Judgment on the Fed's December Rate Cut and 2026 Monetary Policy Trend: Identifying Opportunities in the U.S. Stock Market

1. Introduction

Since U.S. stocks pulled back from their late-October highs, they have staged a rebound after hitting a cyclical low in mid-to-late November. Currently, the S&P 500 has largely recouped all its previous losses (Figure 1). The sharp volatility in U.S. equities over the past month and a half stemmed primarily from the market’s fluctuating expectations for a December interest rate cut by the Federal Reserve—expectations that shifted repeatedly from strong to weak and then back to strong. With the December rate cut finalised on 10 December, the trajectory of U.S. stocks in 2026 will depend heavily on the Fed’s monetary policy stance throughout next year.

Our research findings indicate that the sticky nature of U.S. inflation will persist through the first half of next year, with a high probability of remaining stubbornly elevated (i.e., prone to upward pressure and resistant to downward moves). Driven by this trend, the Federal Reserve is likely to halt its rate-cutting cycle before the end of Q2 2026, which will exert notable downward pressure on U.S. equities. However, starting from the second half of next year, as Kevin Hassett—known for his dovish policy leanings—takes over as Fed Chair, the magnitude of rate cuts in Q3 and Q4 2026 is expected to far exceed current market expectations. At that point, U.S. stocks are poised to stage a bottoming rebound. Notably, the broader market currently anticipates one rate cut from the Fed in both the first and second halves of next year. If our assessment proves accurate, this would imply that the market has overestimated the pace of rate easing in H1 2026 while underestimating the scale of cuts in H2. In light of this, U.S. equities are highly likely to follow a "bearish-then-bullish" trajectory throughout next year.

Against this forecast, investors may be presented with a favourable entry opportunity following a short-term market decline. Based on this outlook, passive investors can prioritize broad U.S. stock market ETFs such as SPY and QQQ, while active investors may focus on sectors and leading stocks that stand to benefit most from interest rate cuts, including tech giants like NVIDIA (NVDA), Meta (META) and Microsoft (MSFT), homebuilders Lennar (LEN) and D.R. Horton (DHI) in the real estate sector, as well as consumer sector leaders Amazon (AMZN) and Tesla (TSLA).

Figure 1: S&P 500 Index

Source: Mitrade

2. Interest Rate Cut in December 2025

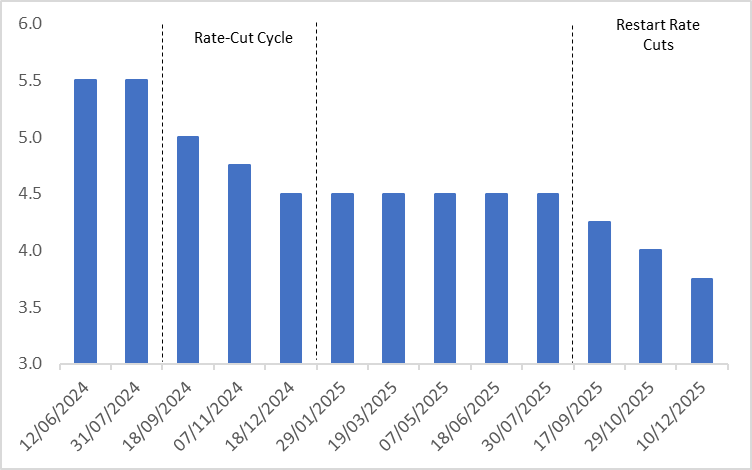

On 10 December, the Federal Reserve held its FOMC meeting and announced a 25-basis-point cut to its benchmark federal funds rate, bringing the target range to 3.50%-3.75%. This marked the third rate reduction implemented by the Fed since September 2025 (Figure 2). The core driver behind this rate cut was that, despite inflation having rebounded from the start of the year and currently remaining at an elevated level, the growth momentum of the U.S. labour market has slowed markedly since the beginning of 2025, with the unemployment rate also trending upward in September. The rate-cutting move was in line with the broad market expectations, and its impact had been fully priced in by the market in advance; in fact, the core factor that dictated the trend of the U.S. stock market on that day was the resumption of the reserve management purchase (RMP) program (market participants widely referred to it as the restart of quantitative easing, QE).

As early as 1 December, the Federal Reserve officially terminated its Quantitative Tightening (QT) program. At this FOMC meeting, the Fed went a step further and announced the resumption of Quantitative Easing (QE) starting this week, with an initial monthly bond purchase scale of $40 billion. This move is aimed at injecting liquidity into the economy to prevent a further intensification of pressures in the credit market. This policy shift emerged as the largest positive signal from the meeting. Bolstered by this news, the three major U.S. stock indexes began a sustained upward trend starting at 2:00 p.m. Eastern Time on that day. By the close of trading, the S&P 500, Nasdaq, and Dow Jones Industrial Average had recorded gains of 0.67%, 0.33%, and 1.05% respectively.

