EUR/USD nudges higher ahead of US GDP, Jobless Claims figures

- The Euro advances on Thursday against a softer US Dollar ahead of US GDP, Jobless Claims data.

- Fed Williams boosted hopes of interest rate cuts and sent the US Dollar lower on Wednesday.

- EUR/USD immediate bias remains negative, with support at the 1.1585 area as the bears' primary focus.

The EUR/USD pair extends its recovery from 1.1575 trading, reaching intra-day highs at 1.1670 ahead of the US session opening, with all eyes on the US GDP and Jobless Claims releases due later on the day. On Wednesday, dovish comments from New York Federal Reserve (Fed) President John Williams left the door open for an interest rate cut in September and increased pressure on the USD.

Williams affirmed in an interview on CNBC that interest rates are likely to move lower over time, and that, in his opinion, every monetary policy meeting is "live". These comments fuelled investors' expectations that a cut in September is a plausible option, which undermined support for the USD.

The US Dollar was also weighed down by US President Donald Trump's attacks on the Fed. Earlier this week, Trump attempted to fire the central bank's Governor Lisa Cook, with the likely aim of replacing her with a dovish-leaning policymaker. This is the latest episode of an extended series of attacks that have raised doubts about its status as an independent central bank.

Market hopes of Fed easing have offset the negative impact of the French political crisis. French opposition parties have refused to support Prime Minister Françoise Bayrou in a confidence vote announced for September, which will force the government to resign and lead to another snap election.

Eurozone data released earlier on Thursday has failed to support the Euro. The Economic Sentiment index deteriorated to 95.2 from a downwardly revised 95.7 reading in June, below the market expectations of a 96.0 reading. Industrial Confidence dropped to -1.3 from -10.5, also revised down from the previously reported 10.4 reading, while Consumer Confidence remains at -15.5, unchanged from the previous month.

In the US, the second estimate of the Q2 Gross Domestic Product (GDP) is expected to be revised slightly upwards. The impact of these figures on FX markets is likely to be limited, with investors bracing for the US Personal Consumption Expenditures (PCE) Price Index release due on Friday, for more clues about the outcome of September's Federal Open Market Committee (FOMC) meeting.

Euro Price Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.25% | -0.17% | -0.41% | -0.17% | -0.37% | -0.25% | -0.37% | |

| EUR | 0.25% | 0.12% | -0.19% | 0.07% | -0.09% | 0.01% | -0.10% | |

| GBP | 0.17% | -0.12% | -0.28% | -0.01% | -0.21% | -0.09% | -0.20% | |

| JPY | 0.41% | 0.19% | 0.28% | 0.26% | 0.00% | -0.12% | 0.08% | |

| CAD | 0.17% | -0.07% | 0.01% | -0.26% | -0.20% | -0.08% | -0.10% | |

| AUD | 0.37% | 0.09% | 0.21% | -0.00% | 0.20% | 0.12% | 0.00% | |

| NZD | 0.25% | -0.01% | 0.09% | 0.12% | 0.08% | -0.12% | -0.10% | |

| CHF | 0.37% | 0.10% | 0.20% | -0.08% | 0.10% | -0.01% | 0.10% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: Political uncertainty is likely to keep the Euro on the defensive

- The Euro bounced up from the bottom of the last few weeks' trading range, although upside attempts are likely to remain limited. Market fears of a collapse of France's cabinet and the resurgence of the Eurosceptic rhetoric by some of the major opposition parties are set to keep Euro bulls in check.

- Higher expectations of Fed easing, however, are keeping the EUR/USD pair afloat. Recent comments by NY Fed President Williams reinforced that view on Wednesday, and futures markets are pricing in a nearly 90% chance of a 25 basis points rate cut next month and, at least, another one before the end of the year.

- Traders, however, are likely to remain hesitant on Thursday, awaiting confirmation of the Fed easing expectations at Friday's PCE Prices Index report. The market consensus anticipates a 2.6% yearly advance on the headline reading, unchanged from the previous month, with the core PCE Price Index ticking up to a 2.9% year-on-year reading from 2.8% in the previous month.

- In the US, the preliminary second quarter's Gross Domestic Product is expected to have been revised up to a 3.1% annualized growth, from the 3% previous reading.

- At the same time, Jobless Claims data is expected to show that requests for unemployment benefits dropped by 5,000 to 230,000 in the week of August 22.

