Broadcom’s Quiet Software Power Grab

- Broadcom posted $15 billion in Q2 revenue, up 20% YoY, with $6.4 billion in free cash flow.

- AI semiconductor revenue reached $5 billion quarterly, over 60% YoY growth, driven by Ethernet switching and XPU deployments.

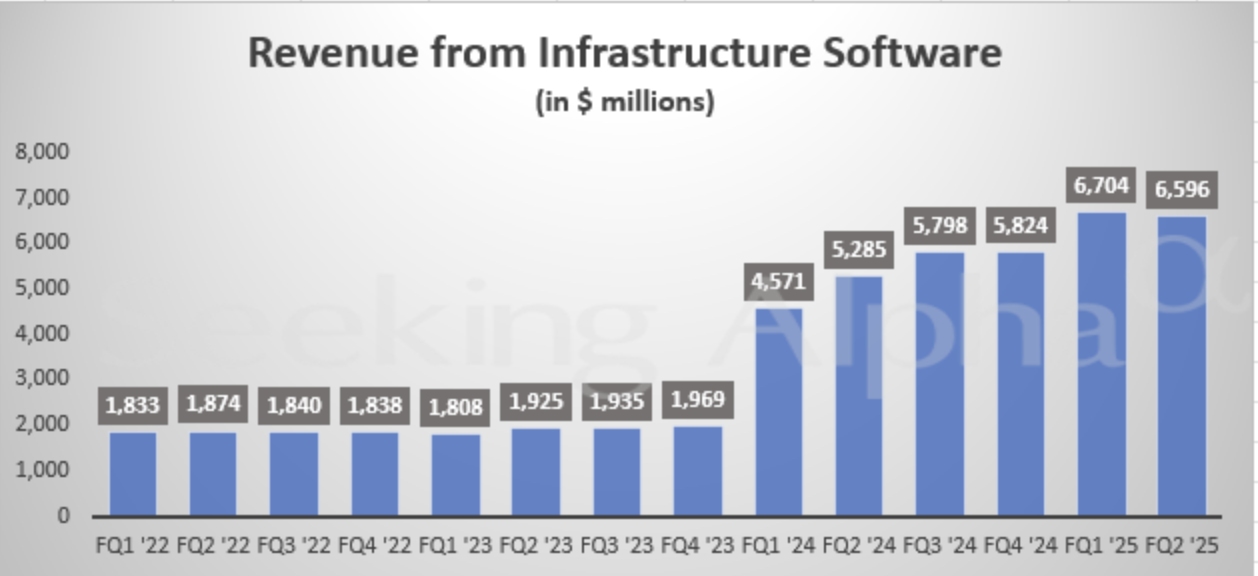

- Infrastructure software revenue rose 25% YoY to $6.6 billion, with 90%+ gross margins and 87% VMware adoption among top clients.

- Valuation is stretched at 91.16x GAAP P/E and 18.74x forward P/S, far above sector medians by over 500%.

