Gold price climbs as recession fears rise on sour mood

- Gold buyers regain control as risk-off sentiment spreads across financial markets.

- US Dollar and Treasury yields slide as traders bet on deeper Fed rate cuts.

- Traders brace for a crucial US data week with GDP, Core PCE and NFP in focus.

Gold price resumes its uptrend on Monday after erasing some of its earlier losses, which saw the precious metal hit a daily low of $3,268. A shift in market mood lifted Bullion’s buyers’ spirits, driving XAU/USD up by 0.55%, exchanging hands at $3,338.

Risk appetite turned sour as Wall Street erased its earlier gains due to traders concerned about the trade war. Investors are also awaiting a crucial week for mega-cap tech companies reporting earnings, like Microsoft, Apple, Meta and Amazon. As investors sought safety, they continued to buy Gold instead of US dollars.

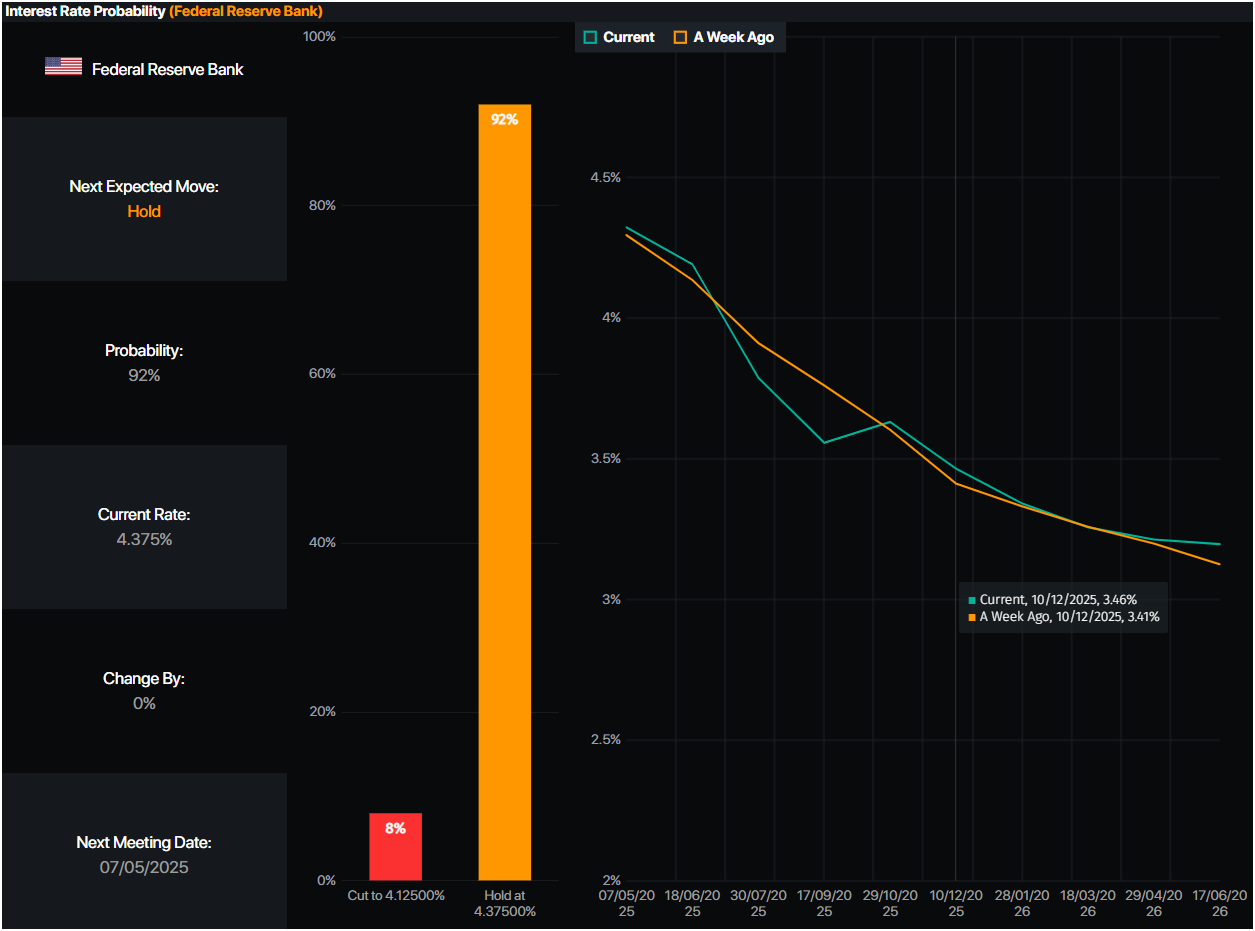

Therefore, the US Dollar Index (DXY), which tracks the American currency's performance against a basket of six other currencies, edged down 0.36% to 99.22. US Treasury yields are also falling, an indication that market participants are becoming worried about a recession in the US due to traders expecting 91 basis points of easing by the Federal Reserve (Fed), according to Prime Market Terminal data.

Source: Prime Market Terminal

Regarding trade talks, although US President Donald Trump said there is progress with China, Beijing denied that trade talks are occurring.

This week, traders are targeting the release of US economic data—mostly hard data, including Gross Domestic Product (GDP) figures for Q1 2025, the Core Personal Consumption Expenditures (PCE) Price Index, and Nonfarm Payroll figures.

Daily digest market movers: Gold price climbs underpinned by falling US yields

- The yield on the US 10-year Treasury note has dropped three basis points, reaching 4.224%.

- US real yields collapsed three bps to 1.954%, as shown by the US 10-year Treasury Inflation-Protected Securities yields.

- On Tuesday, the US docket will feature the latest JOLTS report for March, in which traders expect vacancies to dip from 7.568 million to 7.5 million.

- The US Conference Board (CB) will also release Consumer Confidence figures, which are expected to worsen from 92.9 to 87.

- Risks of the global economy slipping into a recession are increasing, revealed a Reuters poll.

XAU/USD technical outlook: Gold's bullish poised to test $3,400

The uptrend in the precious metal remains intact even though buyers have failed to push prices above the previous daily high, indicating buyers' presence. However, sellers also lacked the strength to drive Gold below $3,300, which could exert pressure on XAU/USD and drive spot prices toward $3,200.

On the other hand, as long as Gold stays above $3,300, the next key resistance would be last Friday’s peak at $3,370. If cleared, the next ceiling level will be $3,400, followed by $3,450.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.