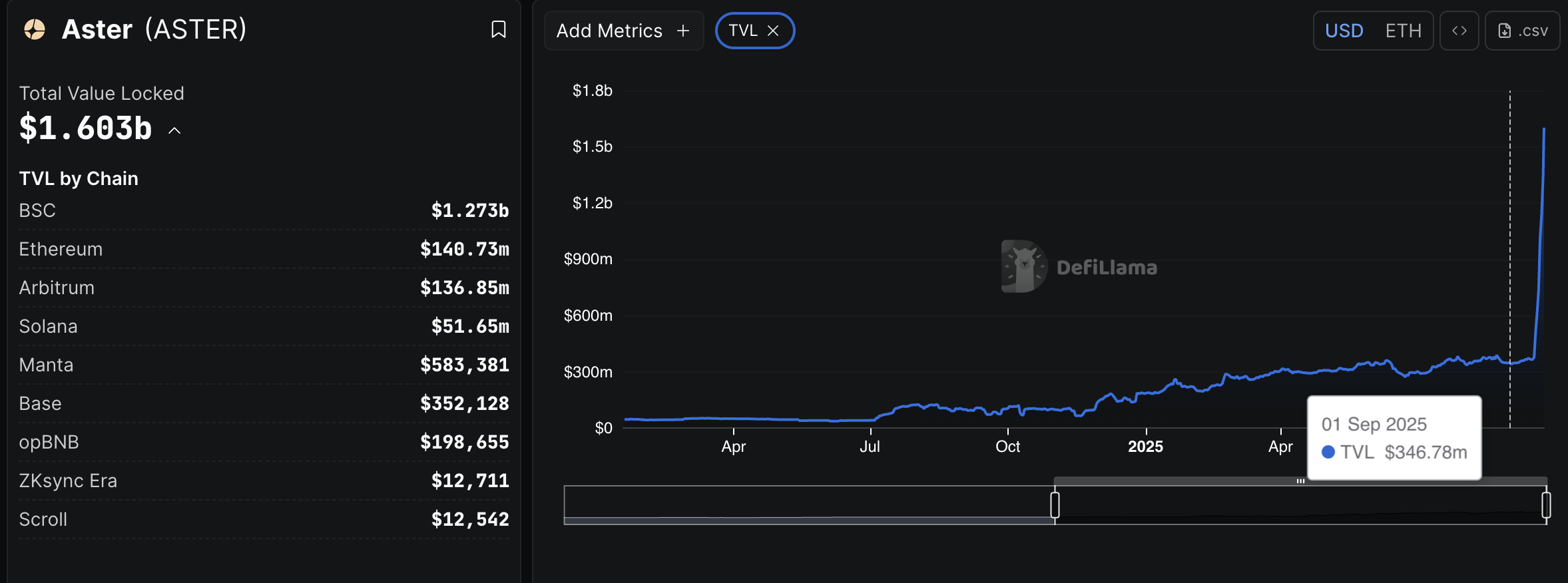

The protocol’s self-reported Open Interest (OI) stands at $255 million, with the Decentralized Finance (DeFi) trading Total Value Locked (TVL) averaging $776 million at the time of writing.

According to DefiLlama, the TVL, which refers to the total value of all coins locked in smart contracts on the protocol, has reached $1.6 billion. The chart below reflects the growing demand for Aster’s staking, considering the TVL averaged $347 million as of September 1.

Aster DeFi TVL | Source: DefiLlama

Technical outlook: Can Aster sustain its rally?

Aster hovers slightly below the $2.00 mark at the time of writing on Tuesday. As short-term support, established at around $1.90, backs the token’s bullish outlook.

With key technical indicators on the 2-hour chart upholding the bullish sentiment, Aster could extend the uptrend above $2.00. For instance, the Moving Average Convergence Divergence (MACD) has been displaying a sell signal triggered earlier in the day. If investors heed the signal and increase their exposure, Aster would likely nurture the uptrend above the $2.00 level.

ASTER/USDT daily chart

The Relative Strength Index (RSI), which has risen to 68, indicates that bullish momentum is building. Still, higher RSI readings above 70 would signal extremely overheated conditions and may result in a sudden correction if investors start booking profits.

Key areas of interest for traders are the record high of $2.14 and the initial support at $1.90. Price action on either side of this range could shape Aster’s short-term technical outlook.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.