Bitcoin ETFs Bleed $4.5 Billion in 2026 So Far – Will the Outflows Continue?

US spot Bitcoin exchange-traded funds (ETFs) are facing their most sustained period of institutional friction this year.

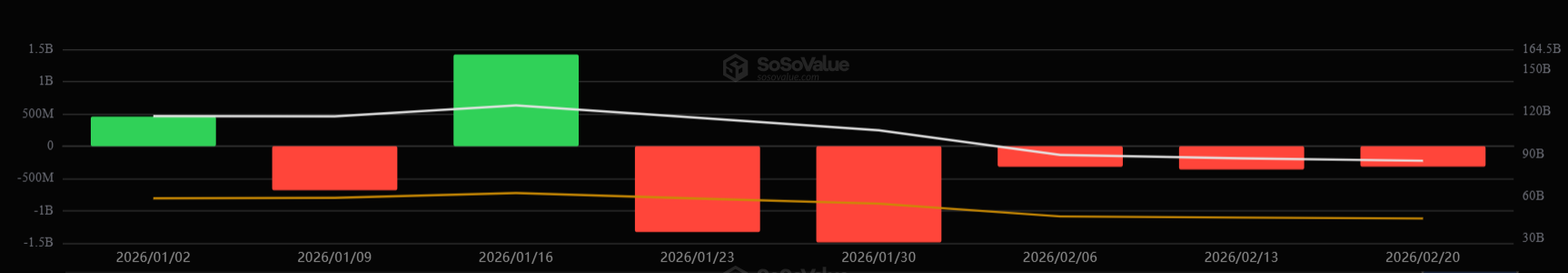

This year, the funds have logged six weeks of outflows amid macroeconomic uncertainty that is driving capital toward traditional safe havens.

BlackRock, Fidelity Lead Bitcoin ETF Exodus Amid Macro Jitters

Since the start of 2026, the funds have bled nearly $4.5 billion, offset by just $1.8 billion of inflows during the first and third weeks of the year, according to data from SosoValue.

The bulk of the damage occurred during the past five-week stretch beginning in late January. That run alone erased roughly $4 billion from the ETF complex, triggered by Bitcoin’s recent price struggles.

Bitcoin ETFs Weekly Flows in 2026. Source: SoSo Value

Bitcoin ETFs Weekly Flows in 2026. Source: SoSo Value

The bleeding has been most pronounced among the category’s heavyweights. BlackRock’s iShares Bitcoin Trust (IBIT) has shed over $2.1 billion in the past five weeks, while Fidelity’s Wise Origin Bitcoin Fund (FBTC) saw more than $954 million walk out the door.

CryptoQuant analyst J.A. Maartun said Bitcoin ETF outflows are at $8.3 billion, down from their October all-time high, marking the weakest year since the funds launched.

Meanwhile, the current steady stream of withdrawals highlights a clear shift in institutional appetite from the aggressive momentum that defined the asset class in its first two years.

Over the past year, the US’s macro policies have prompted a broader de-risking among Wall Street allocators.

This has sparked a rotation out of digital assets and into precious metals like gold and silver. For context, gold and gold-themed ETFs have seen $16 billion in inflows during the past three months.

Still, market observers have pointed out that Bitcoin ETFs’ structural footprint remains largely intact.

Bloomberg senior ETF analyst Eric Balchunas noted that the larger picture remains historically bullish for the nascent asset class.

He noted that, despite recent outflows, the funds have significantly outperformed early market expectations, which had projected first-year inflows of just $5 billion to $15 billion.