Where Will Nvidia Stock Be in 5 Years?

Key Points

Nvidia's primary source of growth comes from its data center services.

The company has made a number of investments and partnerships in emerging opportunities to broaden its reach.

Nvidia looks poised to sustain robust revenue and profit growth well into the future.

- 10 stocks we like better than Nvidia ›

It's hard to believe that we're three years into the artificial intelligence (AI) revolution. It seems like just yesterday that Nvidia (NASDAQ: NVDA) was perceived as a niche semiconductor business focused on improving graphics for online gamers.

But when OpenAI released ChatGPT to the general public on Nov. 30, 2022, everything changed. At that point in time, Nvidia sported a market capitalization of $345 billion. Today, Nvidia is worth $4.5 trillion -- making it the most valuable company in the world.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Throughout the AI revolution, investors have realized that Nvidia's chips carry use cases far beyond enhancing visuals. The company's GPUs and accompanying CUDA system became the hardware-software stack on which generative AI was created.

While Nvidia's rally over the last three years has been nothing short of epic, growth investors still have plenty of time to partake in the company's upside. Let's explore a number of Nvidia's catalysts that could send its share price to new heights throughout the latter half of the decade.

Image source: Nvidia.

What near-term catalysts does Nvidia have?

Each quarter when Nvidia reports earnings, Wall Street analysts focus on one performance indicator above all else: data center growth. Over the last 12 months, Nvidia's data center business has generated $167 billion in revenue -- making it the largest source of growth for the company by a wide margin.

Between the current Blackwell chips, upcoming Rubin architecture, and their accompanying networking services, Nvidia boasts a total order book to the tune of $500 billion.

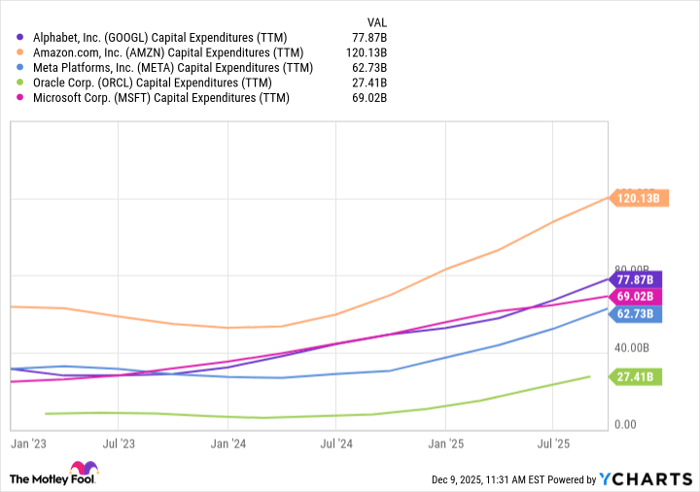

Microsoft, Alphabet, Amazon, Oracle, Meta Platforms, and OpenAI are some of Nvidia's largest customers. As the hyperscalers accelerate their AI capital expenditures (capex), demand for Nvidia's GPUs should remain strong.

GOOGL Capital Expenditures (TTM) data by YCharts

What long-term catalysts does Nvidia have?

While Nvidia's primary tailwinds still revolve around chip demand, the company has a number of longer-term catalysts that smart investors should know about.

- Back in September, Nvidia made a $5 billion investment in Intel. Through this alliance, the two semiconductor powerhouses will collaborate on next-generation personal computing hardware.

- In late October, Nvidia made a $1 billion investment in Nokia. As part of the partnership, Nvidia plans to integrate its new Arc Aerial RAN Computer with Nokia's 6G development efforts.

- Nvidia also announced a strategic partnership with data analytics specialist Palantir Technologies in late October. Marrying Nvidia's ecosystem with Palantir's Artificial Intelligence Platform (AIP) opens up a number of opportunities and new use cases at the enterprise level beyond training large language models (LLMs).

- Nvidia has signed multi-billion dollar deals with both Anthropic and OpenAI. Both companies rely on Nvidia's infrastructure to train their models, making Nvidia a central pillar supporting the next generation of AI products.

- Thinking even further down the road, Nvidia has numerous opportunities in the world of physical AI through robotics and autonomous systems. Moreover, the company should also play an important role in the emergence of agentic AI as well as quantum computing.

The main theme here is that Nvidia is subtly evolving from a chip designer to a much more sophisticated business. The company is increasingly expanding its addressable market beyond semiconductors and data center services. In the long run, Nvidia should become a diversified platform business supporting a number of different applications in the AI realm.

Nvidia could be headed for significant valuation expansion

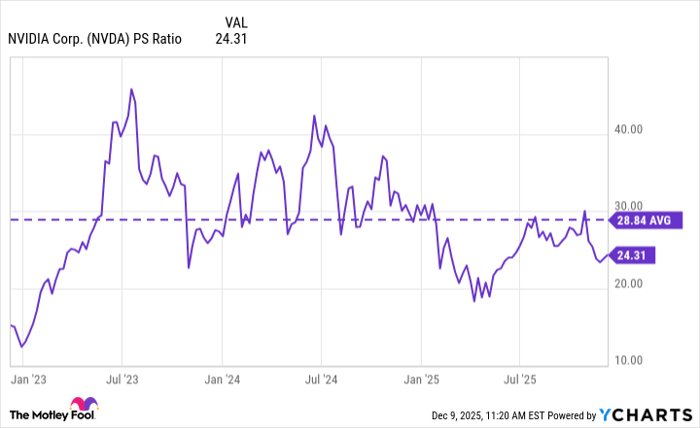

Despite its record growth and dominant position in the AI chip market, Nvidia's valuation multiples have been normalizing as of late. Currently, the company's price-to-sales (P/S) ratio of 24 is below its three-year average and well discounted from prior peaks during the AI revolution.

NVDA PS Ratio data by YCharts

In my eyes, the reason for Nvidia's multiple compression is due to two factors: rising competition as well as wariness that the AI trade is a bubble. The common thread between these two ideas is fear. Investors often make emotional decisions that are not always rooted in underlying fundamentals.

In reality, Nvidia's business is operating from a position of strength. Furthermore, the company is already laying the groundwork to generate growth from new products and industries beyond its core data center segment over the next several years.

Against this backdrop, I think Nvidia will experience accelerating revenue and continued profit margin expansion through 2030. For this reason, I think the company is poised to experience meaningful valuation expansion over the coming years.

In the long-run, I think Nvidia could become the first $20 trillion stock -- representing more than 300% upside from its current levels. All told, I view Nvidia as a compelling buy-and-hold opportunity for investors with a long-term time horizon.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $499,978!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,126,609!*

Now, it’s worth noting Stock Advisor’s total average return is 971% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Palantir Technologies. The Motley Fool has positions in and recommends Alphabet, Amazon, Intel, Meta Platforms, Microsoft, Nvidia, Oracle, and Palantir Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.