Vitalik Buterin Sells $7 Million in Ethereum as ETH Price Sinks 30%

Ethereum co-founder Vitalik Buterin is unloading millions of dollars’ worth of ETH into a rapidly declining market.

On February 22, Lookonchain revealed that Buterin withdrew 3,500 ETH— valued at approximately $6.95 million — from the DeFi protocol Aave. Within hours of the withdrawal, he had already sold 571 of those tokens for $1.13 million.

Buterin’s Selling Lands Amid Ethereum’s Oversold Signals

The sudden movement of assets highlights a stark contrast between Buterin’s stated long-term financial strategy and his immediate market actions.

On January 30, the 32-year-old developer announced that the Ethereum Foundation was entering a period of “mild austerity” to achieve its goals.

He withdrew 16,384 ETH to support the firm, planning to strategically deploy the tokens for long-term goals “over the next few years.”

Instead, the execution has been remarkably swift. Since February 2, Buterin has sold more than 7,380 ETH for roughly $15.5 million at an average price of $2,100.

Combined with today’s transactions, the co-founder has liquidated over half of his designated austerity reserve in less than a single month.

The concentrated selling pressure from the network’s most prominent architect arrives at a precarious moment for the asset.

ETH has plummeted 30% over the past month, currently trading just below the psychological support level of $2,000.

Institutional investors and market participants frequently view heavy founder liquidations during steep market drawdowns as a bearish indicator, regardless of the stated administrative intent.

Despite the persistent sell-side pressure originating from Buterin, some blockchain intelligence firms argue the asset is flashing oversold technical signals.

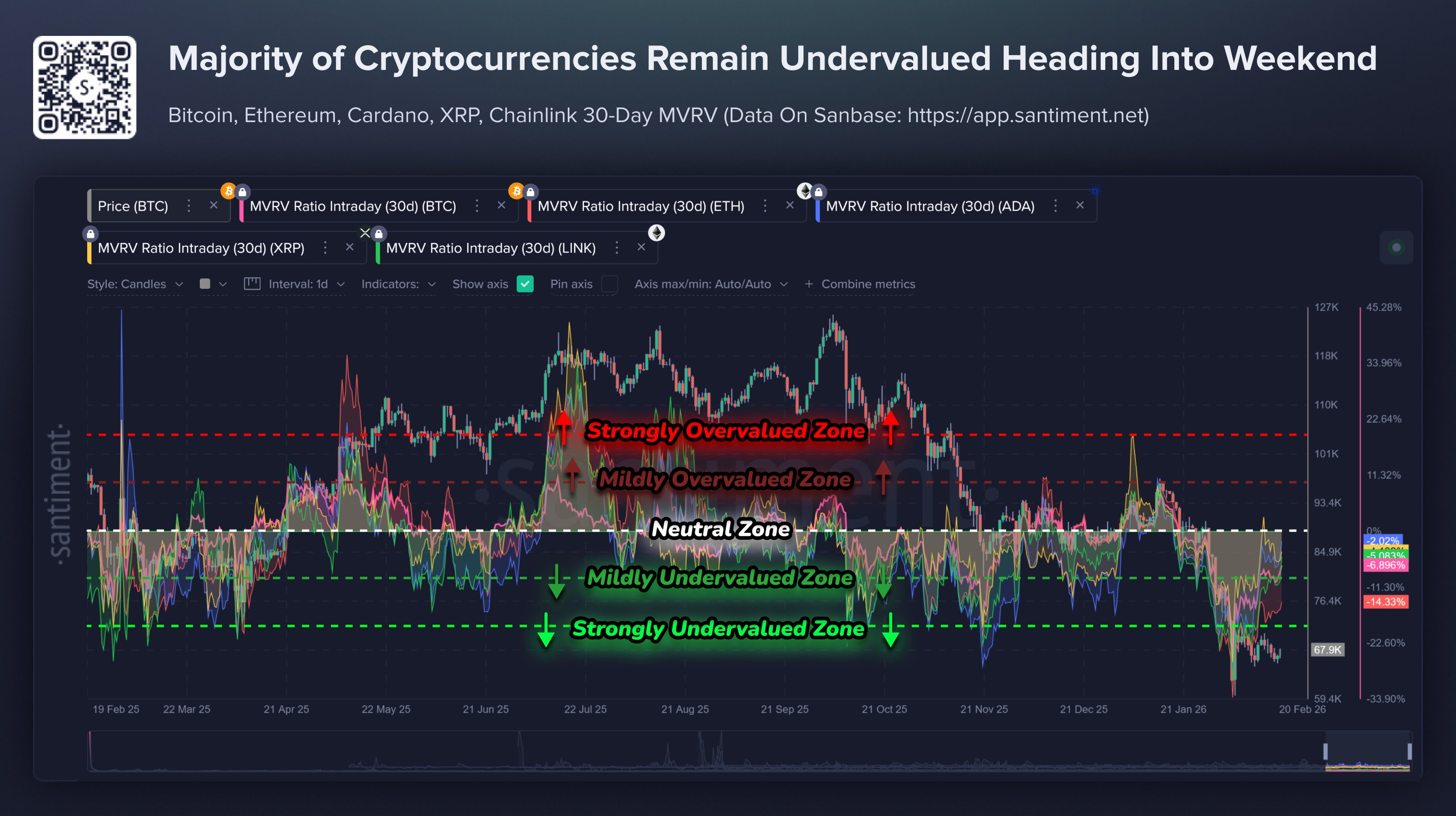

Data from Santiment indicates that ETH’s 30-day Market Value to Realized Value (MVRV) ratio points to severe technical undervaluation.

The MVRV metric, which compares an asset’s total market capitalization to its realized value to estimate average holder profitability, currently places ETH at a 14.3% deficit.

Ethereum’s MVRV Shows Oversold Signal. Source: Santiment

Ethereum’s MVRV Shows Oversold Signal. Source: Santiment

According to Santiment’s data, Ethereum is the most aggressively discounted asset among major cryptocurrencies over the last 30 days. By comparison, Bitcoin shows an undervaluation of 6.9%, Chainlink stands at 5.1%, XRP at 4.1%, and Cardano at 2%.