Gold price sinks on traders' optimism as strong US Dollar erodes safe-haven demand

- Risk appetite rebounds as Trump exempts some auto tariffs, sparking trade deal hopes.

- Weak US GDP and jobless claims stoke recession fears, but inflation stays near the Fed’s 2% target.

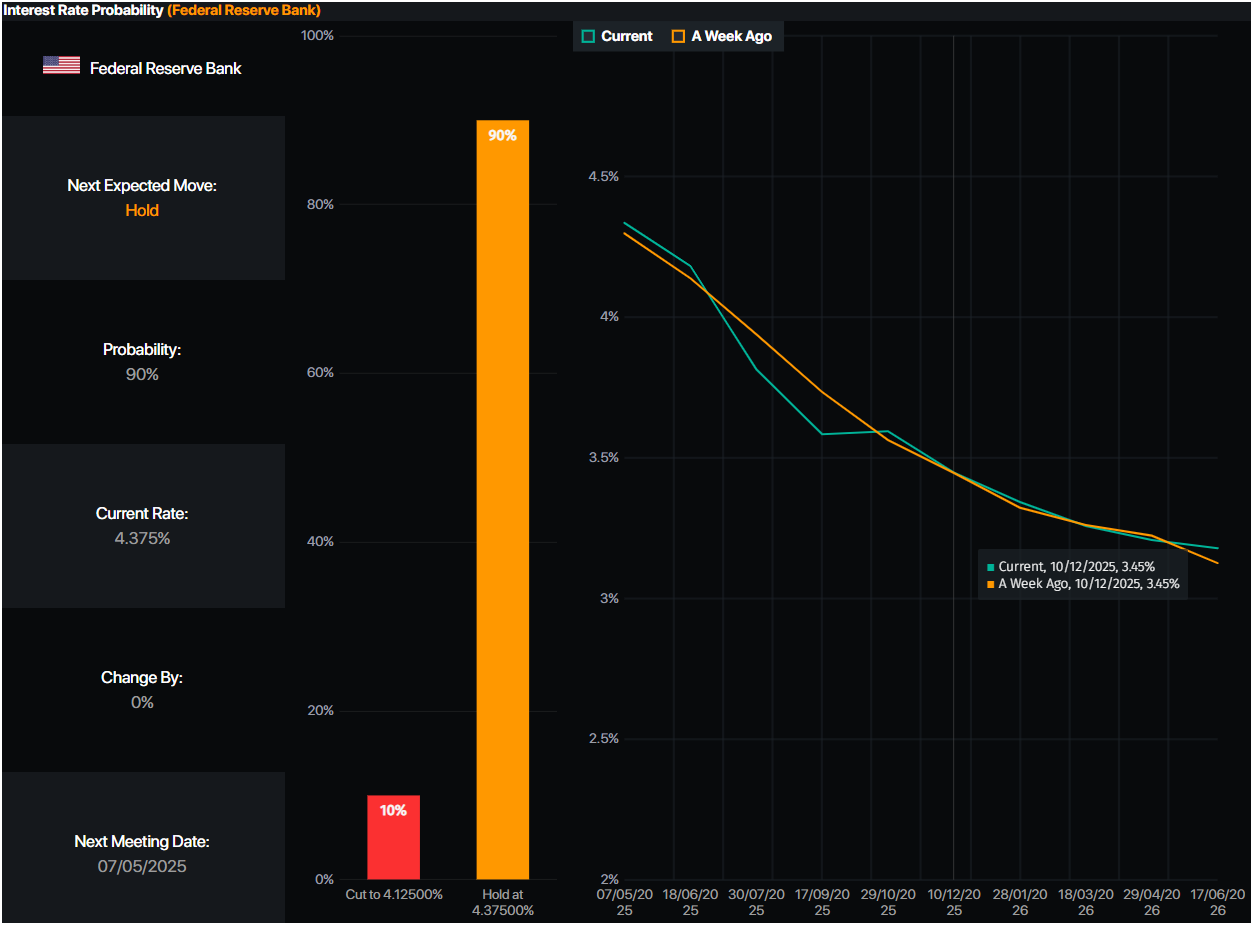

- Markets price in 90 bps of Fed rate cuts; eyes now on Friday’s Nonfarm Payrolls report.

Gold price tanked close to $70, or 2%, on Thursday as risk appetite improved during the North American session. Trade tensions between the United States (US) and its counterparts eased, keeping investors optimistic for the remainder of the week. At the time of writing, XAU/USD trades at $3,226.

US-China trade tensions eased as news revealed that Washington was contacting Beijing to begin negotiations. US President Donald Trump's decision to exempt some automotive industry tariffs and advances in deals with India, South Korea, and Japan were cheered by investors who bought the Greenback to the detriment of the precious metal.

Data on Wednesday painted a dismal economic outlook for the US as GDP for Q1 2025 contracted and a measure of inflation for the same period jumped. Nevertheless, the Core Personal Consumption Expenditure (PCE) Price Index, sought by the Fed as the preferred inflation gauge, was unchanged, within the 2% handle.

Although this was Gold supportive, positive earnings reports of US companies keep sentiment positive. However, Wall Street’s gains remained capped as business activity in the manufacturing sector disappointed traders. This and the rise of Americans filing for unemployment benefits fueled recession fears ahead of Friday's release of the Nonfarm Payrolls report.

After the data release, investors rushed to price in 90 basis points of Fed rate cuts, as revealed by data from Prime Market Terminal.

Source: Prime Market Terminal

Ahead in the week, traders are eyeing the release of April Nonfarm Payroll figures.

Daily digest market movers: Gold price dips as US Treasury yields jump

- Recently released data pushed US bond prices down, increasing US Treasury yields. The US 10-year Treasury note yield rose six basis points, up to 4.229%. At the same time, US real yields increased by six bps to 1.99%, as shown by the US 10-year Treasury Inflation-Protected Securities yields.

- The Institute for Supply Management (ISM) Manufacturing PMI was higher than estimates of 48 and rose by 48.7, down from the March 49 reading. Timothy Fiore, the ISM Manufacturing Business Survey Committee Chair, revealed that demand and production retreated while layoffs continued. He added, “Price growth accelerated slightly due to tariffs, causing new order placement backlogs, supplier delivery slowdowns, and manufacturing inventory growth.”

- Initial Jobless Claims for the week ending April 26 rose by 241K, much higher than the 224K expected and up from 223K revealed a week ago.

XAU/USD technical outlook: Gold price poised for pullback below $3,250

Gold price seems to be undergoing a pullback as buyers failed to defend the April 23 swing low of $3,260, exposing the $3,200 mark. The Relative Strength Index (RSI) is falling towards its neutral line, hinting that sellers are stepping in.

Therefore, if XAU/USD clears $3,200, the next support would be the April 3 high, which turned support at $3,167. Once surpassed, the next stop would be the 50-day Simple Moving Average (SMA), at $3,080.

Conversely, if buyers lift Gold prices above $3,300, it would clear the path to challenge $3,350, followed by $3,400.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.