However, it is important to note that while Federal Reserve Chair Jerome Powell has explicitly ruled out the possibility of interest rate hikes, he also stated that the Fed will maintain a "wait-and-see" stance before taking its next monetary policy action. It is evident from this that the current rate cut is a classic case of a hawkish rate cut.

Figure 2: Fed Policy Rate (%)

Source: Refinitiv, TradingKey

3. No Interest Rate Cuts in H1 2026

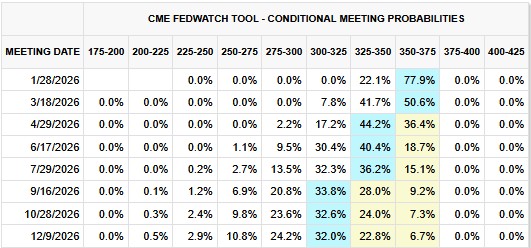

The broader market consensus holds that after the Federal Reserve delivers a 25-basis-point rate cut this December, it will implement two additional cuts before the end of next year — the first in April and the second in September 2026, totalling a 50-basis-point reduction (Figure 3.1). However, our view diverges from the market’s expectations: we believe the Fed will pause its rate-cutting cycle in the first half of next year, while the number of rate cuts in the second half is highly likely to exceed two.

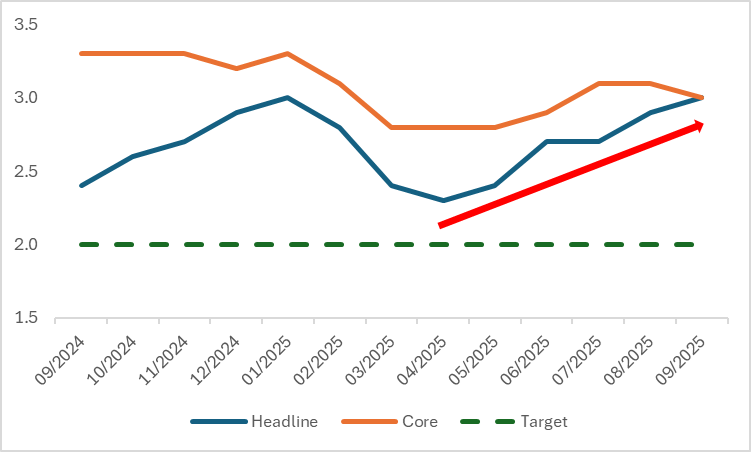

A rate cut is highly likely to be suspended in the first half of 2026, with the core rationale being that U.S. inflation is expected to fail to cool effectively in the short term (Figure 3.2). This trend stems from two key factors: First, housing costs—the most sticky component of inflation, accounting for over one-third of the overall inflation index—will remain elevated in the short term. Even though new lease prices have dropped significantly, their impact on the CPI is subject to transmission lags. Additionally, the moderate pace of rate cuts in 2025 and the shortage of rental housing supply may make it difficult for housing costs to decline sharply in the near future. Second, price adjustments in the service sector have been sluggish. Strong labour demand persists in areas like healthcare, education, and leisure, keeping wage costs high. As a result, the virtuous cycle of “wage-inflation” normalisation will be hard to achieve in the short run. With services excluding housing making up nearly 30% of the inflation basket, this segment is expected to continue underpinning core inflation.

While the Federal Reserve is currently more focused on the weakness in the labour market rather than high inflation, as sticky inflation persists and the risk of reflation rises further in the first half of 2026, the Fed is expected to adopt a "wait-and-see" approach and put its interest rate cut plans on hold for the time being. In a rate-cut cycle, pausing rate cuts is essentially equivalent to a de facto tightening of monetary conditions. As a result, U.S. stocks may come under downward pressure in H1 2026 due to this factor. However, short-term pullbacks will instead lay a solid foundation for a bottoming rebound in the second half of 2026, while also offering a rare entry opportunity for medium- to long-term investors.

Figure 3.1: Probability of the Fed's Rate Cuts in 2026

Source: CME Group, TradingKey

Figure 3.2: U.S. CPI (%, y-o-y)

Source: Refinitiv, TradingKey

4. Renewed Expectations for Interest Rate Cuts in H2 2026

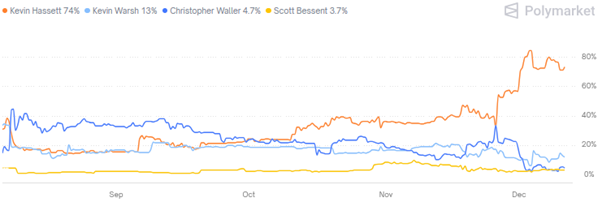

The term of the current Federal Reserve Chair Jerome Powell will expire in May 2026, at which point the Trump administration will nominate a new candidate for the position. Kevin Hassett, the current Director of the U.S. National Economic Council, is the leading contender for the next Fed Chair. According to the latest betting data from Polymarket’s prediction market, the probability of Hassett securing the nomination has reached 74% (Figure 4.1). Hassett’s recent remarks have signalled a pro-growth policy stance. As a key confidant of former President Trump, he publicly stated that if appointed as Fed Chair, he would "immediately cut interest rates," citing that "data indicates this is the appropriate course of action."

