Bitcoin Price Forecast: BTC extends recovery as ETF records positive flows

- Bitcoin price extends its recovery above $91,500 on Thursday, following a rebound from its key support level.

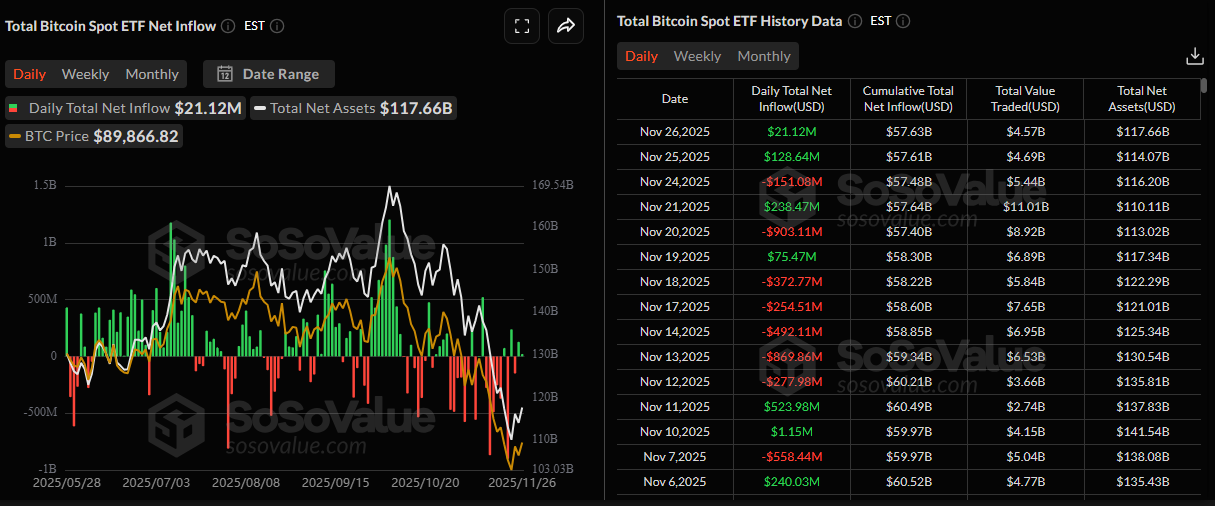

- US-listed spot ETFs recorded a mild inflow of $21.12 million on Wednesday, the second day of positive flows this week.

- On-chain data shows BTC’s market drifting lower amid limited inflows and fragile liquidity.

Bitcoin (BTC) price continues to trade in green above $91,500 at the time of writing on Thursday after rebounding from the key support level. On the institutional front, a modest inflow into US-listed spot Bitcoin Exchange Traded Funds (ETFs) signals a reduction in selling pressure and further support BTC’s recovery. However, traders should still be cautious as on-chain data highlights BTC’s market drifting lower amid limited inflows and fragile liquidity.

Bitcoin institutional demand records mild inflows

Institutional demand for Bitcoin shows a reduction in selling pressure. According to SoSoValue data, US-listed spot Bitcoin ETFs recorded a mild inflow of $21.12 million on Wednesday, after a positive flow of $128.64 million the previous day. However, these inflow intensities are not as strong as the outflow streak recorded last week. For BTC to continue its recovery, the inflow trend should persist and intensify.

