SOL rallies as Forward Industries secures $1.65 billion offering for Solana reserve

- Forward Industries completes a $1.65 billion PIPE investment to establish a Solana reserve.

- Galaxy Digital, Jump Crypto and Multicoin Capital collectively raised over $300 million to support the initiative.

- SOL reached a seven-month high on Thursday after breaking above the $224 resistance.

Solana (SOL) reached a seven-month high of $228 on Thursday after Forward Industries (FORD) announced the completion of a $1.65 billion private investment in public equity (PIPE) deal to establish a SOL treasury.

Forward Industries completes $1.65 billion offering to fund Solana reserve

Nasdaq-listed Forward Industries is set to establish a Solana treasury following the completion of a $1.65 billion PIPE deal, according to a Thursday statement.

The offering, backed by a $300 million joint investment from Galaxy Digital, Multicoin Capital and Jump Crypto, involved support from several digital asset investment firms. Bitwise Asset Management, Borderless Capital, Coinlist Alpha, CyberFund, FalconX, Jupiter and Big Brain Holdings joined in as investors.

Multicoin Capital co-founder and managing partner Kyle Samani has been named chairman of Forward Industries’ board, joined by interim CEO Michael Pruitt as a director.

The company, which announced its Solana treasury strategy on Monday, plans to use net proceeds from the offering mainly to purchase SOL for its treasury and for working capital.

“Forward Industries’ mission has been centered around operational and innovative excellence, and we are now extending that same principle to our capital strategy by building a balance sheet with SOL at its core,” said Pruitt.

In addition to their investment, Galaxy, Jump Crypto, and Multicoin will provide support to help Forward Industries build and execute its Solana treasury strategy.

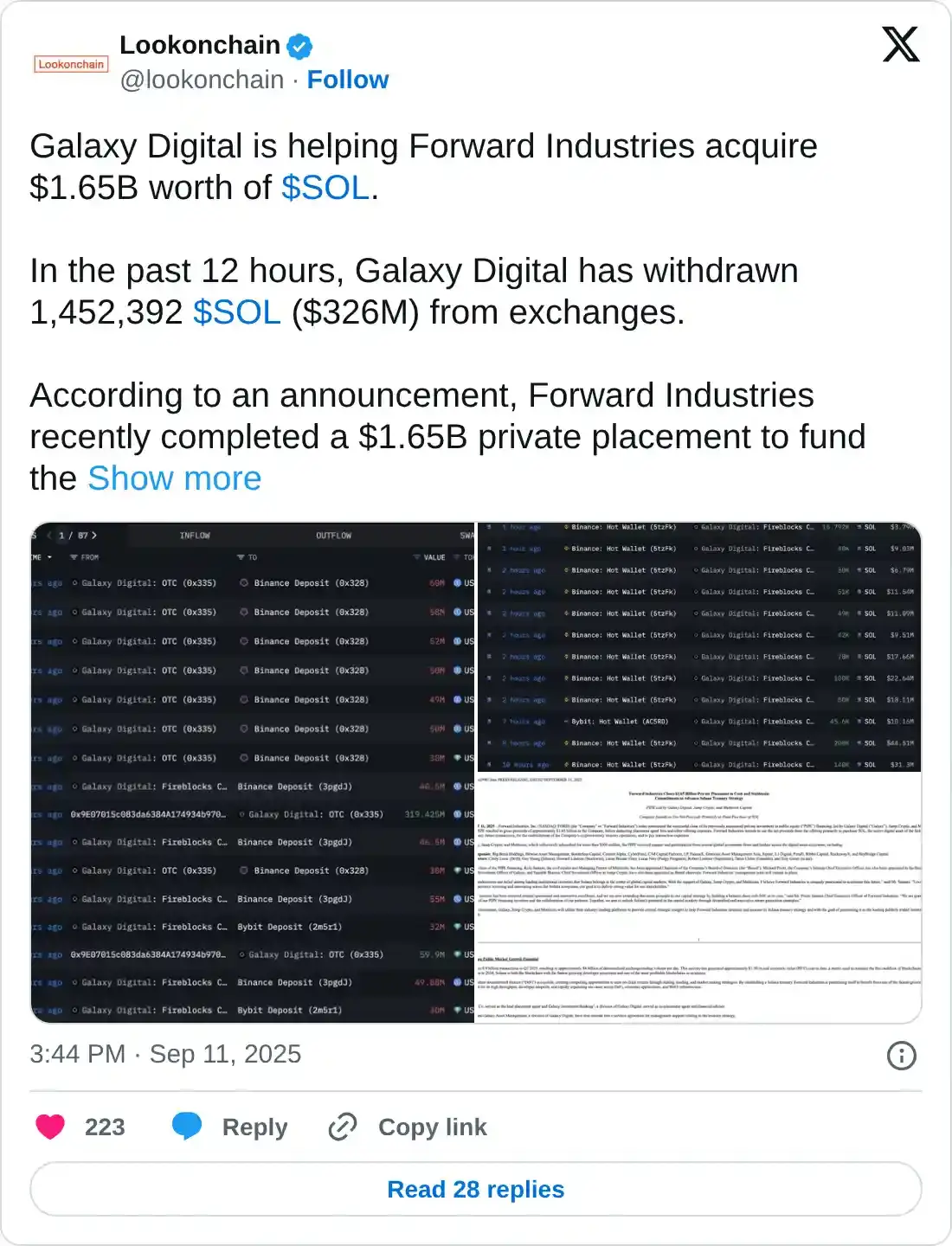

On-chain records suggest Galaxy Digital may have already begun helping Forward Industries acquire SOL. Galaxy Digital withdrew 1.45 million SOL, worth $326 million, from Binance and other exchanges on Thursday, according to data compiled by smart money tracker Lookonchain.

The development comes amid growing interest in altcoin digital asset treasuries over the past six months.

Several firms, including Sharps Technology, DeFi Development Corp and Upexi, have doubled down on their SOL treasury strategy in recent months, with combined holdings of 8.9 million SOL worth just over $2 billion, according to the Strategic Solana Reserves website.

Forward Industries’ potential $1.65 billion SOL stash positions it to overtake Sharps Technology as the leading Solana corporate treasury.

Meanwhile, Bitwise CIO Matt Hougan stated in a Tuesday note that the surge in corporate reserves, coupled with high anticipation for the approval of US spot Solana exchange-traded funds (ETF), could trigger an end-of-year rally for SOL.

SOL reaches seven-month high, breaks $224 resistance

SOL is trading at a seven-month high on Thursday after breaking above the $224 level. The Layer 1 token could stretch its rally toward $246 if it holds $224 as support.

SOL/USDT daily chart

On the downside, SOL could bounce off the $209 level or the lower boundary of a rising wedge, strengthened by the 14-day Exponential Moving Average (EMA).

The Relative Strength Index (RSI) is above its neutral level while the Stochastic Oscillator (Stoch) has crossed into its overbought region. This indicates a strong, dominant bullish momentum, but with potential for a short-term correction due to overbought conditions in the Stoch.