Tron Price Prediction: Tether’s $1B move triggers TRX ahead of US Congress stablecoin bill review on Wednesday

- Tron price rose 3% to $0.25 on Monday, defying the broader market losses led by BTC, ETH and XRP.

- Stablecoin issuer Tether minted $1 billion worth of USDT on the Tron network.

- The Financial Services Panel of the US Congress is set to begin reviewing new stablecoin legislation on Wednesday.

Tron price defied the broader crypto market downtrend, surging 3% to $0.25 on Monday. This bullish momentum comes as stablecoin issuer Tether minted another $1 billion worth of USDT on the Tron network, according to on-chain data from Arkham. Meanwhile, market sentiment is shifting as the U.S. Congress gears up to review new stablecoin legislation on April 2, a move that could significantly impact Tron’s ecosystem.

Tron price defies market gloom to post 3% gains

Tron (TRX) was among the few altcoins that posted gains on Monday, as crypto markets reeled from bearish headwinds due to macroeconomic pressures and Congress’ scrutiny of Paul Atkins, Trump’s nominee to replace Gary Gensler.

Tron (TRX) Price Analysis, March 31, 2025 | Source: CoinMarketCap

While Bitcoin (BTC), Ethereum (ETH), and XRP all posted losses on Monday, Tron’s native token TRX bucked the trend, climbing 3% on Monday, peaking around $0.25, before retracing to find support at $0.24 at press time.

Tron’s failure to close above $0.25 signals early profit-taking as bearish sentiment dominates the broader crypto market amid prevailing macroeconomic uncertainty and regulatory concerns.

However, the 3% rally on Monday also affirms the presence of an active internal bullish catalyst propelling TRX price.