On-chain data show BTC’s fragile market conditions

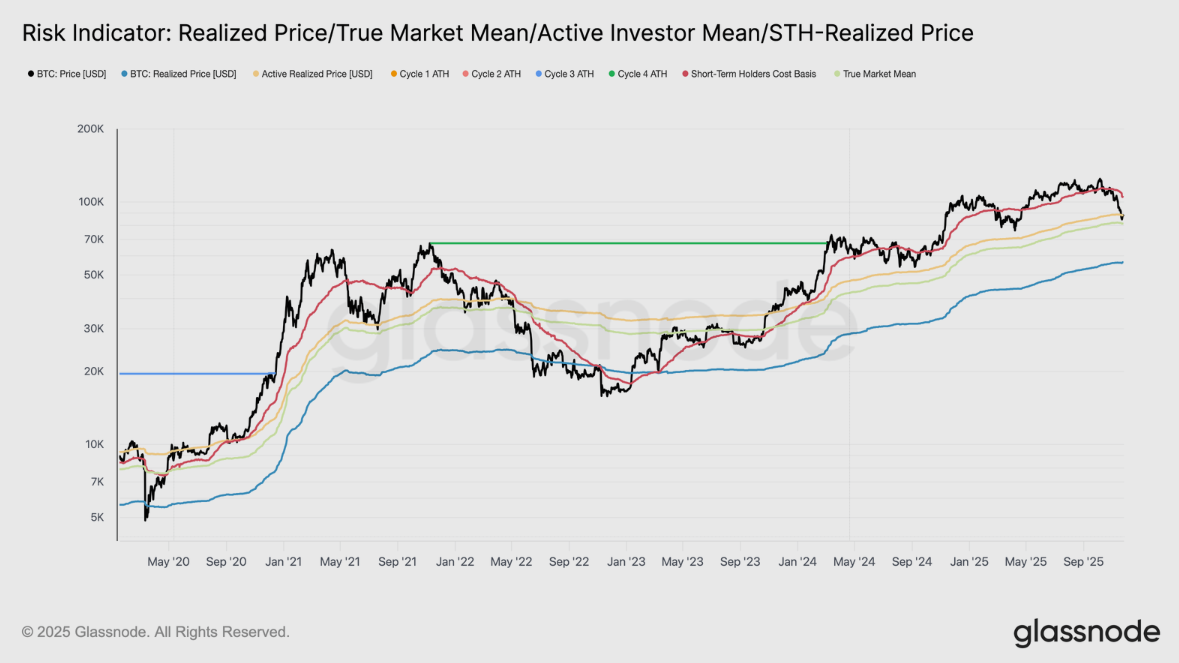

Glassnode's weekly report on Wednesday states that Bitcoin remains structurally fragile, trading within the $81,000 – $89,000 range after breaking below key cost-basis levels. A structure closely resembling the Q1 2022 post all-time high interval, where the market weakened under fading demand. This current range reflects the same dynamic, with the market drifting lower amid limited inflows and fragile liquidity.

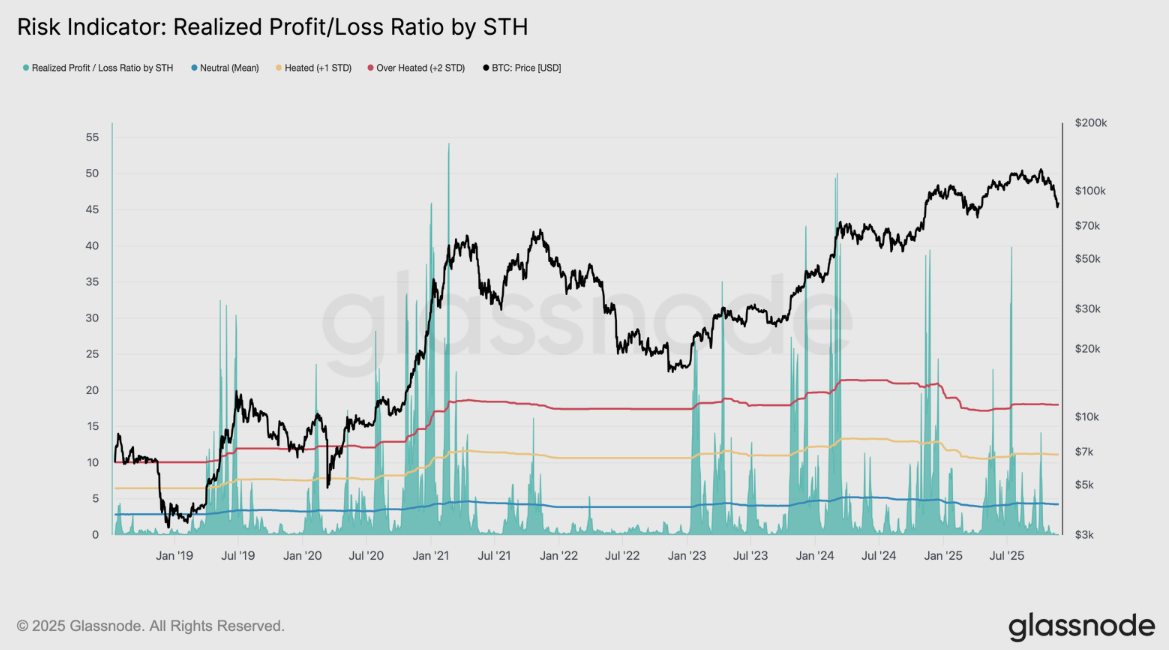

The report further explained that with a weakening market structure, liquidity becomes the key lens for understanding what comes next. A prolonged low-liquidity regime increases the risk of further contraction, and the STH Realized Profit/Loss Ratio offers one of the clearest windows into current demand momentum. The ratio, which compares realized profits to realized losses among recent investors, slipped below its neutral Mean (4.3 times) in early October and has now collapsed to 0.07.

Such overwhelming loss dominance confirms that liquidity has evaporated, especially after the heavy demand absorption seen in (Q2 – Q3) 2025, as long-term holders increased their spending. If this ratio remains depressed, market conditions could begin to mirror the weakness of Q1 2022, raising the risk of a breakdown below the True Market Mean at $81,000.

‘Until price reclaims key cost-basis levels and new inflows return, the market is likely to stay in a low-conviction consolidation, ’ concluded the analyst.

Bitcoin Price Forecast: BTC closes above $90,000 mark

Bitcoin price found support roughly around the key psychological level of $80,000 last week and recovered slightly over the weekend. BTC continued its rebound at the start of this week, closing above $90,000 on Wednesday. At the time of writing on Thursday, BTC continues trading higher above $91,500.

If BTC continues its recovery, it could extend the rally toward the next key psychological level at $100,000.

The Relative Strength Index (RSI) on the daily chart is 41, pointing upward toward the neutral 50 level, indicating fading bearish momentum. Additionally, the Moving Average Convergence Divergence (MACD) showed a bullish crossover on Thursday, providing a buy signal and further supporting the potential continuation of the recovery.

On the other hand, if BTC faces a correction, it could extend the decline toward the key support at $85,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.