Wall Street Thinks This AI Stock Is the Next Big Thing

Key Points

The biggest beneficiaries of the AI revolution so far have been semiconductor and cloud computing stocks.

Wall Street sees massive upside in AI's deployment in digital advertising.

Meta Platforms has quietly built a $60 billion AI advertising empire that no one is talking about.

- 10 stocks we like better than Meta Platforms ›

Prior to the artificial intelligence (AI) revolution, the trillion-dollar club only had three members: Apple, Microsoft, and Alphabet. Since OpenAI released ChatGPT to the world and forever changed the technology landscape, several more companies have achieved trillion-dollar status.

While semiconductor stocks have become some of the most influential contributors to the AI boom, Wall Street has its eyes on another platform as the next big opportunity.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Let's dig into how Meta Platforms (NASDAQ: META) is quietly leading the AI supercycle and assess why the company is poised to continue disrupting its big tech counterparts.

Image source: Getty Images.

How is Meta deploying AI?

Meta's peers have ambitious AI road maps -- promising to revolutionize society through autonomous systems and humanoid robots. While the upside from these moonshots is enormous, physical AI applications remain years -- if not decades -- away from commercial deployment if they are successful at all.

Meta is taking a drastically different approach. The company has one of the clearest ways to showcase how AI is already making a positive impact on its business. Meta Advantage+ is redefining how companies and consumers interact with digital ads.

While this might sound a little mundane, Meta's results since launching this product are so good they are almost impossible to believe.

Why is Meta Advantage+ such a game changer?

The biggest challenge for advertisers is accurately analyzing which types of campaigns different consumer demographics engage with and the frequency with which they respond. Meta Advantage+ is taking much of the guesswork out of this equation -- removing the friction that stands in the way between brands and customers.

At its core, Advantage+ is a suite of models that use machine learning to create, test, target, and price ads across Meta's social media properties.

Thanks to the automation and efficiency Advantage+ brings to the table, Meta's partners are able to realize higher conversion rates on ad campaigns -- thereby improving their return on investment compared to the old style of manually creating and targeting an ad.

This is important for two main reasons. First, the value proposition of Advantage+ should yield higher stickiness from Meta's advertising customers -- making the idea of switching to a competing platform out of the question.

In addition, as Advantage+ grows, Meta will be able to command more pricing power for this service -- ultimately leading to further revenue acceleration, widening profit margins, and robust free cash flow.

What is Wall Street saying about Meta stock?

Among the 67 sell-side analysts who cover Meta stock, 60 of them rate the stock either a buy or strong buy. The average price target for Meta stock is $833 -- implying 25% upside from current levels as of Jan. 23.

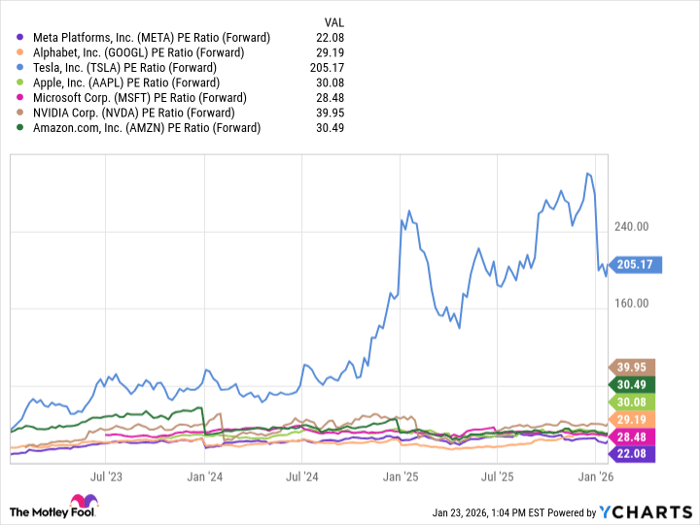

Meta currently trades at a forward price-to-earnings (P/E) multiple of just 22 -- the lowest among the "Magnificent Seven." The reason for this disparity is simple: As Meta continues to accelerate its capital expenditures (capex), investors remain wary about management's ability to strategically allocate capital given some hiccups with Mark Zuckerberg's metaverse obsession from a few years ago. Spoiler alert: It flopped.

META PE Ratio (Forward) data by YCharts

Here's the big picture: Advantage+ is already operating at a $60 billion annual revenue run rate since it launched three years ago. Few developers and infrastructure spenders can reference a similar growth trajectory directly tied to AI.

In my eyes, Wall Street is right to be so bullish on Meta stock.

Should you buy stock in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $462,174!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,143,099!*

Now, it’s worth noting Stock Advisor’s total average return is 946% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 27, 2026.

Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.