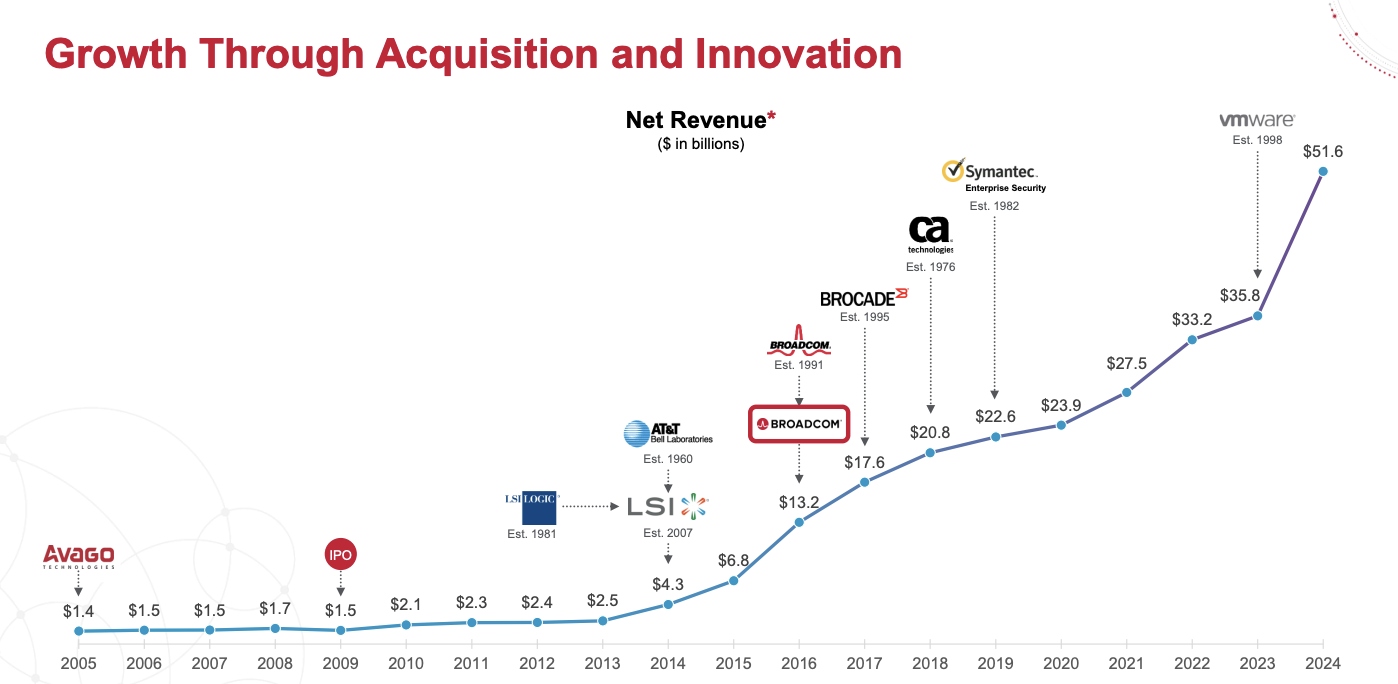

TradingKey - Broadcom Inc. (AVGO) is at the crossroads between two revolutionary trends: hyperscale AI infrastructure and enterprise software unification due to VMware. Its Q2 2025 figures bear enviable momentum: consolidated revenue of $15 billion (an increase of 20% YoY), free cash flow of $6.4 billion with a 43% margin, and an exploding AI semiconductor business now accounting for over $5 billion in quarterly revenue. CEO Hock Tan revealed AI networking leadership with Broadcom’s Ethernet-based solution, identified by him as the focal point of multi-tiered accelerator deployments.

But where revenue growth and capital efficiency are stellar, valuation metrics are cause for concern. AVGO’s TTM GAAP P/E is 98, with a forward 21x EV/Sales ratio, over 600% above sector medians. Its valuation signals overvaluation across most measures, with price/sales and EV/EBITDA multiples above even lofty high-growth tech norms. Here’s the ultimate investor decision: is Broadcom an irreplaceable infrastructure powerhorse riding on a generational AI tailwind or an expensively priced asset due for normalization?