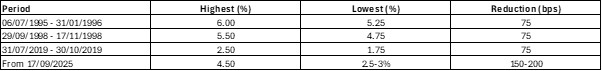

Moreover, Hassett has been a vocal critic of Powell’s overly conservative monetary policy, publicly advocating for a cumulative interest rate cut of 100 to 150 basis points over the next 12 months and even proposing that a single rate cut could exceed 25 basis points—a stance that aligns closely with Trump’s calls for rate reductions. If Hassett is to take office as the next Federal Reserve Chair and follows through on these proposals, the Fed’s benchmark interest rate is projected to fall within the 2.5%-3% range in one year. From the first rate cut that kicks off in September this year, the total magnitude of the current easing cycle would reach 150-200 basis points, a scale that significantly surpasses the 75-basis-point cuts implemented in each of the three classic preventive rate reduction cycles in history (Figure 4.2).

Drawing lessons from history, during preventive rate-cut cycles, the liquidity unleashed by rate reduction policies typically outweighs the adverse impacts of economic slowdown, ultimately driving U.S. equities higher. Therefore, if Hassett secures the appointment, given that the current economy remains resilient, aggressive preventive rate cuts will continue to fuel upward momentum in U.S. stocks. We project that starting from the second half of next year, U.S. equities will embark on a sustained climb and repeatedly hit record highs.

Figure 4.1: Nomination Probability of Next Fed Chair

Source: Polymarket, TradingKey

Figure 4.2: Fed Preventive Rate Cut Cycles (%)

Source: Refinitiv, TradingKey

5. U.S. Stock Strategies

It can be seen that after the 25-basis-point interest rate cut implemented on 10 December this year, the trend of US stocks over the next 12 months will be largely dominated by shifts in the market’s expectations for Federal Reserve rate cuts in the coming year. Affected by inflation trends and the appointment of the next Federal Reserve Chair, the Fed’s rate-cutting magnitude is expected to be moderate initially and then intensify later. Driven by this shift in monetary policy expectations, US stocks are highly likely to enter a downward range in the first half of next year, but a bottoming rebound is anticipated in the second half. As such, the short-term pullback combined with the medium-to-long-term uptrend creates an ideal opportunity for US stock investors. Passive investors may focus on broad-market US stock ETFs such as SPY and QQQ.

Active investors may focus on U.S. stock sectors that are sensitive to interest rate fluctuations, rely on financing support, and have valuations deeply affected by discount rates, against the backdrop of rising expectations for a Federal Reserve rate cut in the second half of next year. These sectors are poised to offer significant profit potential, with core coverage spanning three key areas: technology, real estate, and consumer discretionary.

Among them, the technology sector is set to see the most pronounced gains. Rate cuts will not only reduce financing costs for companies with high R&D expenditures but also boost valuations by lowering discount rates. Coupled with the growth dividends from the AI industry, leading enterprises such as NVIDIA (NVDA, driven by surging demand for AI chips), Meta Platforms (META, supported by advancing AI commercialization and a recovery in advertising business), and Microsoft (MSFT, benefiting from eased capital expenditure pressure in the cloud computing space) will continue to lead the sector’s performance.

The real estate sector will also embrace favourable growth tailwinds. A decline in mortgage rates will stimulate housing demand, while lower corporate financing costs will drive up property valuations. Residential homebuilders like Lennar (LEN) and D.R. Horton (DHI), as well as logistics REIT firm Prologis (PLD), are expected to deliver standout performances.

For the consumer sector, demand elasticity will be gradually unlocked. Strengthened consumer purchasing power will drive overall industry growth, allowing leading players such as Amazon (AMZN, benefiting from both its retail and cloud businesses) and Tesla (TSLA, with demand boosted by lower auto loan costs) to fully capitalise on the sector’s expansion dividends.

6. Conclusion

In summary, following the Federal Reserve’s interest rate cut on 10 December this year, the broader market currently expects the Fed to implement one rate cut in both the first half and the second half of 2026. In contrast, our view is that the Fed will pause its rate-cutting cycle in H1 2026, while the number of rate cuts in H2 2026 will exceed two. If our forecast materialises, the magnitude of rate cuts in H1 2026 will fall short of current market expectations, whereas the easing in H2 will surpass consensus estimates.

This mismatch in rate-cut expectations will gradually transmit to the U.S. stock market, driving a trend of initial pullback followed by a rally. Against this backdrop, investors should capitalise on this investment opportunity characterised by short-term corrections and long-term upside, with a focus on the aforementioned ETFs and leading stocks across key sectors.