Taiwan Semiconductor Manufacturing Just Delivered Fantastic News to Nvidia and Broadcom Investors

Key Points

Taiwan Semi's revenue and profits are accelerating thanks to robust demand for artificial intelligence (AI) chips.

Nvidia and Broadcom outsource their manufacturing needs to Taiwan Semi.

Taiwan Semi's current growth trajectory suggests even better days are ahead for leading chip players.

- 10 stocks we like better than Taiwan Semiconductor Manufacturing ›

As earnings season comes into focus, technology investors are once again predominantly focused on demand trends around artificial intelligence (AI) more than anything else.

Last week, Taiwan Semiconductor Manufacturing (NYSE: TSM) kicked things off with its fourth-quarter and full-year 2025 earnings report. Spoiler alert: If you're an investor in Nvidia or Broadcom, you should be jumping for joy.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Let's dig into Taiwan Semi's earnings results and explore why the company's outlook bodes well for top players in the semiconductor industry.

Image source: Taiwan Semiconductor Manufacturing.

Taiwan Semi just reported monster earnings

In the fourth quarter, Taiwan Semi generated $33.7 billion in revenue. This was about $300 million above the company's previously issued guidance, and represented growth of 25% year over year and 2% sequentially.

Perhaps even more encouraging is the company's profitability profile. In Q4, TSMC posted a gross margin of 62% -- roughly 330 basis points higher compared to the same period in 2024.

The combination of robust acceleration across the top line and widening gross profits fueled meaningful expansion in operating margins and earnings per share (EPS) for Taiwan Semi.

During the earnings call, the company's CEO, C.C. Wei, hinted that Taiwan Semi would use this excess cash flow to continue investing in next-generation foundries -- referring to the ongoing infrastructure boom as a "multiyear AI megatrend."

Why is TSMC important for Nvidia and Broadcom?

Taiwan Semi should be thought of as a pick-and-shovel player along the chip value chain. While Nvidia and Broadcom design different types of semiconductors meant for generative AI development, TSMC is the company behind the scenes bringing this hardware to life.

Taiwan Semi is the largest chip manufacturer in the world in terms of revenue. With a market share hovering around 70%, both Nvidia and Broadcom rely heavily on TSMC's fabrication expertise in order to fulfill their respective backlog orders. Taiwan Semi's current growth trajectory and encouraging forward guidance is especially good news for Nvidia and Broadcom investors.

TSMC's results validate that hyperscalers like Microsoft, Alphabet, Amazon, and Meta Platforms -- some of Nvidia's largest customers -- are accelerating their AI infrastructure roadmaps.

Taiwan Semi's ability to manufacture advanced processing nodes such as 5 nanometer and 3 nanometer at scale matters greatly for Nvidia. The reason this is important is because higher profit margins and increased output from TSMC suggest that Nvidia's chips are both in high demand and being converted into shipped revenue more quickly.

Broadcom benefits from TSMC's success for a different reason than its GPU counterpart. Broadcom's value in AI infrastructure comes from designing networking gear for data centers, custom silicon architectures, and connectivity chips. Many of these specialty processes are also manufactured by Taiwan Semi.

TSMC's booming business underscores the idea that AI budgets aren't entirely consumed by GPUs. Rather, the hyperscalers are deploying capital across a broad suite of critical infrastructure beyond general-purpose training hardware.

In other words, the resiliency of Taiwan Semi's business suggests that the current infrastructure supercycle differs materially from the historical cyclicality of the semiconductor industry. Developers are investing beyond raw compute and opting for a full hardware stack to build out their AI systems.

Should you buy Taiwan Semi stock right now?

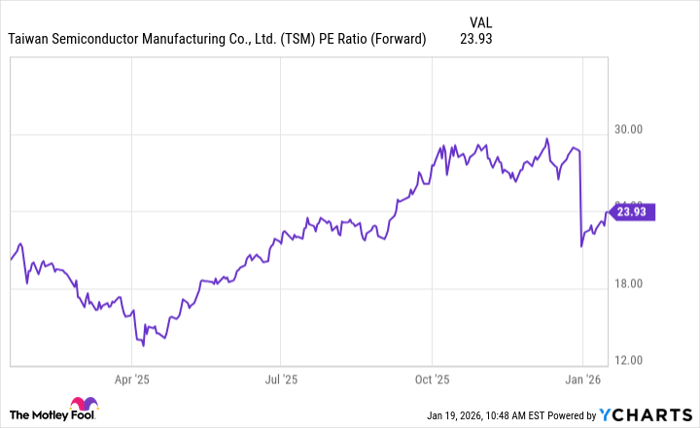

Taiwan Semi currently trades at a forward price-to-earnings (P/E) ratio of 24. While the company has experienced meaningful valuation expansion over the last year, TSMC's forward earnings multiple trades at a steep discount to prior highs.

TSM PE Ratio (Forward) data by YCharts

In my eyes, the compression in the company's valuation multiple could suggest that investors have not yet priced in the entirety of Taiwan Semi's growth prospects over the next several years. In other words, despite a strong earnings report and encouraging outlook, some investors may still be suspicious that AI is a bubble and therefore are not assigning premium valuations.

To me, TSMC's latest report should mitigate the bubble fears. The company's growth is accelerating across the board, and management has been explicit about its expansion plans. I think Taiwan Semi is positioned for significant revenue and profit growth through the rest of the decade, making now an interesting time to buy the stock at a reasonable price point.

Should you buy stock in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $460,340!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,123,789!*

Now, it’s worth noting Stock Advisor’s total average return is 937% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 22, 2026.

Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.