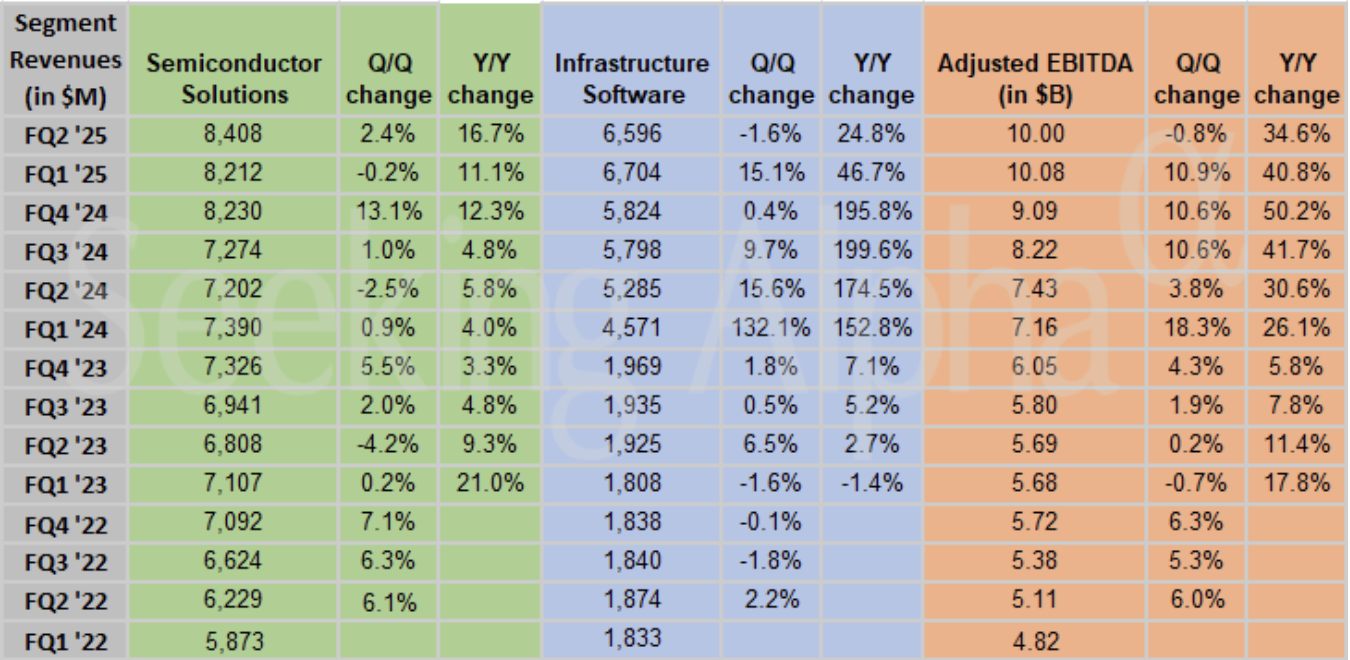

Broadcom’s Dual Flywheels: Semiconductors and Infrastructure Software

Broadcom’s model revolves around a dual-engine business approach: high-margin infrastructure software and AI-leading semiconductor revenue. Its semiconductor business reached $8.4 billion during Q2, 17% YoY growth, with more than half coming from AI-based revenue, consisting of Ethernet switches and XPUs. Its recently released Tomahawk 6 switch with 102.4 Tbps capacity makes Broadcom the backbone interconnect for hyperscale AI clusters, cutting tiers from three to two and enabling scalability.

![]()

Source: Seeking Alpha

At the same time, the segment comprised of the infrastructure software, headed by the purchase of VMware, brought in revenues of $6.6 billion, up 25% YoY. The business itself is sticky by nature: over 87% of Broadcom’s top 10,000 customers now possess the VMware Cloud Foundation (VCF). Gross margins for the segment are over 90%, producing a stable, high-cash-flow generator that compensates for hardware cyclicality.

Source: Seeking Alpha

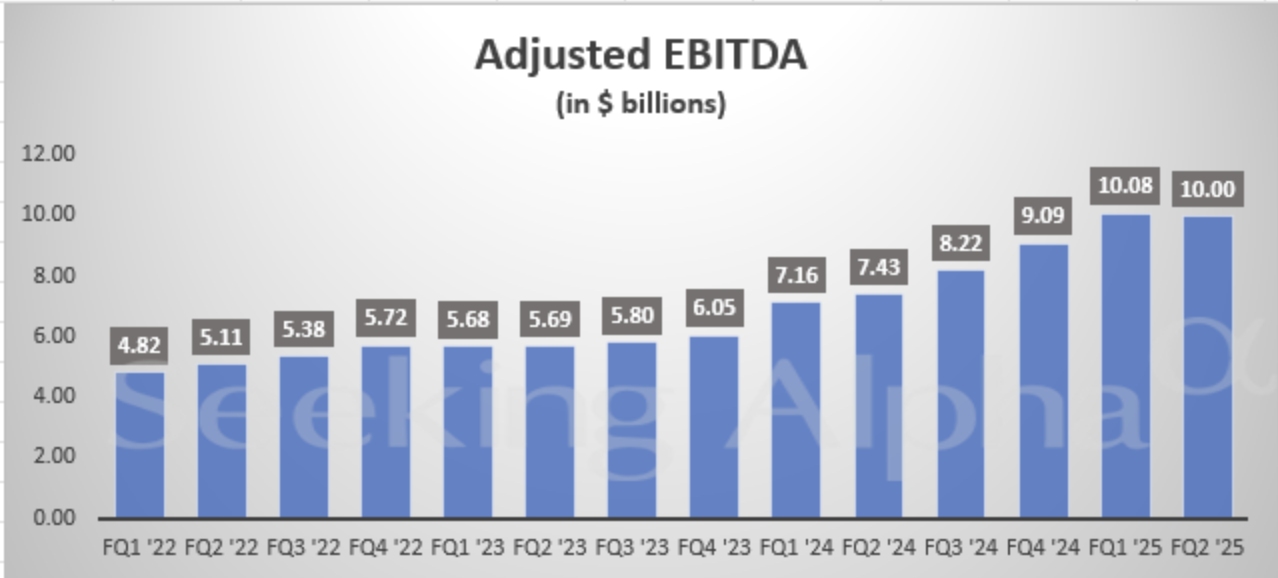

Operationally, the company is a fortress. Gross margins reached 79.4%, and adjusted EBITDA went over $10 billion (67% margin). The model scales with remarkable efficiency, driven by cost discipline, deep customer relationships, and leverage of enterprise stack integration.

Source: Seeking Alpha

Competitive Landscape: Positioned to Win, But Not Alone

Broadcom’s competition runs along two axes: vertical infrastructure companies and horizontal chip companies. On the chip side, Nvidia remains the AI compute monarch, but Broadcom’s Ethernet-based networking provides something that doesn’t have a direct one-to-one competition. It's bread and butter here is at the fabric level with AI scaling and switching, both spaces where hyperscalers are deeply interested in cost efficiency and latency reduction.

