Why Netflix Stock Is Worth Buying on This Pullback

Key Points

Investors continue to ditch Netflix stock over uncertainties around the company's interest in acquiring certain assets from Warner Bros. Discovery.

Netflix's underlying business is experiencing robust growth across subscriber counts, advertising fees, and operating margins.

Netflix is trading at its cheapest levels in three years based on historical price-to-earnings (P/E) trends.

- 10 stocks we like better than Netflix ›

The last six months have been brutal for Netflix (NASDAQ: NFLX) investors. As of this writing (Feb. 13), Netflix shares have plummeted 43% from all-time highs.

The main culprit behind the Netflix sell-off revolves around one thing: A potential acquisition of the television and film assets of Warner Bros. Discovery.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

While most continue to panic over how Netflix may finance this transaction -- should the deal go through -- and integrate Warner Bros.' content with its existing content, smart investors are looking past these distractions and thinking longer term.

Image source: Netflix.

Beyond subscriber metrics: What investors are missing about Netflix's financial profile

The key performance indicator that most investors care about for Netflix is its subscriber count. At the end of the fourth quarter, the company boasted 325 million paid memberships -- up from 302 million subscribers at the end of 2024.

Increasing subscriber count is critical as it provides Netflix with recurring, predictable revenue. However, over the last couple of years, Netflix has quietly introduced some new operating levers that I think are going overlooked.

Last year, Netflix's advertising segment grew 2.5x compared to 2024 -- generating $1.5 billion in sales. In just three years, Netflix has been able to turn its advertising division into a billion-dollar business that complements the subscription service.

What I mean by that is the low-cost ad tier helps insulate Netflix from higher churn rates, while also maintaining some degree of premium pricing from audiences who choose to bypass marketing and pay full price.

The combination of recurring streaming fees and high-margin advertising is helping Netflix expand its profit margins. For 2026, management is guiding for a 31.5% operating margin -- up from 29.5% last year. Widening profit margins should flow to Netflix's bottom line -- fueling additional free cash flow that the company can use to reinvest in new content creation.

Netflix stock: Buy the dip or avoid a value trap?

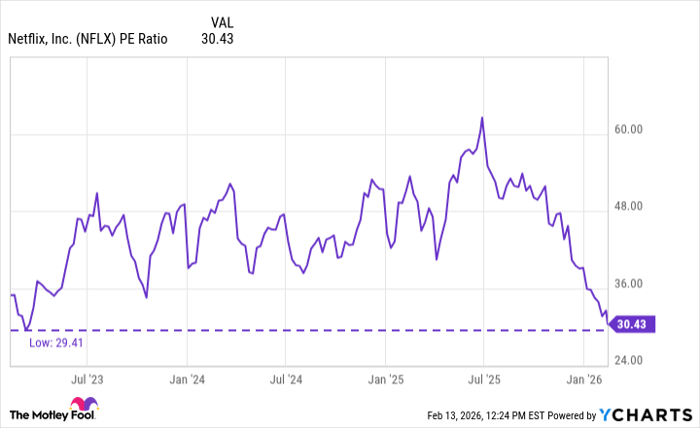

Thanks to the ongoing sell-off, Netflix is now trading at its cheapest valuation in three years based on trends in the price-to-earnings (P/E) multiple. The question now is whether this is a savvy opportunity to buy the dip or if this streaming stock is swiftly turning into a value trap.

NFLX PE Ratio data by YCharts

Given the company's accelerating subscriber base, growing advertising segment, and the company's ability to command positive unit economics on these businesses, I see little reason for Netflix to experience a meaningful decline in revenue or earnings.

The consensus stock prediction for Netflix among sell-side analysts is about $111 -- implying 44% upside from current trading levels.

To me, the entire reason Netflix stock is declining is due to uncertainties around the Warner Bros. deal. But if you zoom out, Netflix has proven that it can navigate the competitive landscape in media and entertainment with or without these assets. For these reasons, I think now is a good opportunity to scoop up shares of Netflix at a rare discount.

Should you buy stock in Netflix right now?

Before you buy stock in Netflix, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Netflix wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $415,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,133,904!*

Now, it’s worth noting Stock Advisor’s total average return is 889% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 18, 2026.

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Netflix and Warner Bros. Discovery. The Motley Fool has a disclosure policy.