This "Magnificent Seven" Stock Is Down 22%. Buy It Before It Sets a New All-Time High.

Key Points

Investors are skeptical of Amazon’s risk-taking.

Amazon will likely be free-cash-flow negative in 2026.

Amazon is dirt cheap.

- 10 stocks we like better than Amazon ›

It's been a rough period for Amazon (NASDAQ: AMZN) investors.

Amazon stock rose a mere 5.2% in 2025, which was less than all of its "Magnificent Seven" peers.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

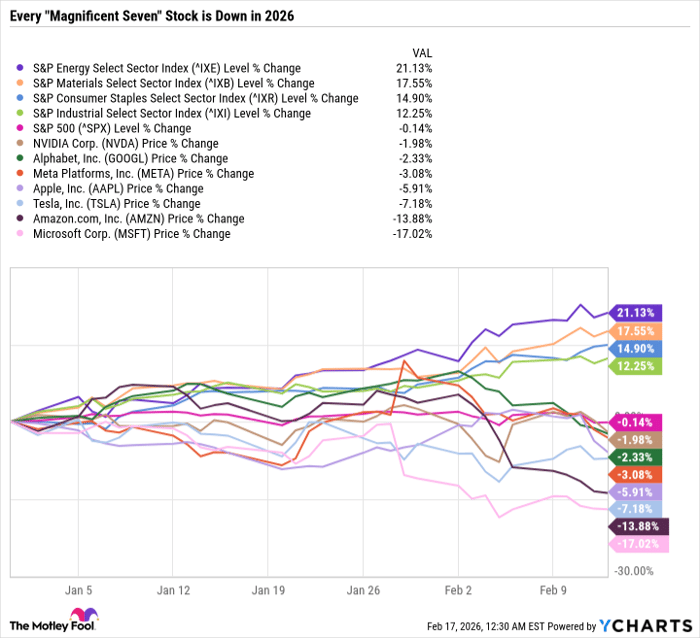

Year-to-date in 2026, Amazon is trading down 10%, making it the second-worst-performing Magnificent Seven stock (behind Microsoft, which is down 18%). Zoom out, and Amazon is now down 18.4% from its all-time high.

Here's why the sell-off in Amazon is a buying opportunity for patient investors.

Image source: Amazon.

Growth stocks are falling

Over time, earnings drive stock prices. But in the near term, emotions and sentiment can heavily impact price action. The sell-off in Amazon is unsurprising, given that the stock market currently favors safe and steady, dividend-paying companies with predictable cash flows and business models that can hold up regardless of artificial intelligence (AI) disruption.

The energy, materials, consumer staples, and industrial sectors are all up over 12% year-to-date. Meanwhile, the S&P 500 (SNPINDEX: ^GSPC) is roughly flat, and all of the Magnificent Seven stocks have lost value.

Data by YCharts.

The boldest Magnificent Seven company

Amazon is under pressure because it is aggressively taking on risk in a market that favors caution. In its fourth-quarter 2025 earnings release, Amazon announced plans to spend $200 billion on capital expenditures (capex) in 2026 as it pours money into AI infrastructure, custom chips, and robotics.

For context, Amazon earned $139.5 billion in 2025 operating cash flow, which was 20% higher than 2024. But capex grew even quicker, jumping from $77.7 billion in 2024 to $128.3 billion in 2025. Since FCF is simply operating cash flow minus capex, it will decline if capex increases by more than operating cash flow, which is exactly what happened to Amazon in 2025 when it reported just $11.2 billion in FCF compared to $38.2 billion in 2024.

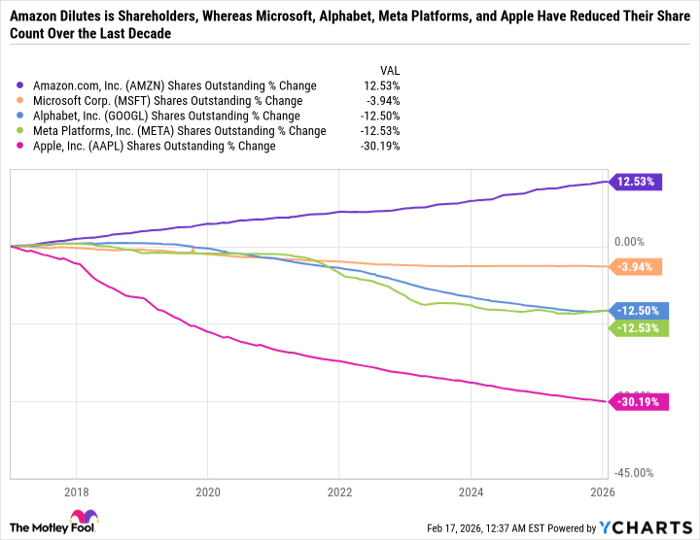

To be fair, Amazon's bold bets on AI are in line with the company's modus operandi. Throughout its history, Amazon has shamelessly bet big on its best ideas, which have produced smashing hits like Amazon Web Services and epic failures like the Fire Phone and cashier-less Amazon Go convenience stores. Unlike other Magnificent Seven peers, Amazon doesn't pay a dividend. And it routinely dilutes shareholders with stock-based compensation that exceeds its buybacks.

Data by YCharts.

Amazon can afford to bet big

I could see Amazon remaining under a lot of pressure until investors are convinced its spending is the right move. However, I could also see Amazon outperforming the S&P 500 over the long term.

To Amazon's credit, it has the balance sheet to take a big risk. It exited 2025 with $57.3 billion in cash, cash equivalents, and marketable securities net of long-term debt -- meaning even if it takes on debt to fund its AI spending, its balance sheet would still be in good shape.

What's more, Amazon is seeing increased demand from its high-margin AWS segment, which partially justifies the high spending. Over the long term, it could realize efficiency improvements, especially through robotics and automation in its warehouses and processes.

Amazon has a reasonable valuation

Amazon is a classic case of a stock selling off for reasons that have more to do with what's driving the broader market right now than its three- to five-year outlook. Investors who are confident in AWS' growth and Amazon's ability to convert AI spending into FCF growth are getting an incredible opportunity to scoop up shares.

Amazon now has a mere 25.8 forward price-to-earnings (P/E) ratio, which is only a slight premium to the S&P 500's 23.6 forward P/E, even though Amazon is a far better company than the average S&P 500 component.

Add it all up, and Amazon stands out as a top buy now.

Should you buy stock in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $424,262!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,163,635!*

Now, it’s worth noting Stock Advisor’s total average return is 904% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 22, 2026.

Daniel Foelber has positions in Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has a disclosure policy.