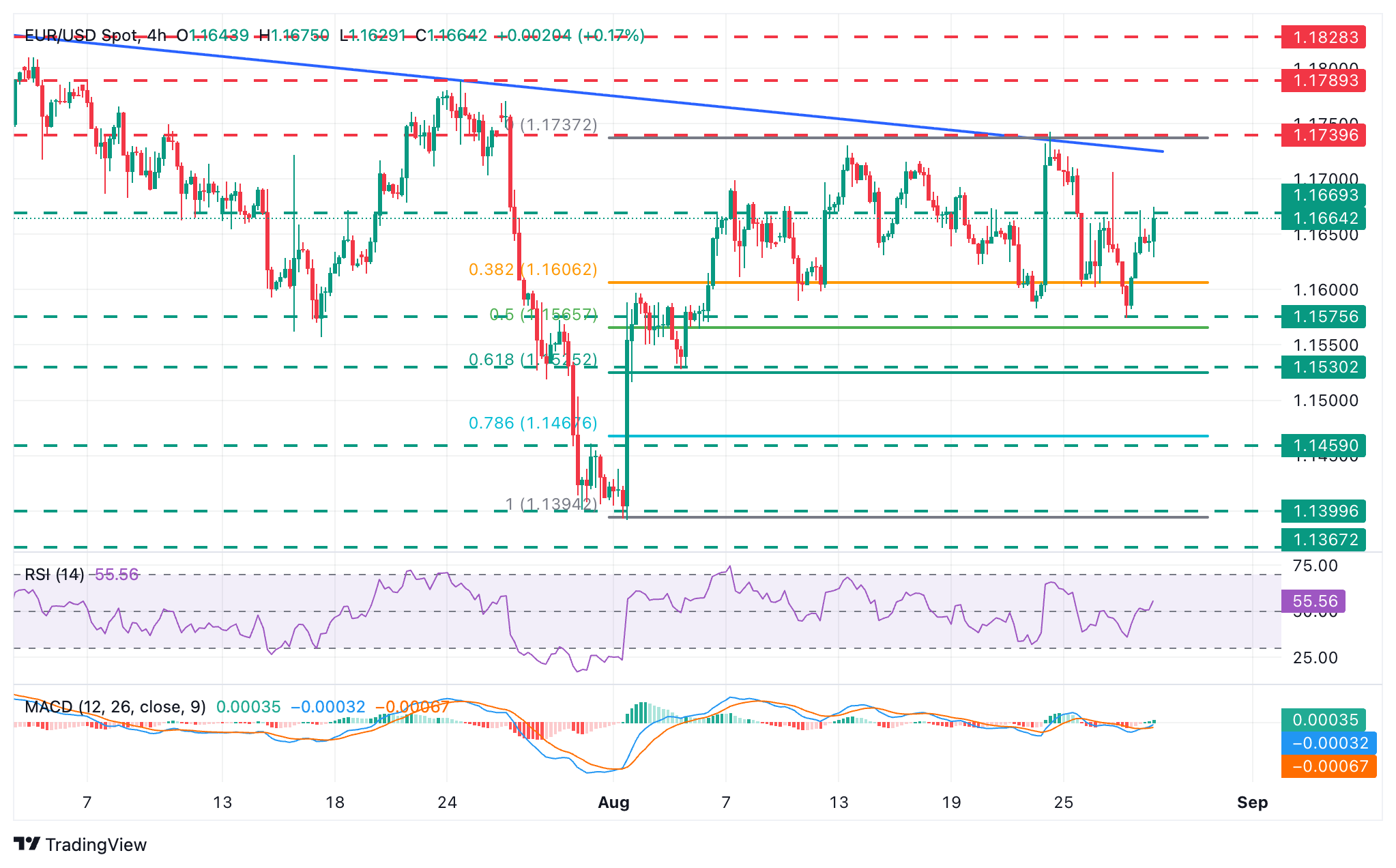

Technical Analysis: EUR/USD holds in range, with bears eyeing the 1.1585 support area

EUR/USD bears failed to confirm below the bottom of the last three weeks' trading range, at 1.1585, but the pair's immediate bias remains moderately bearish. The Relative Strength Index (RSI) is flat around the 50 level, but a sequence of lower highs and lower lows after the rejection above 1.1700 last week suggests that further depreciation is likely.

Wednesday's high at 1.1670 is holding bulls for now and keeps the immediate bearish structure in play. Above here, the confluence of the trendline resistance from July 1 highs, now at 1.1730, and the August 22 high, at 1.1740, is likely to pose a significant challenge for bulls.

To the downside, the area between 1.1575 and 1.1590, which broadly encloses the lows of August 11, 22, and 27, is the key level for bears. Below here, 1.1562, the 50% Fibonacci retracement level of the early August bullish run might provide some support ahead of the August 5 low, near 1.1530.

Economic Indicator

Gross Domestic Product Annualized

The real Gross Domestic Product (GDP) Annualized, released quarterly by the US Bureau of Economic Analysis, measures the value of the final goods and services produced in the United States in a given period of time. Changes in GDP are the most popular indicator of the nation’s overall economic health. The data is expressed at an annualized rate, which means that the rate has been adjusted to reflect the amount GDP would have changed over a year’s time, had it continued to grow at that specific rate. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Wed Jul 30, 2025 12:30 (Prel)

Frequency: Quarterly

Actual: 3%

Consensus: 2.4%

Previous: -0.5%

Source: US Bureau of Economic Analysis

The US Bureau of Economic Analysis (BEA) releases the Gross Domestic Product (GDP) growth on an annualized basis for each quarter. After publishing the first estimate, the BEA revises the data two more times, with the third release representing the final reading. Usually, the first estimate is the main market mover and a positive surprise is seen as a USD-positive development while a disappointing print is likely to weigh on the greenback. Market participants usually dismiss the second and third releases as they are generally not significant enough to meaningfully alter the growth picture.

Economic Indicator

Initial Jobless Claims

The Initial Jobless Claims released by the US Department of Labor is a measure of the number of people filing first-time claims for state unemployment insurance. A larger-than-expected number indicates weakness in the US labor market, reflects negatively on the US economy, and is negative for the US Dollar (USD). On the other hand, a decreasing number should be taken as bullish for the USD.

Read more.Last release: Thu Aug 21, 2025 12:30

Frequency: Weekly

Actual: 235K

Consensus: 225K

Previous: 224K

Source: US Department of Labor

Every Thursday, the US Department of Labor publishes the number of previous week’s initial claims for unemployment benefits in the US. Since this reading could be highly volatile, investors may pay closer attention to the four-week average. A downtrend is seen as a sign of an improving labour market and could have a positive impact on the USD’s performance against its rivals and vice versa.

against