The Best Stocks to Buy With $1,000 Right Now

Key Points

Alphabet's advertising empire was saved by a court case earlier this year.

Meta Platforms' stock fell significantly due to spending plans.

The Trade Desk is still working through some internal problems.

- 10 stocks we like better than Alphabet ›

If you've got $1,000 ready to deploy, now is a perfect time to do it. The stock market can sometimes end the year on a strong note because fund managers are moving their portfolios into stocks they believe will be successful in the year ahead. The idea here is to look for stocks that could have a strong 2026, but also have an even brighter future beyond that.

Three that I think fit that bill are Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), Meta Platforms (NASDAQ: META), and The Trade Desk (NASDAQ: TTD), and all have one thing in common: advertising.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

The advertising market is strong

Advertising is a cyclical business and goes up and down based on the economic outlook. Currently, the primary concerns with the economy have to do with artificial intelligence spending, not as much with what the consumer is doing. So, companies are continuing to spend at a normal pace in the advertising world. This is showing up in companies that derive a significant amount of their revenue from ad-related sources, like these three.

Meta Platforms gets nearly all of its revenue from ads, with $50 billion of its $51.2 billion in Q3 revenue coming from ad sources. Meta Platforms, formerly known as Facebook, has an incredibly successful social media business with properties like Facebook, Instagram, and Threads. Although there was some fear that TikTok could dethrone it, Meta has clearly secured its place at the top of the social media world.

Its stock has been a bit weak over the past few weeks because investors didn't love how much it planned to spend on data centers in 2026, but as many big tech CEOs have told investors, the risk of underspending is far greater than overspending in the AI buildout.

Alphabet gets slightly less of its revenue from ads, with $74.2 billion of its $102.3 billion total coming from ads in Q3. The crown jewel of its advertising empire is the Google Search engine. Although there were calls to break up Alphabet's alleged search monopoly earlier this year, Alphabet has survived that court case and can operate nearly as normal. This helps secure Google's future, but so does its generative AI integration.

Alphabet integrated AI search overviews into Google search earlier this year to give users a hybrid search experience. This has been a wildly popular feature and has helped Google maintain its place at the top of the search engine hierarchy. Additionally, Alphabet's generative AI model, Gemini, has become so advanced that OpenAI declared "code red" over the model's capabilities versus its own ChatGPT's. This bodes well for Alphabet, and I think it gives it a strong future.

Lastly, there is The Trade Desk, which is far smaller than its peers. Alphabet and Meta operate a walled garden, so they control all advertising information and placement on their platforms. However, there is still a large portion of the internet that isn't managed by them, which is where a platform like The Trade Desk comes in. The Trade Desk provides ad buyers with the information they need on a consumer in order to place the perfect ad in front of them. This isn't without competition, as there are several other ad agencies vying for this space.

However, the Trade Desk rolled out its new AI-powered platform, Kokai, and the reception hasn't been great. This has caused The Trade Desk to post several poor quarters, but it's still posting strong growth, with it experiencing 18% growth in Q3.

The Trade Desk's stock has had an abysmal 2025, falling over 65%. I wouldn't be surprised if it bounces back in a big way in 2026, as its stock is trading at a cheap level.

All three of these stocks look like solid buys

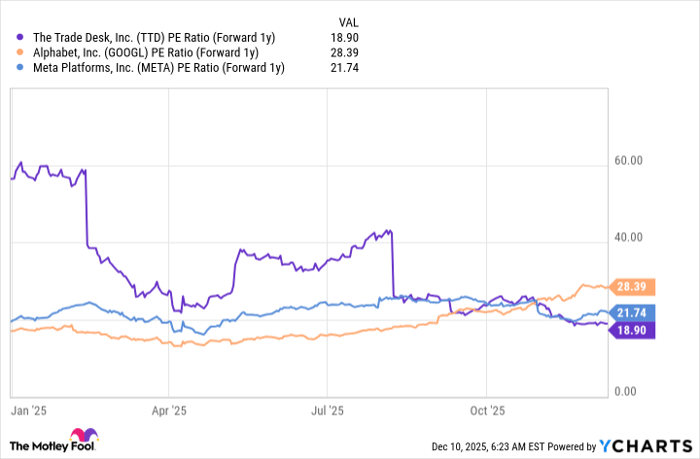

Although it entered the year as the most expensive stock in this group, The Trade Desk now trades for less than 20 times next year's earnings.

TTD PE Ratio (Forward 1y) data by YCharts

That's a bargain price tag, and investors should scoop up shares of The Trade Desk when they have the chance as a result. Meta Platforms is in a similar boat, trading for 22 times 2026 earnings. There is little risk of overpaying for Meta's stock right now, and investors should be willing to buy now. Alphabet is the most expensive of the group, but with how successful its AI offering is, I think it deserves that premium.

I think these stocks are all slated for a strong 2026, and if you've got $1,000 lying around, I can think of few better places to invest.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $513,353!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,072,908!*

Now, it’s worth noting Stock Advisor’s total average return is 965% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 15, 2025

Keithen Drury has positions in Alphabet, Meta Platforms, and The Trade Desk. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, and The Trade Desk. The Motley Fool has a disclosure policy.