WTI crude oil surges on Iran nuclear talk uncertainty and Strait of Hormuz closure

- US and Iran concluded a second round of nuclear talks in Geneva with both sides citing progress on guiding principles, though key gaps on enrichment and sanctions remain unresolved.

- Iran's partial closure of the Strait of Hormuz for military drills and an 8.5 million barrel US inventory build from the prior week's Energy Information Administration (EIA) report are pulling crude in opposite directions.

Oil prices whipsawed this week as the second round of US-Iran nuclear negotiations in Geneva dominated sentiment. Both sides reported progress on broad principles, but Iran continues to reject Washington's demand for zero uranium enrichment while the US pushes to expand talks beyond the nuclear file. Iran's Revolutionary Guard conducted live-fire drills in the Strait of Hormuz during the talks, partially closing the waterway that carries roughly 20% of global oil flows; the first such closure since the US military buildup in the region began. Weighing against the geopolitical bid, last week's EIA data showed US crude inventories rose by 8.5 million barrels, the largest weekly build in a year, while the Organization of the Petroleum Exporting Countries and its allies (OPEC+) are leaning toward resuming production increases from April when the group meets on March 1.

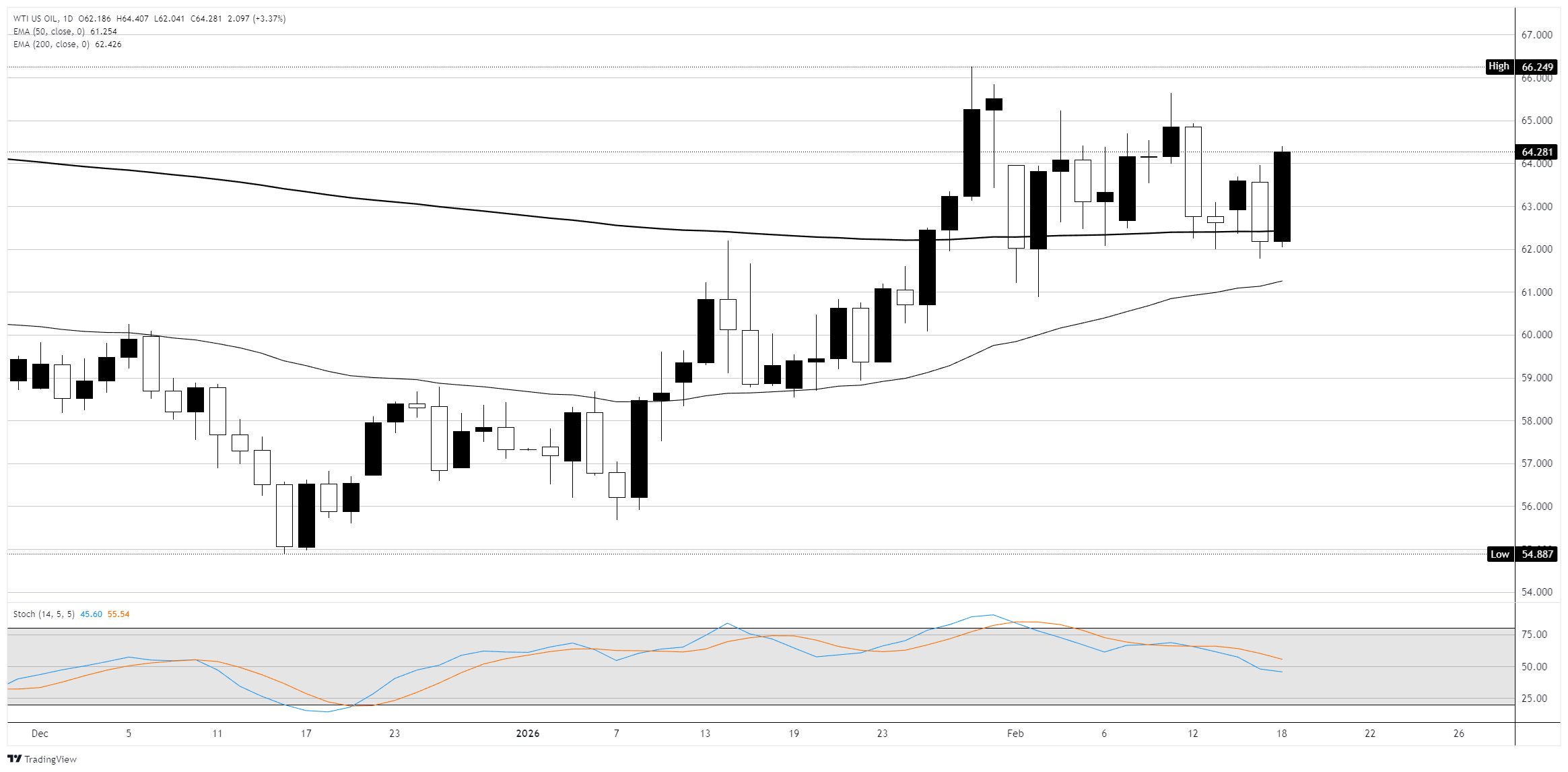

Strong bullish daily candle reclaims the 200-day Exponential Moving Average (EMA) near 62.43

On the daily chart, WTI opened Tuesday's session near $62.20, climbing 3.4% on the day. The rally drove price back above the 200-day and 50-day EMAs, restoring a bullish alignment after several sessions of testing the 200-day level from both sides. The move erased the prior session's losses and pushed price action back into the upper half of the consolidation range that has held since the late-January pullback from early-year highs. The Stochastic Oscillator is stuck in the midrange zone, suggesting momentum has room to develop in either direction. Resistance sits at $65.00 and the $66.25 year-to-date high; a break above would open the door toward the $67.00 handle. Support rests at the 200-day EMA near $62.45, with a failure there exposing the 50-day EMA at $61.25.

WTI daily chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.