XRP Price Struggles Below $3 As Capital Outflows Reach 9-Month High

XRP continues to struggle in its attempt to break past the $3.00 mark. Despite several efforts, the altcoin has repeatedly failed to sustain an upward move.

Investor support remains weak, with neither existing holders nor new participants contributing enough momentum to fuel a breakout above critical resistance levels.

XRP Investors Remain Skeptical

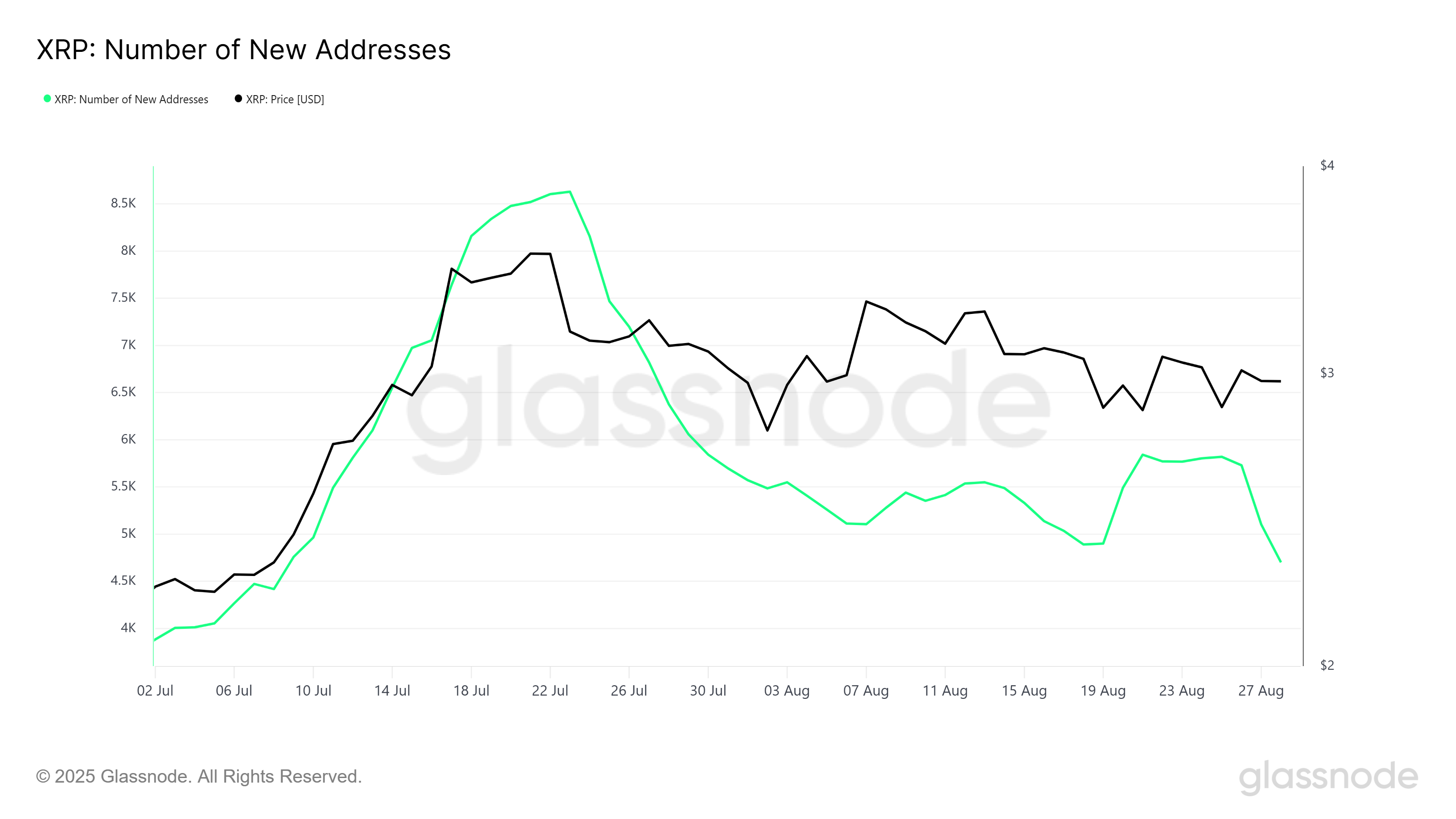

Network data highlights declining interest from new participants. The number of new addresses, measured by first-time transactions, has dropped near a two-month low. This slowdown signals reduced activity from fresh investors, limiting the inflow of new capital into XRP and contributing to the asset’s ongoing stagnation.

