Bitcoin Falls Below $113,000, But This Indicator Says It’s Time To Buy

Bitcoin has slipped under the $113,000 level during the past day, but an analyst has pointed out how a technical indicator could suggest this is a buying opportunity.

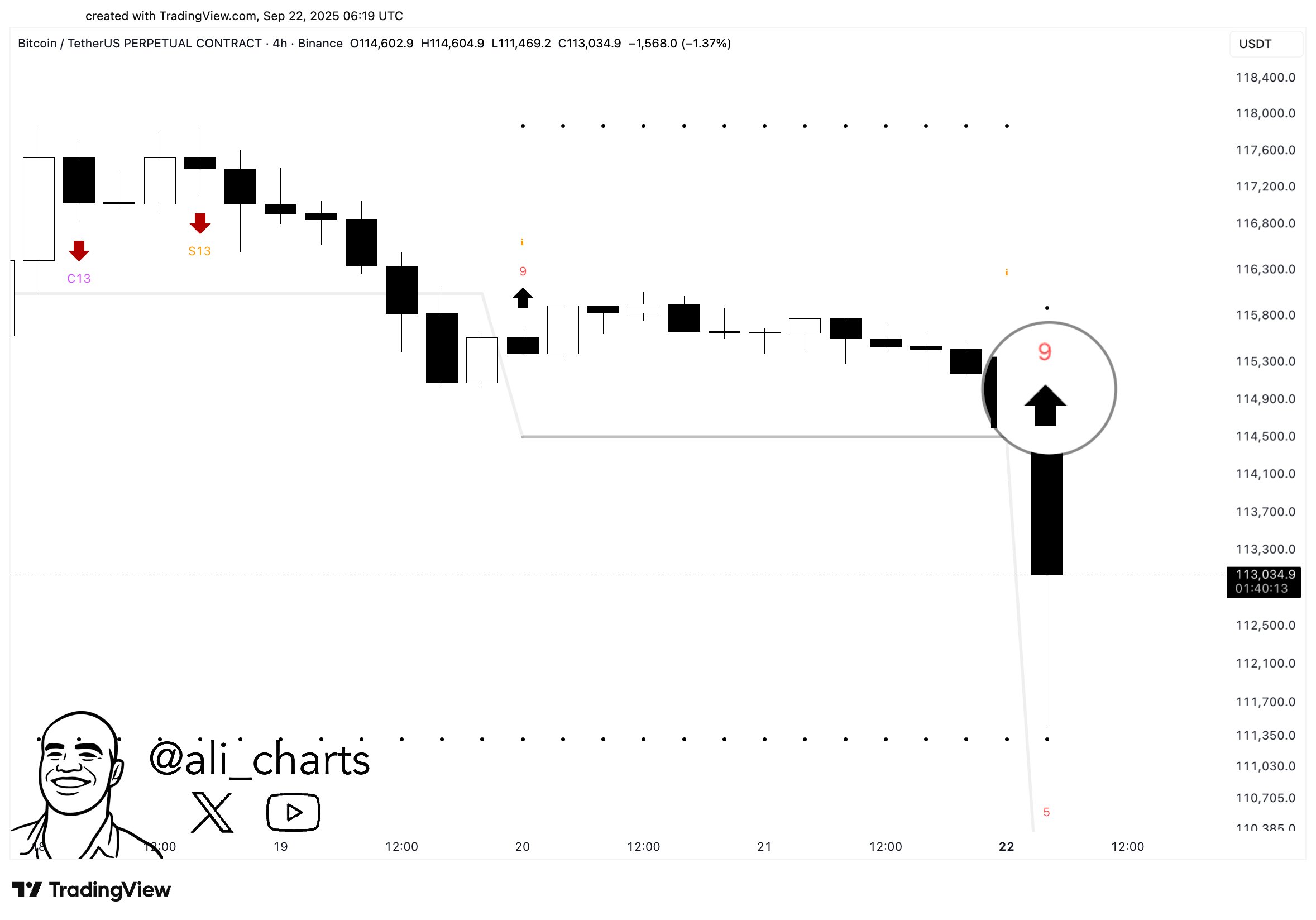

TD Sequential Has Just Given A Buy Signal For Bitcoin

In a new post on X, analyst Ali Martinez has talked about how the Tom Demark (TD) Sequential has just formed a signal for Bitcoin on its 4-hour price chart. The TD Sequential is an indicator from technical analysis (TA) that’s used for locating potential points of reversal in an asset’s price.

The indicator involves two phases. In the first of these, known as the setup, it counts candles of the same color up to nine. Once the ninth candle is in, it gives a turnaround signal for the asset. Naturally, the signal is a buy one if the preceding candles were red and a sell one if they were green.

As soon as the setup is over, the second phase, called the countdown, kicks off. The countdown works much like the setup, with the key difference being that the indicator counts up thirteen candles here, not nine. Following these thirteen candles, the price trend is considered to have reached exhaustion once more. In other words, the asset may have reached another top or bottom.

Bitcoin has completed a TD Sequential phase of the first type recently. Below is the chart shared by Martinez that shows the signal forming in BTC’s 4-hour price.

From the graph, it’s visible that the TD Sequential has completed this setup with nine red candles, which implies Bitcoin may have arrived at some sort of bottom.

The signal has come as the cryptocurrency’s price has plummeted and retraced its recent recovery. It now remains to be seen whether the buy setup will hold, or if there is more decline coming for the asset.

In another X post, the analyst has talked about a potential pattern forming for Bitcoin that could also point to a bullish outcome.

As displayed in the above chart, Bitcoin’s 4-hour price has potentially been following an inverse head-and-shoulders. This pattern appears whenever an asset’s price registers a low (called the head) between two higher lows (the shoulders).

BTC has formed the left shoulder and head so far, with the right shoulder possibly brewing with the price crash. In the scenario that the right shoulder does get confirmed, a bullish breakout may follow for the cryptocurrency, since an inverse head-and-shoulders is generally considered to be a bullish reversal pattern.

BTC Price

At the time of writing, Bitcoin is trading around $112,300, down over 2.5% in the last 24 hours.