XRP price sees bullish momentum accelerate near $3.00 as crypto markets cheer BTC's all-time high

- XRP’s bullish momentum has no sign of fatigue with the price approaching $3.00 on Monday.

- The XRP derivatives market holds steady, with the Open Interest expanding to $8.3 billion.

- XRP’s uptrend is steady despite related digital investment products experiencing $104 million in outflows last week.

Ripple (XRP) is trading around $3.00 on Monday as bulls tighten their grip with 11% in intraday gains. The rise in interest in the cross-border token can be attributed to positive market sentiment, buoyed by Bitcoin (BTC) price’s rally to the highest level on record above $123,000.

XRP approaching $3.00 despite capital outflow

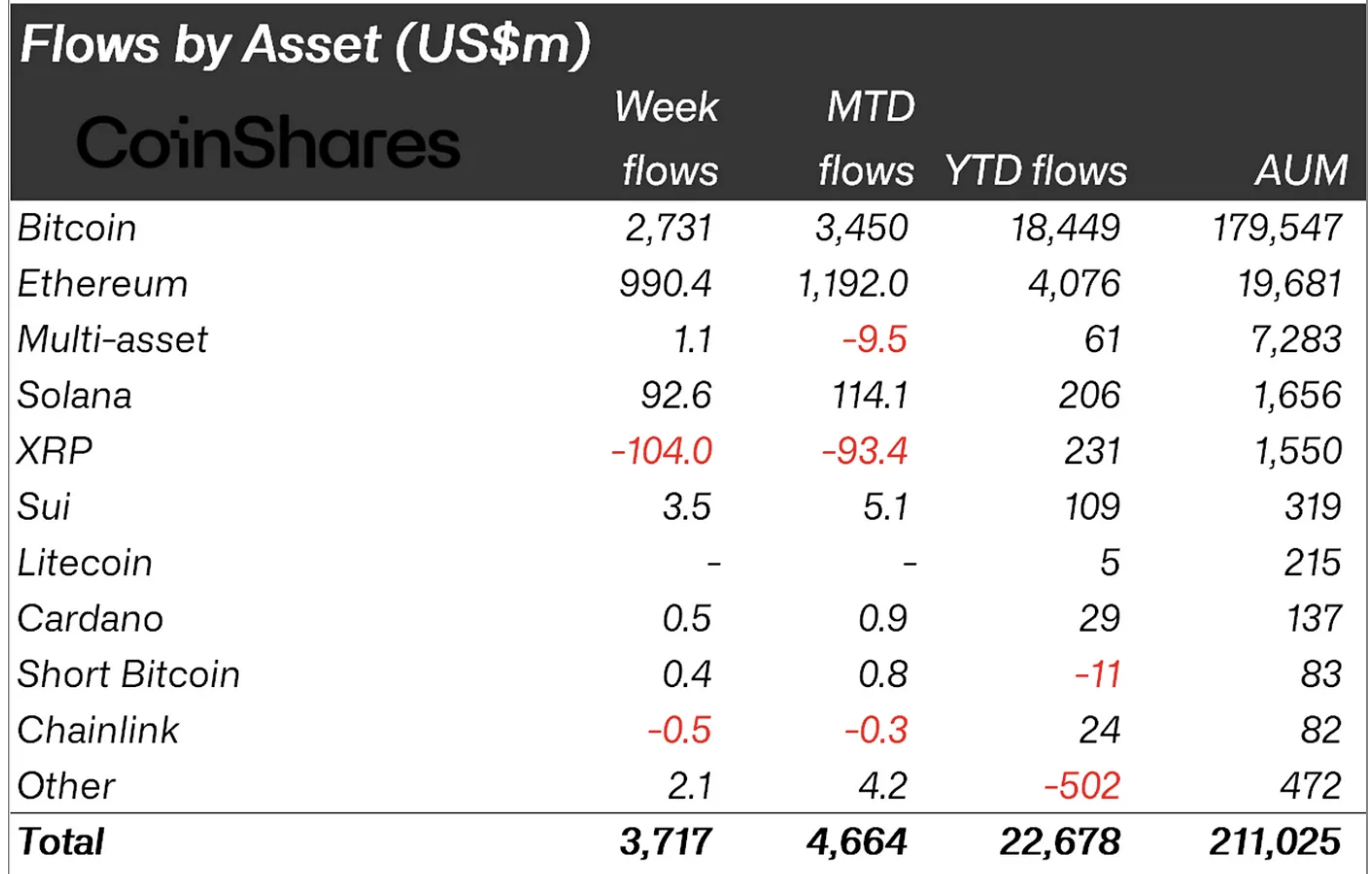

Digital investment products posted the second-largest cumulative weekly inflow volume of $3.7 billion in history. Bitcoin and Ethereum (ETH) led the bullish streak with $2.73 billion and $990 million, respectively.

According to CoinShares’ report, released every Monday, interest in XRP dropped last week with related digital investment products experiencing a total outflow of $104 million. XRP’s total assets under management (AUM) adjusted to $1.55 billion, with the year-to-date inflow averaging $231 million. Chainlink was the only other asset characterized by net weekly outflows of $500,000.

Digital asset investment products flow stats | Source: CoinShares

Despite the negative flows last week, retail interest seems steady based on the derivatives market outlook. CoinGlass data highlights a significant increase in the Open Interest (OI), which expanded by nearly 12% to $8.3 billion over the past 24 hours.

A subsequent 53% rise in the trading volume to approximately $23 billion in the same period underscores a strong risk-on sentiment and a surge in trading activity. In other words, traders are leaning bullish and betting that the price of XRP will continue to rise, extending the rally in the short term.

A break and daily close above the critical round-figure hurdle at $3.00 is likely in upcoming sessions, especially if the crypto market continues cheering Bitcoin’s rally to record highs.

Meanwhile, QCP Capital said in Monday’s market update that “the Crypto Fear & Greed Index has shifted dramatically, rising from 40 to 70 in just three weeks, flipping sentiment from fear to greed.”

In other words, while the market is bullish at the momentum, caution is advised as greed levels can often result in sharp reversals, especially if investors sell for profit.

The total supply in profit hit 58 billion XRP on Wednesday, underpinning the potential for sell-side pressure. With the supply on exchanges rising, as seen last week, overhead pressure could overshadow demand, thus increasing the probability of the price dropping.

XRP supply in profit data | Source: Glassnode

Technical outlook: XRP accelerates uptrend, eyeing $3.00

XRP is closing in on the $3.00 critical level, showing that bulls are expanding their scope to record highs at around $3.40. The path of least resistance holds upward, backed by the steady rise of the Money Flow Index (MFI) indicator to 92 on the daily chart below.

The MFI indicator tracks the amount of money entering and leaving XRP. If the uptrend persists, risk-on sentiment could buoy XRP’s rally.

However, since the indicator is heavily overbought, traders should tread carefully, keeping in mind that overhead pressure could result in a sudden trend reversal, fueled by profit-taking activity and the change in sentiment in the broader cryptocurrency market.

XRP/USDT daily chart

Still, the Relative Strength Index (RSI) flaunts overbought levels at 84, which could keep the uptrend steady in the short term. A technical reversal would not be a far-fetched idea, especially due to the same overbought conditions. Hence, there’s a need to keep eyes glued on XRP price behavior around the immediate $3.00 resistance level. Tentative support levels include May’s peak at $2.65 and the 50-day Exponential Moving Average (EMA) near $2.32.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.