Crypto Today: BTC price stalls at $95.5K as XRP, DOGE and AVAX slide on ETF verdict delay

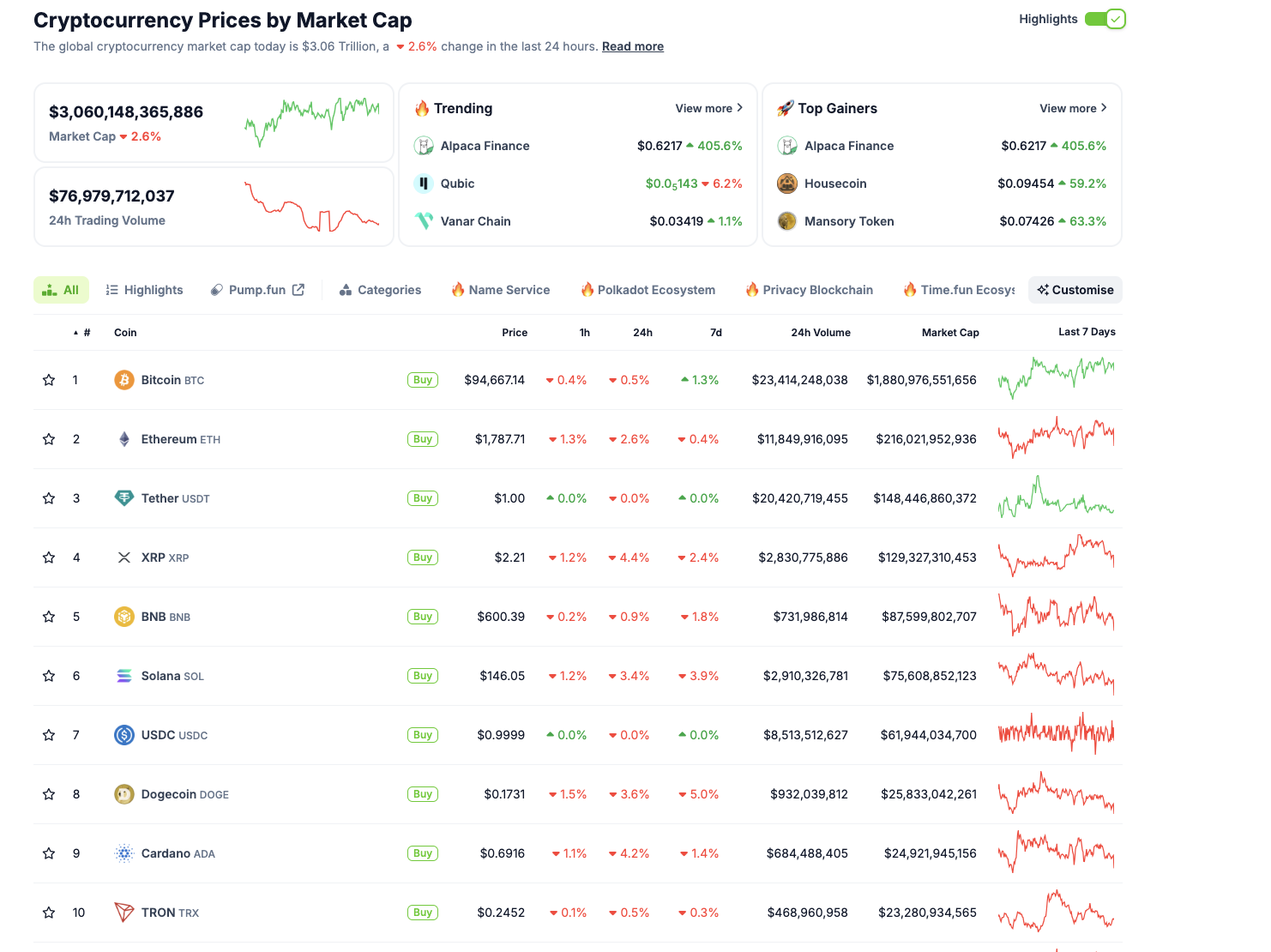

- The cryptocurrency market capitalization dips 2.6% on Wednesday, but consolidates above the $3.06 trillion level.

- Bitcoin price approached the $95,500 level for the sixth consecutive day before pulling back to $94,200.

- On Tuesday, the US SEC opted to delay its decision on altcoin ETFs until June 2025.

- XRP, DOGE and AVAX prices all declined more than 3% in reaction to the altcoin ETF delay.

The cryptocurrency sector capitalization declines 2.6% on Wednesday, as the United States (US) Securities and Exchange Commission (SEC) decision to delay XRP ETF reviews until June has triggered cascading sell-offs across top altcoin markets.

