Down More Than 50% From Its High, Is Rigetti Computing Stock a Good Buy Right Now?

Key Points

Quantum computing has been a top investing theme this year.

Rigetti's market cap hit more than $18 billion on investor enthusiasm.

However, the stock has pulled back sharply and trading volumes have declined.

- 10 stocks we like better than Rigetti Computing ›

When there's a pullback in price for a top-performing stock, it can potentially make for a lucrative buying opportunity. In other cases, however, it can simply be overdue for a stock that's become significantly overvalued.

It may be tough to see which category Rigetti Computing (NASDAQ: RGTI) falls into today. The potential for quantum computing to revolutionize tech is encouraging, and Rigetti is a promising company in the industry, but it also comes with risks and mounting losses.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Investors have recently been dumping the tech stock. Last week, it finished trading at less than $26 -- that's a 55% decline from its 52-week high of $58.15. Is this a great time to buy shares of Rigetti, or could this be the beginning of a much larger decline?

Image source: Getty Images.

Plenty of question marks remain

Rigetti is a speculative stock because it doesn't generate much in the way of revenue. While its sales have totaled $7.5 million over the trailing 12 months, that pales in comparison to its operating expenses, which came in at just under $83 million during that time frame.

Investing in Rigetti is a long-term play. There are serious question marks about when quantum computers will be commonplace in tech, and whether the company will be a leading player in the industry when that happens.

Investors look to signs of progress with the company's development as signs that the business is on the right track, but there's no certainty with the stock whatsoever. Where it might be in five years or more is anyone's guess, and that also goes for the overall industry as a whole.

While there's plenty of optimism around quantum computing, the excitement comes with risk. And lately, the excitement around the stock has been cooling.

Interest in the stock has been dying down

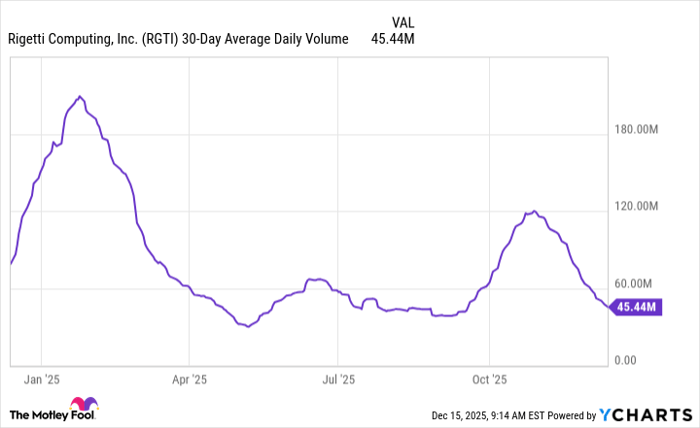

Although the stock has been doing well this year, rising by around 70%, Rigetti is a largely speculative buy due to all the risk and uncertainty ahead. And the problem is that interest in the company appears to be dwindling. That's evident through its trading volumes, which are down considerably from where they were earlier in the year.

RGTI 30-Day Average Daily Volume data by YCharts.

At the beginning of the year, it wasn't uncommon to see trading volumes for Rigetti rise to well over 100 million shares. Nowadays, it's often less than half of those levels. This suggests that interest from retail investors has fallen sharply.

Part of the reason may have to do with the stock's valuation, which at one point this year topped $18 billion. Even now, however, the stock's $8.5 billion market cap puts it at a high price-to-sales multiple of around 1,000.

Rigetti could be due for more of a decline in 2026

Investors should be wary of Rigetti since its future is highly uncertain. Although the stock has been red hot in recent years, it wasn't all that long ago that it wasn't. In 2022, when the stock market was in the midst of a crash, shares lost 93% of their value. Between its high valuation today and the possibility of a slowdown in the economy in the near future, there's ample reason to believe that the stock may not have bottomed out anytime soon; more of a decline may still be coming.

Even if you're bullish on quantum computing, you may want to consider simply investing in an exchange-traded fund (ETF) that gives you a position in that area of tech. ETFs can at least provide you with some diversification and a bit more protection than going with just a single stock. Trying to pick a winner in an industry that's still in its early stages comes with significant risk, and it's by no means a guarantee that simply buying and holding Rigetti's stock will lead to great returns in the long run.

Should you buy stock in Rigetti Computing right now?

Before you buy stock in Rigetti Computing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rigetti Computing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $509,955!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,089,460!*

Now, it’s worth noting Stock Advisor’s total average return is 968% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 17, 2025.

David Jagielski, CPA has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.