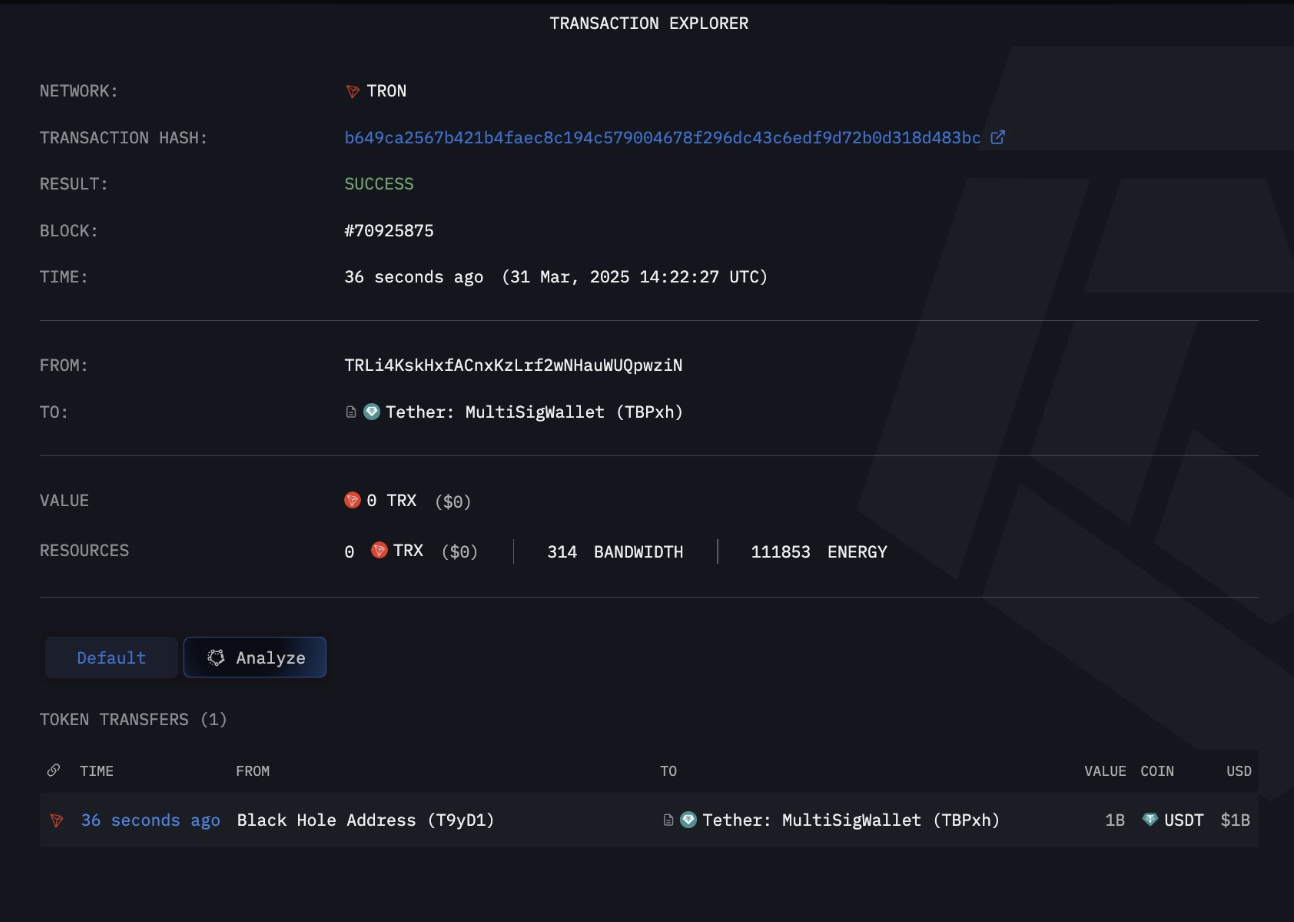

Tether’s $1 Billion USDT minting sparks optimism for Tron’s ecosystem

On Monday, On-chain analytics platform revealed that Tether, the world’s largest stablecoin issuer, has minted another $1 billion in fresh USDT tokens on the Tron blockchain network.

According to Arkham Intelligence, Tether’s $1 billion inflows now mean over 50% of USDT’s total supply now resides on the Tron network, reinforcing its position as the preferred blockchain for stablecoin transactions due to its low fees and high-speed transfers.

Tether mints $1 billion worth of USDT on Tron blockchain network, March 31, 2025 | Source: Arkham

Tether’s latest $1 billion move is bullish for TRX price action, for a number of reasons.

First, it re-emphasizes the Tron blockchain’s dominance in the stablecoin market, after multiple US corporate players made strategic moves to foray into the sector last month.

In March 2024, the likes of Fidelity, Trump-backed WLFI and the State of Wyoming all announced official moves to launch stablecoins.

Historically, large USDT mints have correlated with bullish momentum for TRX, as increased stablecoin liquidity often translates into higher transaction volume and network activity.

If demand for USDT on Tron continues to grow, TRX price could extend its gains in the coming weeks.

U.S. Congress to Review Stablecoin Legislation on April 2—What It Means for Tron

The U.S. House Financial Services Committee is set to begin reviewing a new stablecoin bill on April 2, a key regulatory development that could shape the future of digital dollar alternatives like USDT.

Bloomberg reports suggest the proposed legislation aims to introduce stricter oversight on stablecoin issuers, potentially impacting Tether’s operations and, by extension, Tron’s role in the market.

If the legislation imposes new compliance requirements on stablecoins, it could introduce volatility into TRX price action.

However, if the bill provides clearer regulatory guidelines that favor stablecoin adoption, Tron could see further institutional demand and network expansion potentially driving prices towards $0.30 as April 2025 unfolds.