Broadcom’s enterprise stack with VMware is countered by cloud-native infrastructure suppliers like Red Hat, Oracle, and Microsoft Azure Fabric. But Broadcom’s lock-in is because it controls the software that binds bare metal and the hybrid cloud, and that role is less disrupted by hyperscale vertical integration.

Source: Broadcom Company Overview

But with AI-related CapEx clustering by multiple mega-buyers, customer concentration risk is on the horizon. Furthermore, Nvidia’s increasing incursion into networking (via Spectrum-X) and SmartNICs bodes potential Broadcom encroachment within future cycles. And despite Ethernet’s scalability and economic advantages, InfiniBand still dominates latency-sensitive workloads, placing Broadcom in “scale-up efficiency” instead of categorical leadership.

Drivers of Growth and Financial Deep Dive: Strong, but Patchy AI Semiconductor Growth

Broadcom's ramp of AI is the bigger picture. Management now forecasts $5.1 billion of AI semiconductor revenue in Q3, which is 60% YoY growth. Demand-driven ramping is happening, particularly for inference. With XPU deployment through 2026 slated to explode, Broadcom’s networking stack could see 5–10 times greater scale-up density, and that’s something that the company has early visibility into.

VMware Integration & Software Recurrence

VMware is ingrained in Broadcom’s business, with a 44% revenue contribution. With >87% market adoption among premier customers and stable 76%+ operating margins, this business provides a critical protection against semiconductor cyclicality.

Cash Flow, Efficiency & Profitability

Free cash flow hit $6.4 billion in Q2, up 44% YoY. CapEx remains modest at $144 million, and Broadcom pays out $7 billion to shareholders through dividends and buybacks. GAAP net income was 134% YoY higher at $4.97 billion, with 35% higher adjusted EBITDA. However, debt is elevated at $67 billion, partly an acquisition hangover with respect to the purchase of VMware.

Source: Seeking Alpha

Source: Broadcom Company Overview

Profitability Mix and Cost Drivers

GAAP gross margin dipped slightly due to XPU mix shift, but EBITDA margin remains robust. Non-GAAP operating income for the company is over $9.7 billion quarterly, with OpEx kept in strict control. Interest expense ($769 million), however, and amortization are still high, both due to acquisition-related accounting noise and due to heavy debt servicing.

Valuation Check: Priced Like a Platform, Not a Hardware Business

Broadcom's valuation now implies platform-like defensibility and endless growth tailwinds. But the math doesn't agree.

At $270/share, AVGO is trading at:

- P/E GAAP (TTM): 98 (vs. 28.7 sector median, 242% premium)

- P/S (FWD): 20x (vs. 3.2 sector median, 603% premium)

- EV/EBITDA (FWD): 32x (vs. 15 sector median, 113% premium)

If we assume a more conservative 25x FCF multiple against the trailing $26 billion annualized trailing FCF run-rate, we reach a ~$650 billion enterprise value. Subtract out our $67 billion net debt, and that leaves us with a ~$583 billion equity valuation, or ~$215/share. At 30x FCF (platform premium), fair value rises to ~$258. So at $270, AVGO is essentially priced for perfection.

Add current macro unpredictability, competitive creep, and debt repayment, and there’s little room for mistakes.

Risk Factors: AI Saturation, Regulatory Fog, Debt Overhang

Other risks could compel AVGO's lofty valuation:

- AI Saturation: In case AI CapEx stabilizes or becomes normalized after 2026, AVGO’s AI tailwind may fray, particularly as Ethernet faces competition from maturing networking models such as Nvidia’s NVLink or Infiniband.

- Regulatory Headwinds: The trade tensions and export controls, especially affecting the components related to AI chips, remain an active threat. Hock Tan himself validated how fluid such constantly changing restrictions are.

- Leverage Sensitivity: Broadcom has more than $67 billion of long-term debt. With rising rates and capital charges, debt servicing (already nearing $1.6 billion quarterly) limits flexibility.

- Customer Concentration & Cyclical Exposure: Non-AI chip demand remains "at the bottom," by management's estimate. A decrease in cloud or enterprise IT budgets would disproportionately impact semiconductor orders.

Conclusion

Broadcom executes beautifully, monetizing AI infrastructure and VMware software with surgical accuracy. But with valuation multiples 500–600% above sector medians and AI optimism priced in already, one cannot help but wonder: how much of Broadcom’s future is priced in? For those with multi-year time horizons and support for Broadcom’s execution, it’s still a quality compounder. But near-term, the asymmetric bet may be waiting for a reset.

Copyleaks Report: https://app.copyleaks.com/report/hmrqv7er9by3hssb/preview?key=e43fl93gfyt8cl9s&viewMode=one-to-many&contentMode=text&sourcePage=1&suspectPage=1&showAIPhrases=false&alertCode=suspected-ai-text

.png)