Without a steady supply of new addresses, XRP faces reduced demand pressure. The lack of new investor participation makes it difficult for the altcoin to generate strong upward momentum.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XRP New Addresses. Source: Glassnode

XRP New Addresses. Source: Glassnode

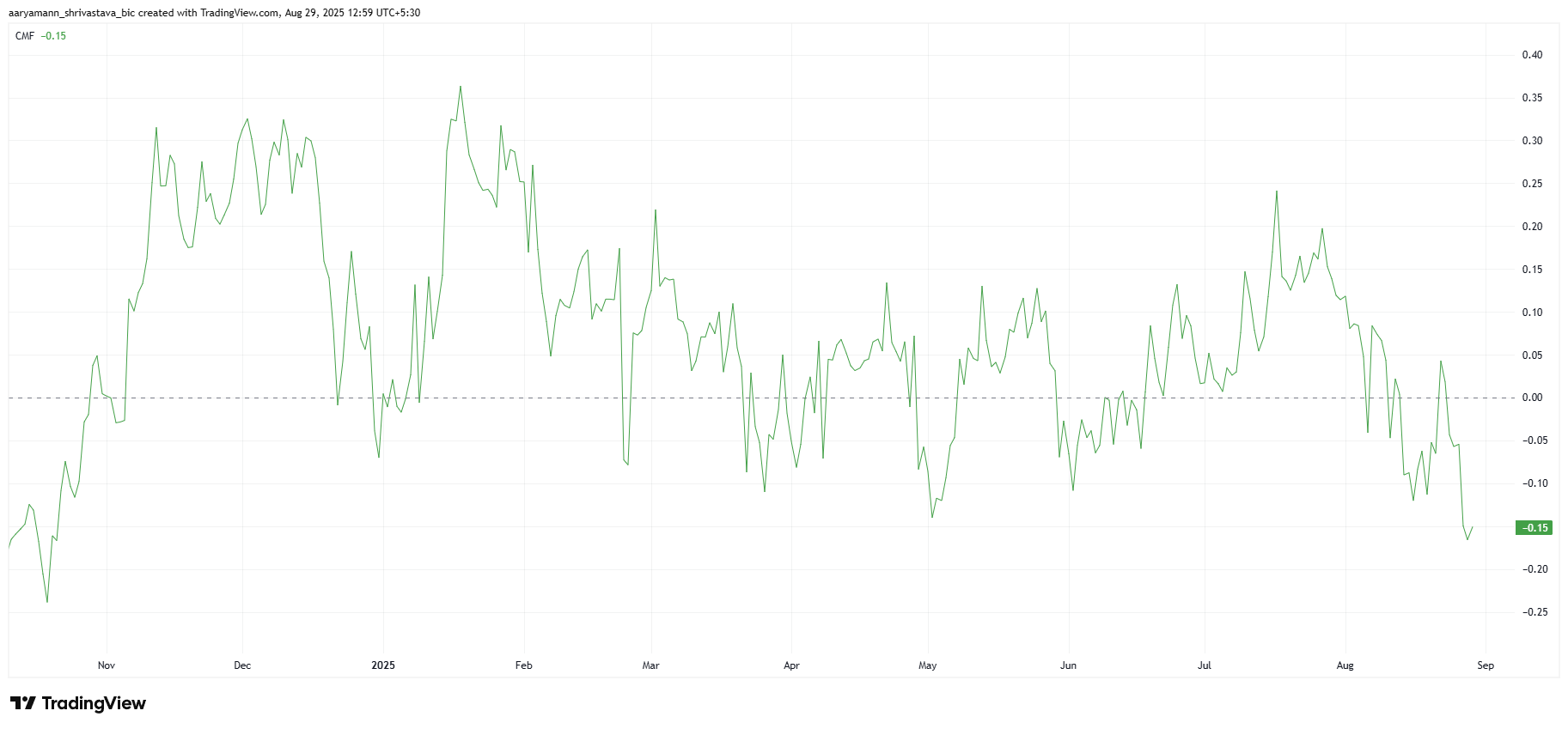

The broader macro momentum for XRP shows similar weakness. The Chaikin Money Flow (CMF), a metric tracking capital inflows and outflows, has dropped to a nine-month low. This decline confirms that outflows are currently overwhelming inflows, a bearish sign for the cryptocurrency’s short-term outlook.

With existing investors reducing activity and new participants absent, XRP’s capital pool is shrinking. The lack of buying pressure has amplified the recent downtrend, preventing the asset from establishing sustainable support levels.

