Prediction: This Spectacular Vanguard ETF Will Beat the S&P 500 (Again) in 2026

Key Points

The S&P 500 index gained 17% during 2025, but the S&P 500 Growth index soared by 21%.

The S&P 500 Growth index invests in 216 of the best-performing growth stocks from the regular S&P 500 and disregards the rest.

The Vanguard S&P 500 Growth ETF gives investors a simple way to own a slice of the growth index, and it could beat the market again in 2026.

- 10 stocks we like better than Vanguard Admiral Funds - Vanguard S&P 500 Growth ETF ›

The S&P 500 (SNPINDEX: ^GSPC) is a stock market index made up of 500 companies from 11 different sectors of the economy. It climbed 17% in 2025, which was comfortably above its long-term average annual return of 10.6% dating back to when it was established in 1957.

But then there is the S&P 500 Growth index, which exclusively holds 216 of the best-performing growth stocks from the regular S&P 500 and disregards the rest that might not perform as well. This unique portfolio composition propelled the index to a 21% return last year.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

The Vanguard S&P 500 Growth ETF (NYSEMKT: VOOG) is an exchange-traded fund (ETF) that tracks the performance of the Growth index, and it has beaten the S&P 500 every year since its inception. Here's why I predict it will outperform again in 2026.

Image source: Getty Images.

High exposure to tech and tech-adjacent companies

The S&P 500 Growth index selects stocks from the regular S&P 500 based on factors like their momentum and the sales growth of the underlying companies. Technology and technology-adjacent companies typically deliver faster growth and better returns than other companies, which is why the following sectors have higher weightings in the Vanguard S&P 500 Growth ETF than in the S&P 500:

|

Sector |

Vanguard ETF Weighting |

S&P 500 Weighting |

|---|---|---|

|

Information technology |

41.4% |

34.6% |

|

Communication services |

16.8% |

10.7% |

|

Consumer discretionary |

11.9% |

10.3% |

Data source: Vanguard. Sector weightings are accurate as of Nov. 30, 2025, and are subject to change. ETF = exchange-traded fund.

The information technology sector is home to three of the world's largest companies: Nvidia, Apple, and Microsoft, which have consistently operated at the forefront of tech revolutions like cloud computing, personal computing, software, and, now, artificial intelligence (AI).

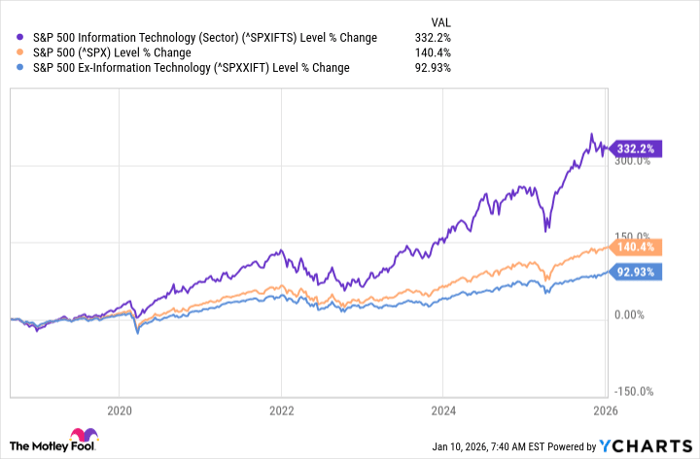

Led by the incredible growth of those three companies, the information technology sector has delivered a whopping 332% return over the last decade. In fact, if we exclude the sector from the S&P 500, the index's 10-year return drops from 140% to just 92%, which truly highlights its significance.

Data by YCharts.

Not every company in the communication services sector can be considered tech-adjacent, but it's home to powerhouses like Meta Platforms and Alphabet, which are investing billions of dollars in areas like AI. The same can be said for the consumer discretionary sector, which is home to companies like Amazon and Tesla.

But investing more aggressively in high-growth sectors is only half of the equation when it comes to beating the S&P 500. The Vanguard ETF also assigns much smaller weightings to sectors that typically deliver steady, but slower growth. For example:

|

Sector |

Vanguard ETF Weighting |

S&P 500 Weighting |

|---|---|---|

|

Financials |

10.4% |

13% |

|

Healthcare |

5.6% |

9.8% |

|

Consumer Staples |

3% |

4.8% |

Data source: Vanguard. Sector weightings are accurate as of Nov. 30, 2025, and are subject to change.

Well positioned to beat the S&P 500 again in 2026

The Vanguard S&P 500 Growth ETF has delivered a compound annual return of 16.7% since its inception in 2010, beating the S&P 500, which was up by an average of 14% per year over the same period. The 2.7 percentage-point difference might not sound like much, but it would have made a huge impact in dollar terms thanks to the magic of compounding:

|

Starting Balance In 2010 |

Compound Annual Return |

Balance In 2026 |

|---|---|---|

|

$10,000 |

16.7% (Vanguard ETF) |

$118,340 |

|

$10,000 |

14% (S&P 500) |

$81,372 |

Calculations by author.

That doesn't mean investors should put all their eggs in one basket, but the Vanguard ETF could be a great addition to any diversified portfolio that has minimal existing exposure to high-growth sectors like technology.

For example, $10,000 invested in the Vanguard Total World Stock ETF (which holds around 10,000 different stocks) 10 years ago would be worth $30,236 today. However, $10,000 split equally between the Total World Stock ETF and the S&P 500 Growth ETF ($5,000 placed in each) would have grown to $38,744 over the same period.

Past performance isn't a reliable indicator of future results, but the Vanguard S&P 500 Growth ETF is well positioned to beat the market again in 2026. Microsoft, Alphabet, and Amazon have order backlogs worth hundreds of billions of dollars from AI developers that are waiting for more data center capacity to come online, so they will be eagerly trying to fill that demand this year. Chip suppliers like Nvidia will also benefit significantly as those tech giants build more infrastructure.

Simply put, the AI boom looks poised to continue gaining momentum this year, and the Vanguard ETF is holding all the right stocks.

Should you buy stock in Vanguard Admiral Funds - Vanguard S&P 500 Growth ETF right now?

Before you buy stock in Vanguard Admiral Funds - Vanguard S&P 500 Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Admiral Funds - Vanguard S&P 500 Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $482,209!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,133,548!*

Now, it’s worth noting Stock Advisor’s total average return is 968% — a market-crushing outperformance compared to 197% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 13, 2026.

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.