Australian Dollar extends its losses as the Greenback advances on the Fed’s cautious outlook.

RBA’s Bullock said the central bank will continue to monitor data and evolving risks closely to guide its policy decisions.

The White House said US firms will control TikTok’s algorithm, with Americans holding six of seven board seats.

The Australian Dollar (AUD) declines against the US Dollar (USD) on Monday, extending its losses for the fourth successive session. The AUD/USD pair continues its losing streak as the Greenback remains stronger after the Federal Reserve (Fed) indicated no rush to lower borrowing costs quickly in the coming months after delivering an expected rate cut last week.

Reserve Bank of Australia (RBA) Governor Michele Bullock told parliament on Monday that labor market conditions have eased slightly, with unemployment ticking higher, though the market remains tight and near full employment. Bullock noted that recent rate cuts should support household and business spending, while stressing that the RBA must stay vigilant to changing conditions and be ready to respond if needed. The Board, she added, will continue to monitor data and evolving risks to guide its decisions closely.

The People’s Bank of China (PBOC), China's central bank, announced that it would leave its Loan Prime Rates (LPRs) unchanged on Monday. The one-year and five-year LPRs were at 3.00% and 3.50%, respectively.

The White House announced that US companies will take control of TikTok’s algorithm, while Americans will occupy six of seven board seats for its US operations. White House Press Secretary Karoline Leavitt said the agreement could be finalized “in the coming days,” though Beijing has not yet commented.

Australian Dollar loses ground as US Dollar remains stronger on Fed’s cautious tone

The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is gaining ground and trading around 97.70 at the time of writing. The focus this week is on the latest Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s preferred inflation gauge, which is expected to signal subdued price pressures.

The US Department of Labour (DOL) released on Thursday, the Initial Jobless Claims went down to 231K for the week ending September 13. The latest print came in short of initial estimates of 240K and was lower than the previous week’s 264K (revised from 263K). Meanwhile, Continuing Jobless Claims shrank by 7K to 1.920M for the week ending September 6.

The Federal Reserve (Fed) lowered the funds rate by 25 basis points (bps) last week, marking the first cut of the year, and signaled a further 50 bps of easing before year-end, slightly above its June projections.

Fed Chair Jerome Powell pointed to growing signs of weakness in the labor market to explain why officials decided it was time to cut rates after holding them steady since December amid concerns over tariff-driven inflation.

Australia’s seasonally adjusted Employment Change arrived at -5.4K in August from 26.5K in July (revised from 24.5K), compared with the consensus forecast of 22K. Meanwhile, the Unemployment Rate steadied at 4.2% in August, as expected.

The Reserve Bank of Australia (RBA) rate cuts. Markets now price just a 20% chance of a September cut, while odds for November stand at 70%, with above-target inflation keeping policymakers cautious.

Australian Dollar eyes 0.6550 support near 50-day EMA

The AUD/USD pair is trading around 0.6590 on Monday. Technical analysis on the daily chart shows that the pair has broken below the ascending channel, indicating a potential for a bearish shift. However, the 14-day Relative Strength Index (RSI) remains above the 50 level, suggesting the bullish bias is still in play.

The AUD/USD pair may find its initial support at the crucial level of 0.6550, aligned with the 50-day EMA at 0.6548. A break below the support zone would weaken the medium-term price momentum and put downward pressure on the pair to navigate the region around the three-month low at 0.6414, which was recorded on August 21.

On the upside, a successful break above the nine-day EMA at 0.6613, which is aligned with the lower boundary of the ascending channel. A rebound to the channel would support the short-term price momentum and lead the AUD/USD pair to approach the 11-month high of 0.6707, recorded on September 17, followed by the ascending channel’s upper boundary around 0.6720.

AUD/USD: Daily Chart

Australian Dollar Price Today

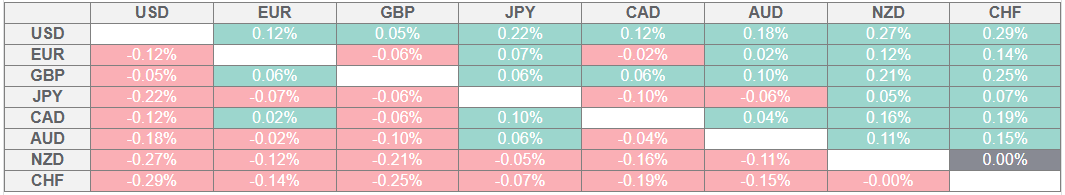

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the US Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.