Is Citigroup Stock a Buy Now?

Key Points

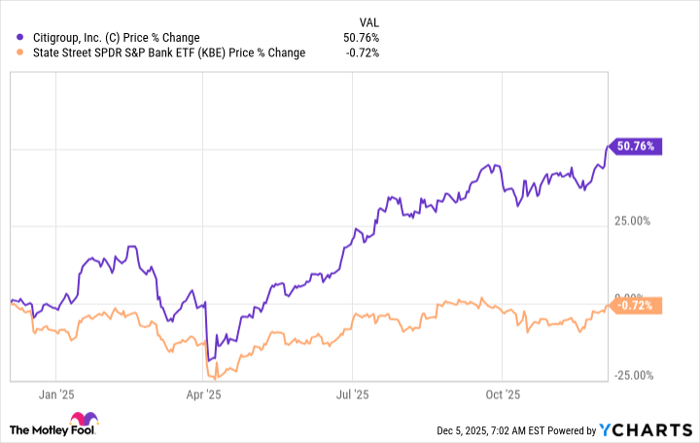

Citigroup's stock has risen 50% over the past year, while the average large U.S. bank has remained flat.

Citigroup's business is performing fairly well, but investors have clearly priced that into the stock price.

While Citigroup doesn't appear wildly overvalued, it is at least fairly valued to a little expensive right now.

- 10 stocks we like better than Citigroup ›

Investing is a challenging task, with the most difficult part likely being controlling your own emotions. This is the warning that world-famous investor Warren Buffett has given for years. It is also the theme behind the story Benjamin Graham, one of Buffett's mentors, tells about Mr. Market. Here's why investors should probably tread with caution as they consider Citigroup (NYSE: C) right now, and it has a lot to do with understanding your emotions and the emotions of investors more broadly.

What does Mr. Market say?

In Benjamin Graham's book geared toward individual investors, The Intelligent Investor, he tells a story about Mr. Market. Mr. Market is your business partner, and he tends to swing between being overly optimistic and being overly pessimistic. On positive days, he'll offer to buy your part of the business for way more than it is worth. On negative days, he will offer to sell you his part for far less than it is worth.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

If you watch how Warren Buffett invests, you'll see that he is a keen analyst of Mr. Market's mood swings. Buffett has frequently swooped in to make investments when other investors are deeply negative on a stock or industry. For example, during the Great Recession, he invested in Bank of America (NYSE: BAC). To be fair, Buffett had enough cash at his disposal that he could create an advantaged position for himself, buying preferred stock and warrants. A small investor couldn't do that.

However, the real takeaway here is that gauging investor sentiment is crucial in purchasing a stock. It is an inherent part of the success that both Graham and Buffett achieved over time. Investor sentiment around Citigroup probably won't compel you to buy the stock, particularly if you have a value focus.

C data by YCharts

Wall Street has favored Citigroup over other banks

Over the past 12 months, the average large U.S. bank, using SPDR S&P Bank ETF (NYSEMKT: KBE) as an industry proxy, has gone virtually nowhere, falling just under 1%. By comparison, shares of Citigroup have rocketed higher, rising 50%. That's more than 4 times the roughly 12% gain the S&P 500 index has made over the past year.

Not only are investors giving Citigroup shares more love than the average bank, they are also showing it more love than the S&P 500 index. That market-beating stock price performance is backed by strong business performance, so there is a reason for Citigroup's price move. Just looking at the top number from the third-quarter earnings report, earnings per share rose from $1.51 in 2024 to $1.86 in 2025. Taking out one-time items, 2025's third-quarter tally increases to $2.24 per share.

Investors are clearly aware of Citigroup's business success and have priced it into the stock. While Citigroup might have attracted value investors before the run-up, the value equation is much different now. For example, the company's price-to-sales, price-to-earnings (P/E), and price-to-book (P/B) value ratios are all notably above their five-year averages.

The story isn't quite as clean as Citigroup being too expensive to buy. The average P/E ratio of a large U.S. bank is around 12, and the average P/B ratio is roughly 1.2. Citigroup's P/E ratio is about 15, and its P/B ratio is roughly 1. The stock's dividend yield is 2.2% compared to the large bank average of 2.4%.

When you take all that valuation information into account, Citigroup doesn't appear to be a bargain. It appears to be at least fully priced, if not a little expensive. That's just not a hugely compelling investment story.

Most investors should tread with caution

With Mr. Market having been so upbeat about Citigroup's shares over the past year, it seems like a stretch to believe the mood won't shift back in the other direction sometime soon. At the very least, given that Citigroup's valuation is roughly in line with the industry average, it seems unlikely that the stock will continue to rocket ever higher. Unless you have a very high conviction about Citigroup's future, you'll likely want to watch this bank from the sidelines. Notably, if you are a value investor, the value story appears to be over.

Should you invest $1,000 in Citigroup right now?

Before you buy stock in Citigroup, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Citigroup wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $540,587!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,118,210!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Bank of America is an advertising partner of Motley Fool Money. Citigroup is an advertising partner of Motley Fool Money. Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.