EUR/JPY steadies near 169.00 as traders await the next catalyst

- EUR/JPY holds firm near 169.00 with the 170.00 psychological level currently holding bulls at bay.

- The Euro benefits from the return of risk-on sentiment, but momentum indicators suggest that the pair may still be overbought.

- The safe-haven Japanese Yen struggles against its G10 counterparts, with Japan’s low-interest rate environment limiting its gains.

The Euro (EUR) is experiencing a modest pullback against the Japanese Yen (JPY) on Thursday, after surging over 3% this month.

EUR/JPY is trading slightly below the 169.00 mark, with Thursday’s low of 168.56 providing imminent support at the time of writing.

With bulls still eager to retest the next big level of resistance at the 170.00 psychological level, both technical and fundamental factors are playing a role in determining the pair’s next move.

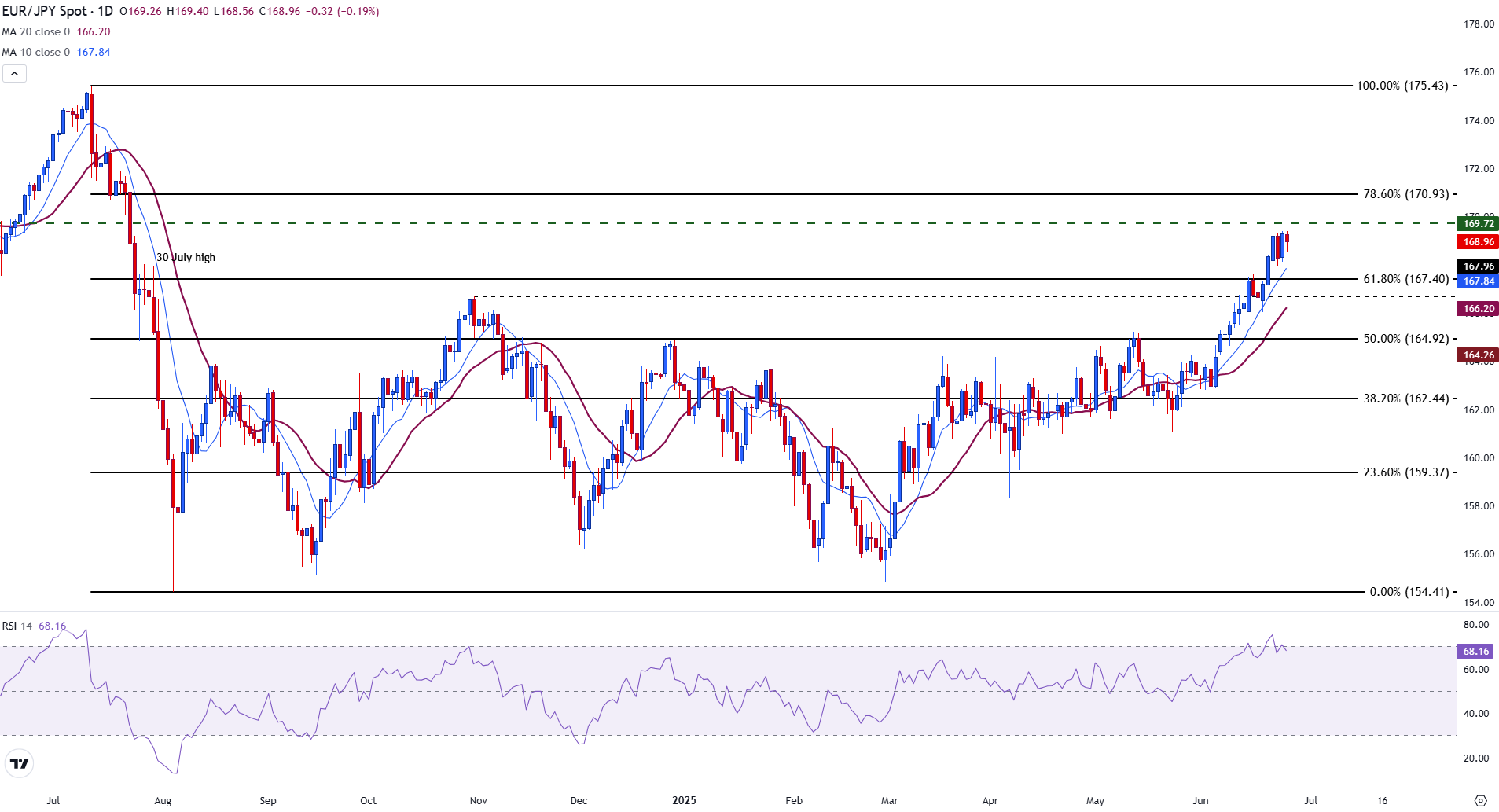

The recent boost in optimism that has pushed the Euro to multi-year highs against a wide range of currencies is showing signs of slowing. For EUR/JPY, the Relative Strength Index (RSI) on the daily chart is above 68, suggesting that the pair is still threatening overbought territory.

However, bearish momentum would need to show positive signs of building before the trend can reverse.

Fundamentally, risk sentiment has eased following the Israel-Iran ceasefire that was confirmed on Tuesday. This has placed the Japanese Yen on the backfoot against its G10 counterparts.

With risk-aversion fading and both Japan and the European Union (EU) pushing for a trade deal with the United States before the July 9 deadline, interest rate differentials remain in favour of Euro strength.

EUR/JPY daily chart

If EUR/JPY rises above 170.00 and geopolitical tensions continue to ease, the 78.60% Fibonacci retracement level of the July-August decline could come back into play at 170.93.

A break of this level and a resilient Euro would then potentially open the door for a move toward the longer-term resistance barrier at 175.43, aligning with the July 2024 high.

In contrast, a resurgence in Middle East tensions or increased potential for the Bank of Japan to hike rates may place bearish pressure on the pair. A clear move below 169.00 could then see prices retest the 10-day Simple Moving Average (SMA) at 167.84.

The next layer of support rests at the 61.80% Fibonacci retracement of the aforementioned move at 167.40, paving the way for a move toward the 20-day SMA at 166.20.

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.