Meme Coins Price Prediction: Dogecoin, Shiba Inu, Pepe rise amid lingering downside risks

- Dogecoin recovers 2% on Monday after a 9% decline last week, holding above a key support level.

- Shiba Inu clings to a crucial support level with a 2% rebound to start the week.

- Pepe mimics the minor recovery among top meme coins amid persistent downside risk.

Meme coins, including Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE), recovered roughly around 2% at press time on Monday after a pullback of 7%-13% last week. Dogecoin and Shiba Inu cling to crucial support while the downside risk persists for PEPE.

According to Artemis data, the meme coin category has recorded a roughly 6% loss over the last seven days, while privacy coins have led the decline with a roughly 6% loss over the last seven daysnearly 18% drop. This suggests a broader risk-off sentiment in the cryptocurrency market, reducing the chances of sustained recovery in meme coins, which are mainly driven by sentiment.

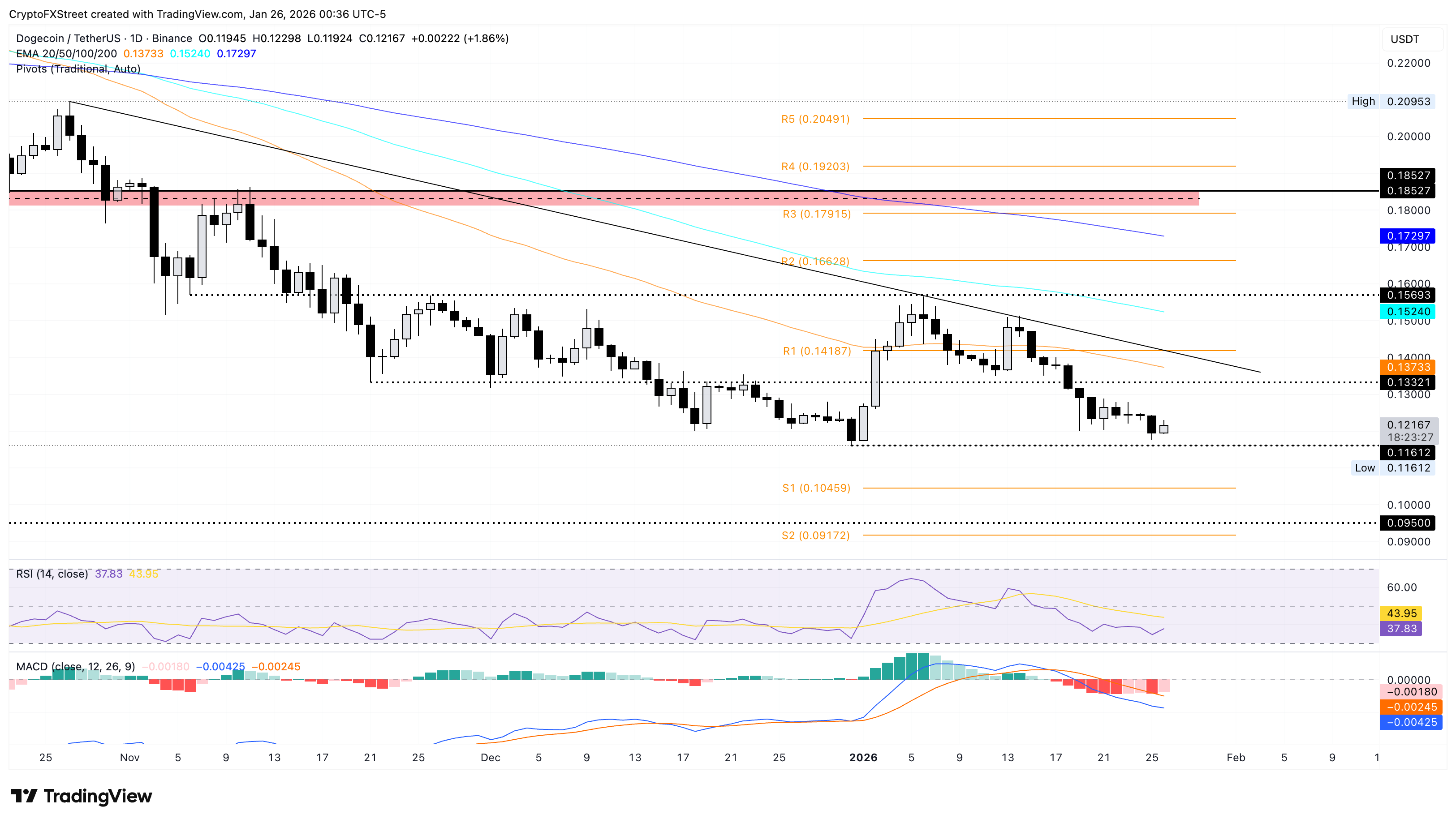

Dogecoin sparks recovery hopes

Dogecoin is up 2% at the time of writing on Monday, recovering from Sunday’s 4% loss. The meme coin hovers above the crucial support level at $0.1161, which aligns with the December 31 low.

Still, the prevailing decline since mid-January keeps DOGE well below the 50-day, 100-day, and 200-day Exponential Moving Averages (EMAs), reaffirming the bearish bias. If DOGE slips below $0.1161, the S1 Pivot Point at $0.1045 would become the next support level.

The technical indicators on the daily chat indicate fading selling pressure. The Moving Average Convergence Divergence (MACD) extends below the signal line in negative territory, but red histogram bars contract. At the same time, the Relative Strength Index (RSI) at 37 shows a minor rebound in a prevailing downward direction.

On the upside, the 50-day EMA at $0.1373 could cap the recovery gains.

Shiba Inu’s recovery lacks momentum

Shiba Inu shows a similar 2% recovery on Monday, after a 4% loss the previous day. The token mimics a similar trend to DOGE, as it clings to the $0.00000755 support level marked by the November 21 low.

If SHIB closes the day below this level, it would open the door to the December 31 low at $0.00000682.

Technical indicators show a similar cooling in selling pressure as MACD histogram bars contract and the RSI at 42 rebounds toward the midline.

Looking up, SHIB should reclaim the 100-day EMA at $0.00000855 to reinstate a recovery run.

Pepe struggles to reclaim a psychological level

Pepe rises over 3% at the time of writing on Monday, as bulls try to reclaim the $0.00000500 psychological level. However, the meme coin could face headwinds near the $0.00000521 support-turned-resistance level and the 50-day EMA at $0.00000530, capping the recovery.

Technical indicators on the daily chart show the frog-themed meme coin mimicking the Dogecoin trend, with the RSI at 42 signaling a minor recovery and the declining MACD histogram bars below zero signaling easing bearish momentum.

If PEPE extends the prevailing decline, the $0.00000431 support, marked by the December 5 low, could limit downside risk.