The Most Undervalued Artificial Intelligence (AI) Stock on Wall Street Right Now

Key Points

SentinelOne has struggled to stand out in the cybersecurity space, and the stock's price has plunged.

But the company continues to grow and is in excellent financial shape.

A bottom-of-the-barrel valuation could propel the stock to significant returns.

- 10 stocks we like better than SentinelOne ›

Protecting your data and technology systems has become paramount in today's world, where everything is connected all the time. The typical breach costs a company an average of $4.4 million in damages, so the stakes are high.

The global cybersecurity market is poised to grow, surpassing an estimated $350 billion by 2030. Investors have placed a hefty valuation premium on cybersecurity stocks, but SentinelOne (NYSE: S) has been a very notable exception.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Shares of SentinelOne, which utilizes artificial intelligence (AI) to protect its customers from cyber threats, trade down over 80% from their late 2021 all-time high. The stock's steep slide arguably makes it the most undervalued AI stock on Wall Street right now.

Image source: Getty Images.

Struggling to stand out in a crowded field

SentinelOne specializes in endpoint security, which protects devices (endpoints) in a network. Its autonomous AI-powered technology proactively finds potential threats. The company has received recognition for its products and serves a laundry list of large corporations.

However, the cybersecurity industry is very complex. There are various types of security, and almost every niche is highly competitive. There are often new entrants to the field, as well as entrenched players trying to expand in the name of growth.

SentinelOne has successfully grown, but has taken some bumps and bruises along the way. In 2023, the company lost some key employees to its rival CrowdStrike Holdings. SentinelOne is also still an unprofitable business. It just doesn't have much pricing power at this point due to all the competition.

The selling may have gone too far

Here's the good news. SentinelOne is generating positive free cash flow and still has $650 million in cash versus almost no debt. In other words, SentinelOne has financial staying power. And to be clear, the company continues to grow.

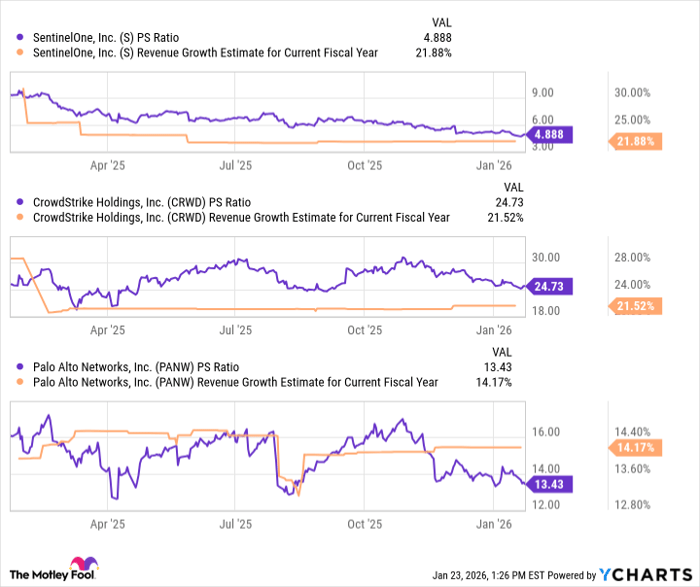

Analysts see SentinelOne ending its current fiscal year right at $1 billion in revenue, with estimates calling for about 20% growth next year. The company isn't anywhere near the size or market share of CrowdStrike or Palo Alto Networks, but the stock has become eye-poppingly cheap relative to them.

The charts below compare the price-to-sales ratio and estimated revenue growth rate for each of these three companies for their current fiscal year.

Data by YCharts.

Compared to these other cybersecurity stocks, SentinelOne is basically trading for cents on the dollar. Now, the stock isn't a guaranteed home run: SentinelOne must continue to grow and demonstrate that it can stick around in this competitive landscape.

But if the company can win back some of the market's confidence, SentinelOne's growth and massively discounted valuation are an excellent springboard for strong investment returns. I wouldn't go as far as calling SentinelOne a buy-and-hold-forever stock, but rather a contrarian stock idea, a bargain with compelling upside that's worth checking out.

Should you buy stock in SentinelOne right now?

Before you buy stock in SentinelOne, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SentinelOne wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $462,174!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,143,099!*

Now, it’s worth noting Stock Advisor’s total average return is 946% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 27, 2026.

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CrowdStrike and SentinelOne. The Motley Fool recommends Palo Alto Networks. The Motley Fool has a disclosure policy.