Forex Today: Gold climbs to new record-high above $3,700, eyes on Fed speeches

Here is what you need to know on Monday, September 22:

Gold builds on its bullish action to end the previous week and trades at a new record-high above $3,700 on Monday. In the absence of high-impact data releases, investors will pay close attention to comments from policymakers of major central banks on Monday.

Following a three-day rally, the US Dollar (USD) holds steady in the European morning on Monday, with the USD Index moving sideways above 97.50. The Federal Reserve's (Fed) cautious tone on further policy easing and upbeat data releases from the US seen in the second half of last week continue to support the USD. In the meantime, US stock index futures lose about 0.2% to start the European session, reflecting a cautious market mood. Fed policymakers John Williams, Alberto Musalem, Thomas Barkin, Beth Hammack and others will be delivering speeches later in the day.

US Dollar Price Last 7 Days

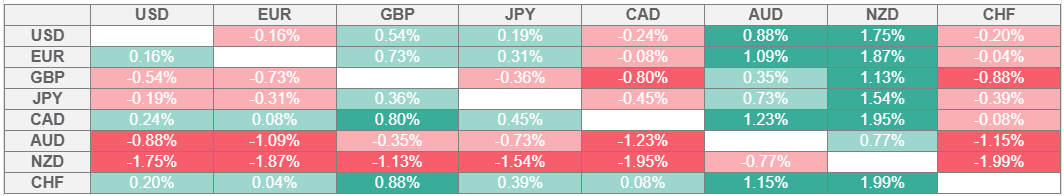

The table below shows the percentage change of US Dollar (USD) against listed major currencies last 7 days. US Dollar was the strongest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Gold benefits from escalating geopolitical tensions and continues to push higher after rising more than 1% on Friday. News of NATO forces intercepting three Russian MiG-31 fighters after they entered Estonia's airspace keeps investors on edge. US President Donald Trump expressed his displeasure at the incursion and said he would help defend European Union members if Russia intensified hostilities.

EUR/USD consolidate the losses it suffered in the second half of the previous week and fluctuates below 1.1750 in the early European session on Monday. The European Commission will publish the preliminary Consumer Confidence data for September later in the day.

GBP/USD moves sideways below 1.3500 after declining sharply on Thursday and Friday. Assessing the Bank of England's (BoE) policy announcements, "the BoE voted by a majority of 7–2 to maintain the Bank Rate at 4.00% in September," UoB Group analysts noted. "The key policy guidance was left unchanged, with the central bank reiterating that a gradual and careful approach to the further withdrawal of monetary policy restraint remains appropriate," they added.

USD/JPY struggles to find direction on Monday and fluctuates at around 148.00. The Bank of Japan (BoJ) left monetary policy settings unchanged following the September policy meeting, as expected. Two policymakers, however, unexpectedly voted in favor of a rate hike. "What matters most for the yen is the hawkish vote split. We have been calling for a rate hike in October, and the dissenters' vote makes us more confident in that view," ING analysts said.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.