Bitcoin market updates:

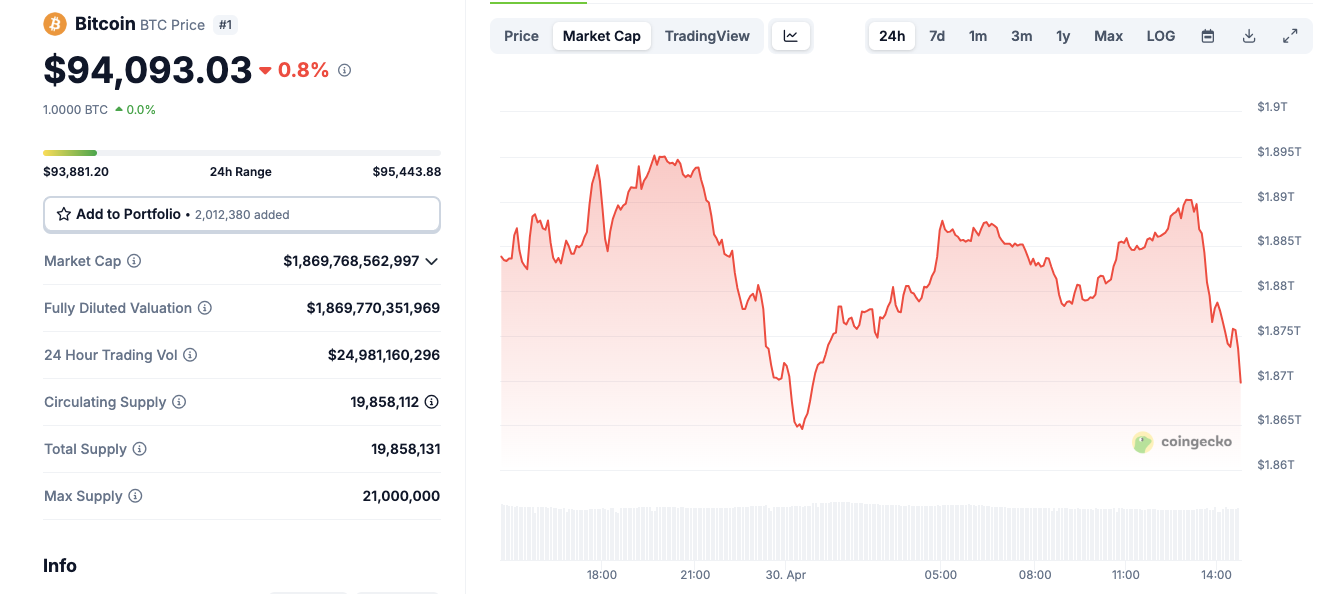

On Wednesday, Bitcoin price staged a fake-out near the $95,500 resistance for the sixth consecutive day.

Bitcoin price action, April 29, 2025 | Source: Coingecko

However, rising trading volumes suggest BTC continues to find new buyers as investors rotate out of top altcoins in reaction to the SEC’s ETF verdict postponement.