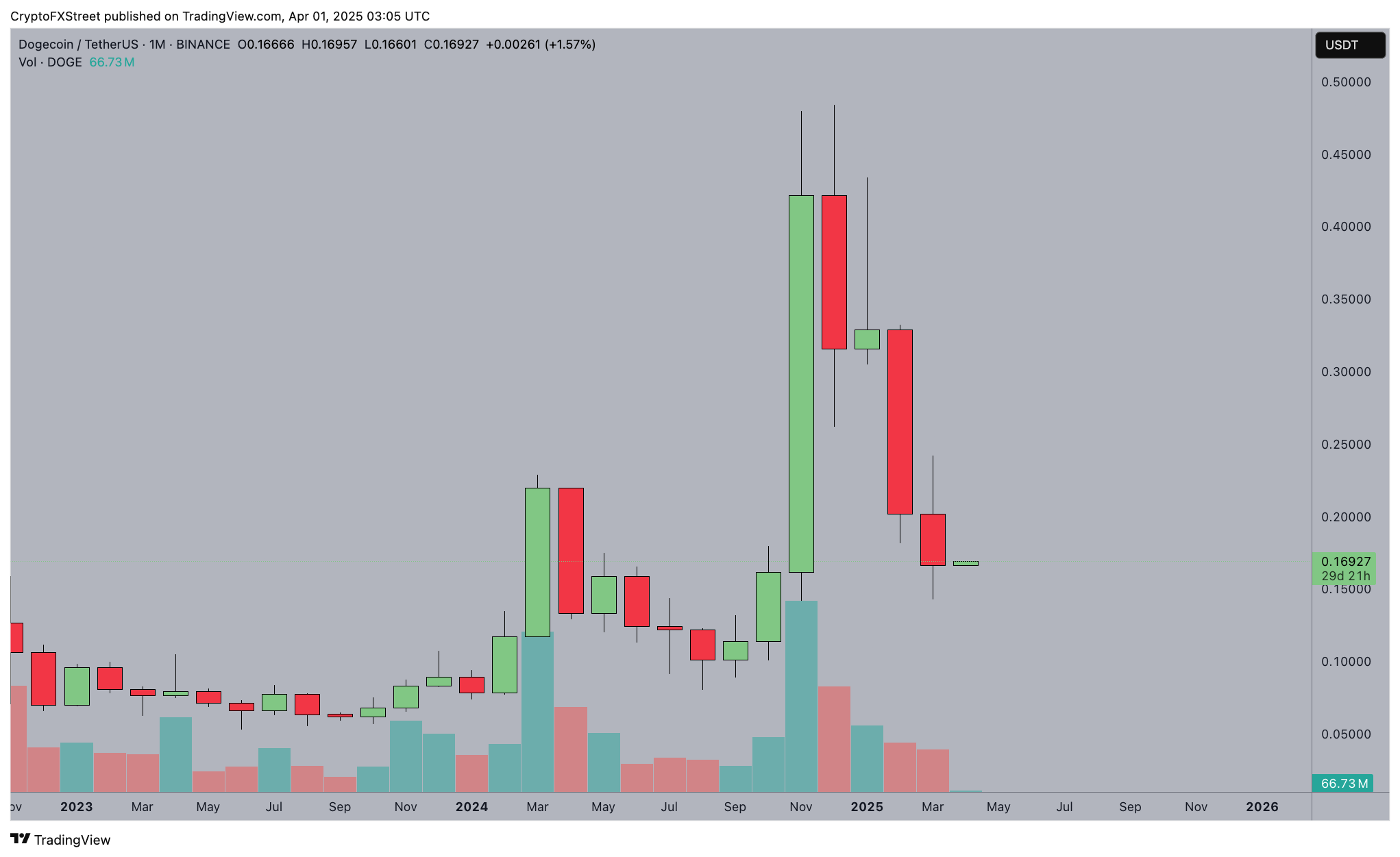

Tron Price Prediction: $0.30 target viable as TRX targets positive start to April

Tron price forecast signals indicate a bullish start to April 2025, especially with the buying momentum intensified by Tether’s latest $1 billion USDT mint.

The stablecoin issuer's increased reliance on Tron’s network reinforces investor confidence.

As the U.S. Congress begins its stablecoin legislation review on April 2, the Tron network is likely to draw more attention.

Technical indicators suggest mixed signals for TRX. The MACD histogram has flipped bullish, with the MACD line crossing above the signal line, indicating growing momentum.

If the rally extends, TRX could break the $0.25 resistance and test $0.27 in the short term. A move beyond this level could trigger a push toward $0.30.

Tron Price Prediction | TRXUSD

However, downside risks remain. The rejection near $0.25 highlights supply zone resistance, and a failure to sustain the uptrend could see a retracement to $0.23.

The volume-weighted average price (VWAP) at $0.2372 signals key demand levels.

If TRX fails to hold above this mark, bearish pressure could intensify.

Tron’s near-term trajectory hinges on stablecoin regulatory developments.

If the U.S. Congress review attracts significant media attention, TRX could sustain its rally into Q2 2025.