This Is What Lululemon's Founder Says Is Wrong With the Company

Key Points

Lululemon's founder Chip Wilson believes the company isn't nearly as innovative as it needs to be.

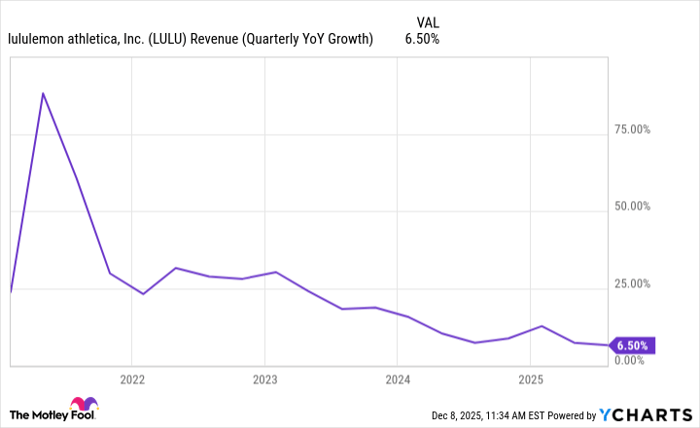

The company has been struggling to generate anything more than single-digit growth in recent quarters.

Its valuation has taken a beating as the stock trades at a sizeable discount when compared to the S&P 500 average.

- 10 stocks we like better than Lululemon Athletica Inc. ›

Shares of apparel company Lululemon Athletica (NASDAQ: LULU) have been in a tailspin this year, down more than 50% to levels they haven't been at since 2020. It has been one of the worst-performing stocks on the S&P 500, amid what's generally been a strong year for the index -- it's up nearly 17%.

The sell-off and the troubles surrounding Lululemon have caught the attention of many people, including its founder and previous CEO, Chip Wilson. He doesn't seem all that surprised by its challenges, as he doesn't appear to be convinced that the business is going in the right direction.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Has Lululemon lost its appeal?

Wilson founded Lululemon in 1998, but he hasn't been part of the company for years; he resigned from the board of directors back in 2015. And while the business has grown under current CEO Calvin McDonald, Wilson believes that the brand simply isn't as strong as it once was. Wilson says that the company is focused more on numbers than creativity, claiming that, "finance focused CEOs don't know how to attract or motivate creative talent, and even worse, they think they understand great product when they don't."

Amid a rise in fast fashion and young consumers looking for cheaper clothing options, it may be more difficult than ever for a premium apparel company such as Lululemon to convince shoppers that its products are worth their hefty price tags.

And consumers often don't even have to look far to find low-priced alternatives. Lululemon has sued Costco Wholesale recently, alleging that the retailer is selling knock-off products that look identical to its own. The problem with apparel is that it can be difficult to win these types of lawsuits since clothing is often very similar from one brand to another, and it highlights a big challenge for Lululemon: rising competition.

Lululemon's growth rate has been going in the wrong direction

It can be difficult to determine how strong a brand's value is. But the numbers don't lie when it comes to sales. Either the business is growing and demand is high, or it isn't. In Lululemon's case, there's been a clear slowdown in business, and it's been a downward trend since the latter part of 2021.

LULU Revenue (Quarterly YoY Growth) data by YCharts

This downturn coincides with rising inflation and consumer budgets getting stretched to their limits. As that has taken place, there's been an unmistakable slowdown in Lululemon's growth. A lack of innovation may be part of the reason, but the timing suggests that it's more than just that; consumers may simply have a hard time justifying paying over $100 for leggings and pants when there is a flurry of other options to choose from.

Should you take a chance on Lululemon's stock?

Lululemon's stock has fallen significantly this year, and that has brought its price-to-earnings multiple down to just 13, which is far below the S&P 500 average of 25.

Investors are heavily discounting the stock as they appear to be clearly concerned about the direction of the business and how tariffs and challenging economic conditions may weigh on its future results. Given its low valuation, the stock may be able to generate strong returns, but not without convincing investors that the brand is strong and that the business can continue to grow at a fast rate. That's not clear today, which is why the more prudent option can be to take a wait-and-see approach with the stock. Although Lululemon's valuation appears low, by no means does that guarantee it's a good buy right now.

Should you invest $1,000 in Lululemon Athletica Inc. right now?

Before you buy stock in Lululemon Athletica Inc., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lululemon Athletica Inc. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $521,550!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,133,904!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

David Jagielski, CPA has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale and Lululemon Athletica Inc. The Motley Fool has a disclosure policy.