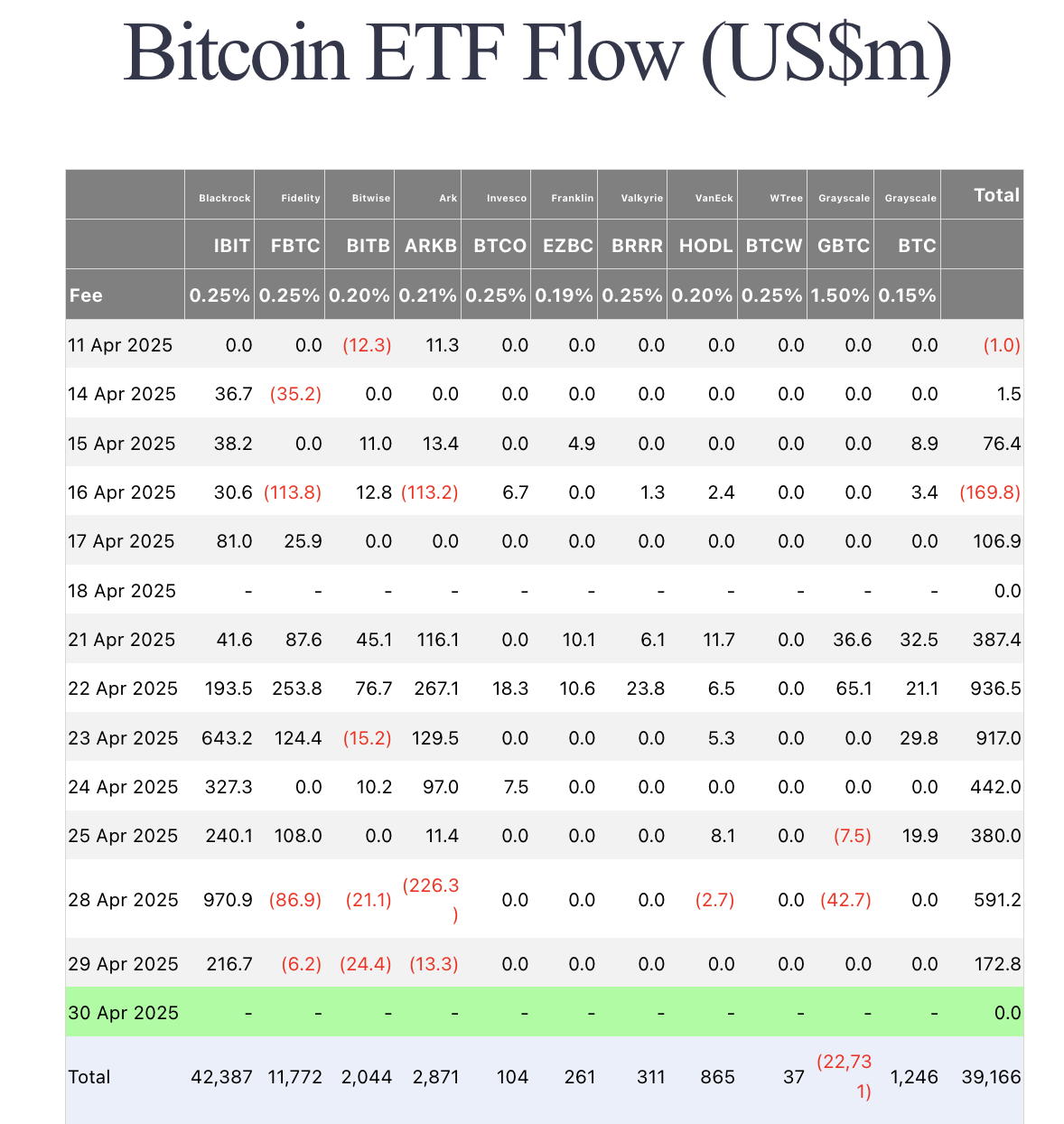

Chart of the day: Bitcoin ETFs mark eight-day buying spree with another $178 million inflow

Demand for Bitcoin among US corporate investors remains on the rise. On Tuesday, Bitcoin ETFs posted another $178 million in inflows.

According to Farside data, BlackRock ETFs did the heavy lifting, with its $216 million deposits crowding out sizable redemptions from Ark Invest, Fidelity and Bitwise funds, which saw $6.2 million, $13.3 million and $24.4 million outflows, respectively.

Bitcoin ETF flows | Source: Farside

The US trade war with China remains largely unresolved, and many US firms now project to miss earnings targets.

Intuitively, Bitcoin ETFs’ unusual BTC demand in the past week suggests corporate investors are diversifying to mitigate anticipated sell-offs in US stocks.

Altcoin market updates: XRP, DOGE and Avalanche post mirror losses after SEC delays ETF verdict

Top altcoins with ETF filings in progress took a synchronized hit after the US SEC delayed decisions on spot ETF applications tied to multiple altcoins.

While, Bloomberg Chief ETF analyst Eric Balchunas confirmed that the spot XRP ETF delay is procedural, market insights show a jittery response among short-term traders.

According to Coingecko data, XRP, Dogecoin (DOGE), and Avalanche (AVAX) each posted comparable losses over the last 24 hours.

XRP, which had rallied to $2.30 earlier, retraced to 4.4% to hit $2.18 at press time, still revealing volatility tied to the ETF verdict delay.

Top 10 cryptocurrencies’ performance, April 30 | Source: Coingecko

DOGE mirrored XRP’s trajectory, trading at $0.1714 after a 3.5% 24-hour loss, though it retained a 7.0% weekly gain, signaling that the downside trigger is nascent.

Meanwhile, Avalanche (AVAX) posted a 3.9% dip as it struggles to hold above the $18 price level at press time

In summary, ETF delays have shifted short-term capital flows toward Bitcoin and Ethereum, each keeping losses less than 3% in the last 24 hours.

While ETF inflows have propelled BTC price above $95,000 for the sixth day running, ETH also hit a monthly time frame peak of $1837, propelled by a leadership shuffle.

Crypto news updates:

SEC closes investigation into PayPal PYUSD without enforcement action

The US Securities and Exchange Commission has closed its investigation into PayPal’s PYUSD stablecoin without pursuing enforcement action. PayPal disclosed the outcome in its latest Form 10-Q filing, noting the probe, which began with a subpoena in November 2023, had officially concluded.

The investigation closure comes after a series of strategic moves by PayPal to boost PYUSD adoption.

These included a partnership with Coinbase that eliminated trading fees for PYUSD transactions and the stablecoin’s recent integration into the Solana blockchain to enhance speed and scalability.

Mark Carney's election as Canada PM sparks crypto regulations skepticism

Mark Carney has secured re-election as Canada’s prime minister following a snap election, defeating opposition leader Pierre Poilievre, a vocal cryptocurrency supporter.

Poilievre’s loss marks a setback for the pro-crypto movement in Canada, which had rallied behind his deregulatory stance and support for Bitcoin adoption.

Notably, Carney has previously voiced skepticism toward cryptocurrencies and blockchain technologies.

His administration is expected to maintain a cautious regulatory posture, focusing on oversight and risk mitigation rather than rapid integration of crypto into the financial system.