3 US Economic Events Crypto Traders Must Watch This Week

Crypto markets kicked off the week with a dip that has sent Bitcoin (BTC) back to the $115,000 range while Ethereum (ETH) revisits the region around $4,300. Whether the drop could extend or is a short-term shakeout could hinge on several US economic events this week.

Bitcoin, in particular, has been overly sensitive to US economic indicators, making this week’s data points critical in its path to new highs.

US Economic Events That Could Move Bitcoin This Week

The following events and data points could influence traders’ and investors’ crypto portfolios this week.

FOMC Minutes

The FOMC (Federal Open Market Committee) minutes from its July meeting are arguably the most critical US economic event this week.

Due on Wednesday, policymakers will potentially provide insights into the Federal Reserve’s (Fed) monetary policy decisions, which significantly influence global financial markets, including crypto.

More closely, the FOMC minutes reveal discussions about potential changes in interest rates. Higher interest rates typically strengthen the US dollar, increasing the cost of borrowing. This tends to reduce investor appetite for riskier assets like Bitcoin.

Conversely, hints of lower rates or dovish policies can boost crypto prices as investors seek higher returns in speculative assets.

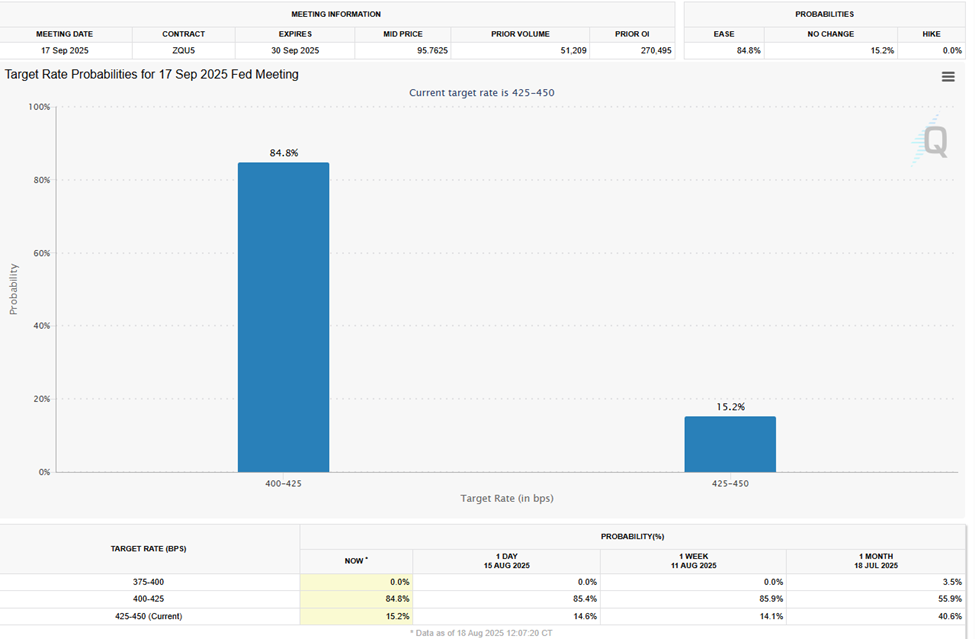

Meanwhile, according to the CME FedWatch Tool, interest bettors see an 84.8% probability that the Fed will cut interest rates to 4.00% to 4.25% in its September 17 meeting. This is against a 15.2% probability of holding interest rate steady between 4.25% and 4.50%.

Interest Rate Probabilities for September 17. Source: CME FedWatch Tool

Interest Rate Probabilities for September 17. Source: CME FedWatch Tool

The expectation comes after reports indicated inflation remains elevated in the US, rising at an annual rate of 2.7% in July.

Further, the FOMC minutes will be critical to indicate individual policymakers’ outlook after the 9-2 vote that left interest rates unchanged.

Therefore, the minutes could expose how divided the committee is on interest rate cut matters in the US.

Initial Jobless Claims

This week, the next US economic indicator with crypto implications is the initial jobless claims, as labor market data progressively becomes a critical macro for Bitcoin.

This data point, due every Thursday, reveals the number of US citizens who filed for unemployment insurance in the country for the first time.

In the week ending August 9, reported initial jobless claims hit 224,000, a slight drop from the 226,000 reported in the week ending August 2. Notably, the reading came in below economists’ expectations, amid predictions of up to 229,000.

Economists surveyed by MarketWatch say last week’s initial jobless claims could reach 224,000, the same as the week before that. Meanwhile, analysts say initial jobless claims have been stabilizing over the last few weeks.

A stable but slightly rising jobless claims figure suggests a cooling labor market, potentially boosting Fed rate-cut bets and supporting Bitcoin’s upward momentum.

Fed’s Jackson Hole Meeting

Another highlight of this week’s US economic events is the Jackson Hole Symposium, which is due on Friday, August 22. Fed Chair Jerome Powell will deliver his keynote address at 10 AM ET on this day.

“Jackson Hole Economic Policy Symposium Meeting Aug 21-23rd (hosting dozens of central bankers, policymakers, academics, and economists from around the world). Jerome Powell is speaking here on August 22 at 10 am EST. This will give us a good outlook for next month’s rate cuts,” wrote CryptoData, a popular account on X.

The Jackson Hole Symposium is popular for creating “seek and destroy” trading environments, with price swings catching traders off guard.

Powell’s remarks carry significant weight because past Jackson Hole speeches have reset expectations around rates and growth. The ripple effects could spread across equities, bonds, and crypto.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Ahead of these US economic events, Bitcoin was trading for $115,233 as of this writing, down by nearly 3% in the last 24 hours.