XRP CMF. Source: TradingView

XRP CMF. Source: TradingView

XRP Price Needs Support

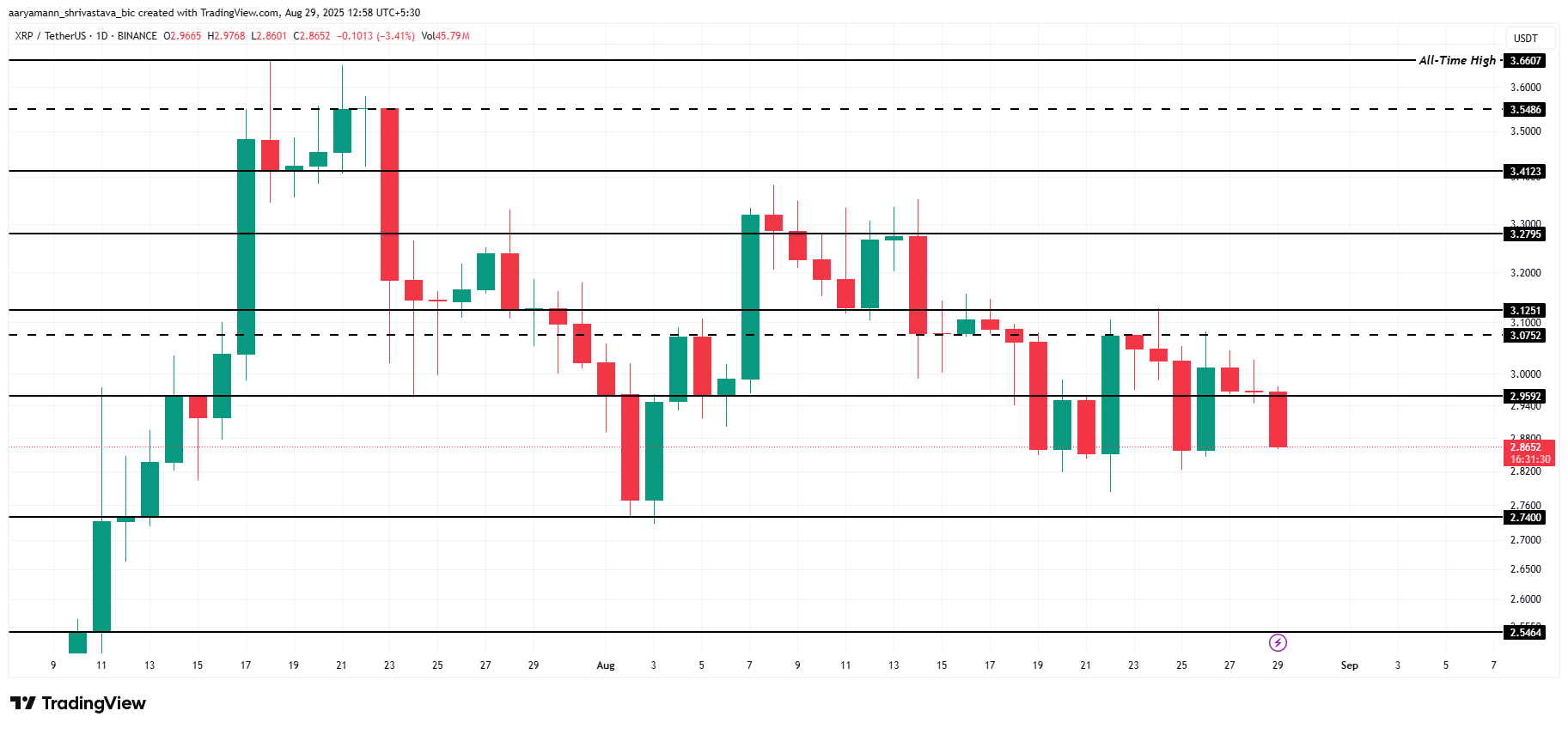

At the time of writing, XRP trades at $2.86, remaining stuck under the $2.95 resistance level. The altcoin has attempted to reclaim the $3.00 threshold for the past two weeks but has repeatedly failed to close above it, highlighting the weakness in bullish momentum.

Given these conditions, XRP could face further declines. A drop toward $2.74 remains likely if selling pressure continues, with the asset consolidating above this zone.

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingView

If investor sentiment shifts, XRP could attempt recovery. Reclaiming $2.95 as support would provide momentum to test higher levels. A successful breakout above $3.07 and later $3.12 would invalidate the bearish thesis.