Australian Dollar remains subdued after the release of the Purchasing Managers’ Index figures on Tuesday.

Australia’s S&P Global Composite PMI dropped to 52.1 in September from 55.5 previously, its lowest level in three months.

The US Dollar may struggle due to growing expectations of further Fed rate cuts.

The Australian Dollar (AUD) edges lower against the US Dollar (USD) on Tuesday, following the release of the preliminary Australia’s S&P Global Purchasing Managers’ Index (PMI) data. However, the downside of the AUD/USD pair could be limited as the Greenback faces challenges amid growing expectations of a further rate cut from the US Federal Reserve (Fed).

Australia’s S&P Global Composite PMI fell to 52.1 in September, from 55.5 prior, marking the lowest reading in three months. Manufacturing and services both noted slowing growth amid weaker new business inflows and lower goods orders at the fastest pace in eight months. The preliminary S&P Global Services PMI showed a modest slowdown to 52 in September, from 55.8 in August. Meanwhile, the Manufacturing PMI fell to 51.6 from 53.0 previously.

Reserve Bank of Australia (RBA) Governor Michele Bullock told parliament on Monday that labor market conditions have eased slightly, with unemployment ticking higher. However, the market remains tight and near full employment. Bullock noted that recent rate cuts should support household and business spending, while stressing that the RBA must stay vigilant to changing conditions and be ready to respond if needed. The Board, she added, will continue to monitor data and evolving risks to guide its decisions closely.

Australian Dollar loses ground despite a weaker US Dollar

The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is weakening for the second successive day and trading around 97.20 at the time of writing. Traders will likely observe the preliminary reading of the US S&P Global PMI reports for September later in the day. US Federal Reserve (Fed) Chair Jerome Powell will also be eyed.

Fed Bank of Cleveland President Beth Hammack warned on Monday that inflation pressures will likely persist for the time being, noting challenges on both sides of the Fed's mandate to both control inflation and support the labor market.

Richmond Fed President Thomas Barkin noted on Monday that tariff policies tend to result in higher prices for consumers, noting that the primary point of concern for businesses remains cloudy trade policy, not high interest rates.

The US Department of Labour (DOL) released on Thursday, the Initial Jobless Claims went down to 231K for the week ending September 13. The latest print came in short of initial estimates of 240K and was lower than the previous week’s 264K (revised from 263K). Meanwhile, Continuing Jobless Claims shrank by 7K to 1.920M for the week ending September 6.

The Federal Reserve (Fed) lowered the funds rate by 25 basis points (bps) last week, marking the first cut of the year, and signaled a further 50 bps of easing before year-end, slightly above its June projections.

Fed Chair Jerome Powell pointed to growing signs of weakness in the labor market to explain why officials decided it was time to cut rates after holding them steady since December amid concerns over tariff-driven inflation.

The People’s Bank of China (PBOC), China's central bank, announced that it would leave its Loan Prime Rates (LPRs) unchanged on Monday. The one-year and five-year LPRs were at 3.00% and 3.50%, respectively.

The White House announced that US companies will take control of TikTok’s algorithm, while Americans will occupy six of the seven board seats for its US operations. White House Press Secretary Karoline Leavitt said the agreement could be finalized “in the coming days,” though Beijing has not yet commented.

The Reserve Bank of Australia (RBA) rate cuts. Markets now price just a 20% chance of a September cut, while odds for November stand at 70%, with above-target inflation keeping policymakers cautious.

Australian Dollar remains below 0.6600 barrier near nine-day EMA

AUD/USD is trading around 0.6590 on Tuesday. Technical analysis on the daily chart shows that the pair remains slightly below the ascending channel pattern, indicating a growth of bearish bias. However, the 14-day Relative Strength Index (RSI) maintains its position slightly above the 50 level, suggesting that bullish sentiment still has play.

The AUD/USD pair may find its initial support at the crucial level of 0.6550, aligned with the 50-day Exponential Moving Average (EMA) at 0.6549. A break below the support zone would weaken the medium-term price momentum and put downward pressure on the pair to navigate the region around the three-month low at 0.6414, which was recorded on August 21.

On the upside, the nine-day EMA at 0.6611 would act as a primary barrier, followed by the lower boundary of the ascending channel around 0.6630. A rebound to the channel would support the short-term price momentum and lead the AUD/USD pair to approach the 11-month high of 0.6707, recorded on September 17, followed by the ascending channel’s upper boundary around 0.6720.

AUD/USD: Daily Chart

Australian Dollar Price Today

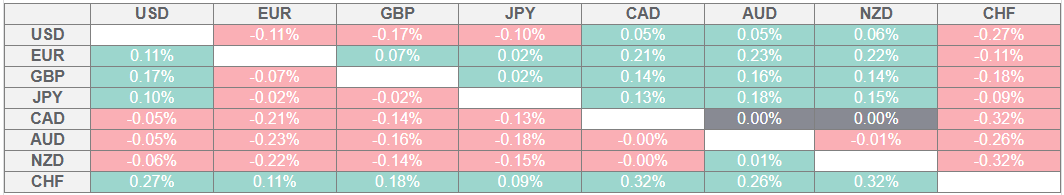

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.