I Predicted TSMC Would Be a Must-Own Stock in 2025. I Still Think It's a Fantastic Buy in 2026

Key Points

TSMC's stock price rose almost 54% in 2025.

Management expects strong growth for 2026.

- 10 stocks we like better than Taiwan Semiconductor Manufacturing ›

In January 2025, I predicted that Taiwan Semiconductor Manufacturing (NYSE: TSM) would rocket higher throughout the year. That prediction ended up being dead-on, as the stock soared nearly 54% higher throughout 2025. That's an impressive one-year return for the computer chip manufacturer and it would cause some investors to hesitate on the stock, thinking it has already had its run. But I'm not ready to give up on TSMC's stock yet.

Almost everything that I discussed in that article in early 2025 is still relevant today, and even if you missed out on 2025's run, I think that TSMC is well-positioned to deliver similar results in 2026.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

AI spending is still occurring at a high level

The main case in my 2025 prediction is that TSMC is in a critical spot for the artificial intelligence buildout. While companies like Nvidia or Advanced Micro Devices may grab most of the headlines, the reality is that these companies are fabless chip companies. That means they design the chip, but they have no part in the manufacturing process.

One of the key members of this process is TSMC, which actually makes the chips. TSMC is so dominant in this space that there is relatively little competition, and it has captured the majority of the market share in the production of cutting-edge chips.

So, when you hear about Nvidia or AMD doing well, or a new data center going up, you can pretty much assume TSMC is also doing well. That's exactly what happened in 2025, and is expected to happen in 2026.

In the fourth quarter, TSMC's revenue rose 26% year over year in U.S. dollars -- a strong sign that its clients are still buying as many chips as they can get their hands on. For 2026, they expect about 30% revenue growth. But 2026 isn't the end for this massive chip demand.

Management believes that revenue from AI chips will increase at a mid- to high-50% compound annual growth rate (CAGR) for the five-year period between 2024 and 2029. That's monstrous growth, and shows that we're far from done building out AI computing power. This trend is still front and center in the broader market, and as long as AI hyperscalers continue to ramp up their spending, TSMC will be a great investment option.

However, there's another part of this story: Valuation.

TSMC trades at nearly the same level as it did in 2025

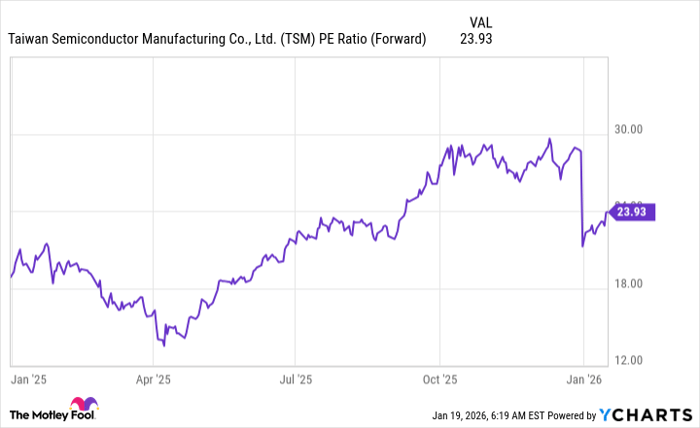

At the start of 2025, I pointed out that TSMC's valuation was cheap, trading at 23 times forward earnings. I still believe that's the case, and now it trades for 24 times forward earnings.

Data by YCharts. PE = price-to-earnings.

As a result, I think TSMC is still an excellent buy in 2026, and those who missed out on 2025's strong run can confidently buy shares now.

Should you buy stock in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $464,439!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,150,455!*

Now, it’s worth noting Stock Advisor’s total average return is 949% — a market-crushing outperformance compared to 195% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 24, 2026.

Keithen Drury has positions in Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.