Prediction: This Artificial Intelligence (AI) Stock Could Be Michael Burry's Next Big Short

Key Points

Michael Burry has short positions in Nvidia and Palantir.

Burry recently took issue with Tesla's valuation.

- These 10 stocks could mint the next wave of millionaires ›

Back in 2008, a then-unknown hedge fund manager named Michael Burry was one of the few investors that predicted the subprime mortgage crisis. Burry is one of the central personalities featured in Michael Lewis' book The Big Short, and was portrayed by actor Christian Bale in the novel's film adaption.

For nearly two decades, Burry has been widely associated with calling market bubbles and shorting stocks. Most recently, the investor made headlines after it was revealed that his fund bought put options on Nvidia (NASDAQ: NVDA) and Palantir Technologies during the third quarter.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Let's break down why Burry is bearish on artificial intelligence (AI) stocks. From there, I'll reveal why Tesla (NASDAQ: TSLA) may be the next mega-cap AI player Burry targets.

Why is Michael Burry shorting AI stocks?

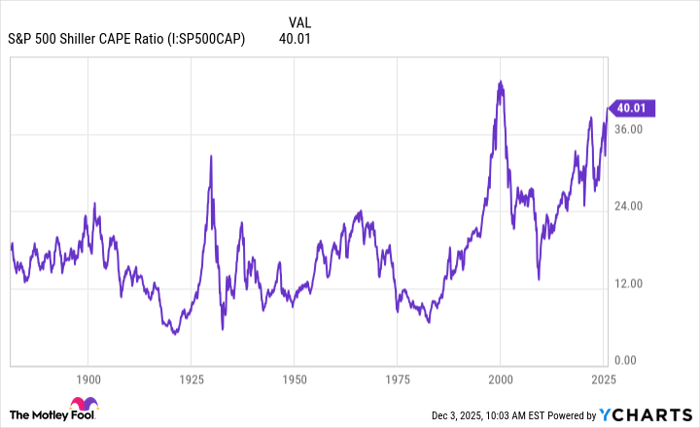

From a macro perspective, Burry's primary concern with artificial intelligence (AI) stocks revolves around frothy valuations. History would suggest that Burry's hunch is accurate.

A useful barometer for stock market valuation is the S&P 500 Shiller CAPE Ratio. As investors can see, the current level of 40 is inching closer to the levels witnessed just prior to the dot-com bubble burst in the late 1990s.

S&P 500 Shiller CAPE Ratio data by YCharts.

Among overvalued AI stocks, Palantir sticks out like a sore thumb. The company's price-to-sales (P/S) ratio of 113 and price-to-earnings (P/E) multiple of 403 are unsustainably high.

With regards to Nvidia, Burry is taking issue with some finer details -- particularly the accounting practices used by big tech. The product life cycle for the average Nvidia GPU is between 18 to 24 months -- at which point the chip designer generally releases new hardware.

While sifting through the notes in company filings, Burry discovered that Nvidia's largest customers -- namely, the hyperscalers -- are depreciating their AI infrastructure over time horizons of five or six years.

Given this is materially longer than the actual useful life of GPUs and servers, Burry thinks widespread accounting deceptions are taking place among big tech -- with Nvidia being particularly vulnerable.

What Burry is really arguing is that if big tech is depreciating their AI hardware over longer timelines than they should, then their earnings and profit metrics could be artificially propped up. In a scenario where revenue decelerates and gross margins tighten, then companies may choose to scale back their AI investments so that earnings don't take a material hit.

While these concerns are valid to some degree, I think Burry is a bit in the weeds on the accounting materials. Nvidia and its customers are audited by major public accounting firms, and each has more than qualified financial leadership in the executive suite.

Moreover, given Nvidia releases new chips every couple of years, it could be argued that this strategy is spurring greater demand for its hardware -- dispelling any concerns that the business is at risk.

What did Michael Burry just say about Tesla?

Burry's short positions in Nvidia and Palantir are not the only reason his name has been in the headlines lately. Following the public reveal of his bearish AI trade, Burry deregistered his hedge fund -- Scion Asset Management. Subsequently, he launched a paid newsletter on Substack.

When you are a hedge fund manager or registered investment advisor, regulators at the Securities and Exchange Commission (SEC) watch your public commentary and social media activity like a hawk. The reason is simple: The SEC assumes that you have outsize influence over the market, and so your comments could potentially be used as a mechanism to try and manipulate a specific stock.

While Burry must still abide by securities law, closing Scion to outside capital and launching a blog gives the investor more leeway in terms of sharing his thoughts and opinions in real time. A couple of days ago, Burry shared that he thinks Tesla is "ridiculously overvalued" and took issue with Elon Musk's new trillion-dollar pay package.

Image source: Tesla.

Is Burry right about Tesla?

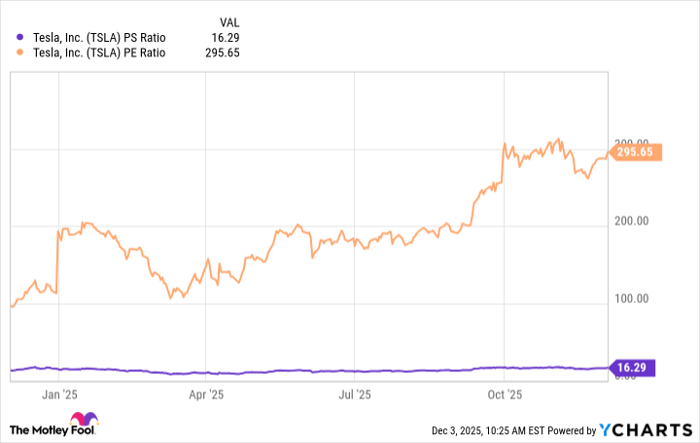

By traditional valuation standards, Burry is spot on when it comes to Tesla. The company's P/S ratio of 16 is abnormally high for a capital-intensive automobile business. Meanwhile, Tesla's P/E multiple is expanding even as the company's sales and profitability decline.

TSLA PS Ratio data by YCharts.

The reason Tesla boasts a premium valuation is because Musk's supporters -- and there are lot of them --are bullish on the company's AI ambitions across autonomous driving and humanoid robotics.

While robotaxis and Optimus each represent trillion-dollar market opportunities, both projects remain a moonshot right now. Neither product has reached commercial adoption nor is it moving the financial needle for Tesla. And yet, investors continue to cheer on the stock as if the company has achieved a meaningful AI breakthrough.

While Burry's issue with Tesla is merely an expression of an opinion, I think it could be a calculated move. Only time will tell if Burry reveals new trades. But given his recent moves and overall negative views of the broader AI landscape, I think it's quite possible Tesla could be his next big short.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $473,121!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $53,035!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $540,587!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, available when you join Stock Advisor, and there may not be another chance like this anytime soon.

See the 3 stocks »

*Stock Advisor returns as of December 1, 2025

Adam Spatacco has positions in Nvidia, Palantir Technologies, and Tesla. The Motley Fool has positions in and recommends Nvidia, Palantir Technologies, and Tesla. The Motley Fool has a disclosure policy.