1 Vanguard ETF I'm Buying in 2026 and Holding Forever

Key Points

As we head into 2026, now is a smart time to revamp your portfolio.

Investing in ETFs can be a simple way to generate long-term wealth.

The right growth ETF could potentially turn just $200 per month into $2 million with enough time and consistency.

- 10 stocks we like better than Vanguard Admiral Funds - Vanguard S&P 500 Growth ETF ›

The end of the year can be a fantastic time to evaluate your investing strategy, and sometimes that involves buying in new places.

Exchange-traded funds (ETFs) can be fantastic options for investors seeking a low-maintenance way to buy into specific sectors of the market. These investments require next to no effort on your part, but they can generate life-changing wealth over time. And there's one ETF I'm loading up on in 2026 and holding forever.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

A growth ETF that can hedge against volatility

Two of the more common types of ETFs are broad market ETFs and growth ETFs. Broad market ETFs, such as S&P 500 ETFs, track large indexes or the entire stock market. They tend to be lower-risk investments, but they can also only earn average returns over time.

Growth ETFs, on the other hand, are designed to beat the market. They can be more volatile in the short term with more substantial downturns, but they have the potential for much higher-than-average returns over time.

One ETF that aims to find a middle ground between these two is the Vanguard S&P 500 Growth ETF (NYSEMKT: VOOG). This fund tracks the S&P 500 (SNPINDEX: ^GSPC), but it only includes stocks from the index that show growth characteristics. Because companies in the S&P 500 are among the largest and strongest in the world, this ETF can help limit risk while also earning higher total returns.

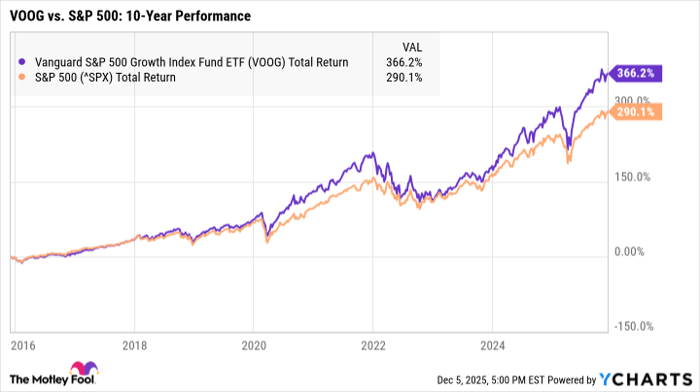

Over the last 10 years, for example, the Vanguard S&P 500 Growth ETF has outperformed the S&P 500 itself with total returns of just over 366%.

VOOG Total Return Level data by YCharts

In other words, if you'd invested $5,000 in each of these places 10 years ago, you'd have accumulated over $23,000 with the Vanguard S&P 500 Growth ETF versus around $19,000 with an S&P 500-tracking fund.

How much could you earn over time?

There are no guarantees in the stock market, so it can be tough to say how much you could earn with any investment. However, it can still be helpful to examine historical returns to estimate future earnings.

Since the Vanguard S&P 500 Growth ETF was launched in 2010, it's earned an average rate of return of 16.82% per year. For context, the market itself has earned an average return of around 10% per year over the last 50 years.

Let's say you can afford to invest $200 per month, and your investment could earn a 10%, 13%, or 16% average annual return. Here's approximately how your earnings would add up in each of those scenarios, depending on how long you have to invest:

| Number of Years | Total Portfolio Value: 10% Avg. Annual Return | Total Portfolio Value: 13% Avg. Annual Return | Total Portfolio Value: 16% Avg. Annual Return |

|---|---|---|---|

| 20 | $137,000 | $194,000 | $277,000 |

| 25 | $236,000 | $373,000 | $598,000 |

| 30 | $395,000 | $704,000 | $1,273,000 |

| 35 | $650,000 | $1,312,000 | $2,690,000 |

Data source: Author's calculations via investor.gov.

If this ETF continues performing at the rate that it has over the last 15 years, you could potentially earn well over $2 million after 35 years. Even if it underperforms going forward, it's still possible to become a stock market millionaire with enough time and consistency.

As with any investment, the sooner you get started and the more consistently you invest, the more you can earn. With just a couple hundred dollars per month, the Vanguard S&P 500 Growth ETF has the potential to transform your finances and build life-changing wealth.

Should you invest $1,000 in Vanguard Admiral Funds - Vanguard S&P 500 Growth ETF right now?

Before you buy stock in Vanguard Admiral Funds - Vanguard S&P 500 Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Admiral Funds - Vanguard S&P 500 Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $540,587!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,118,210!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 1, 2025

Katie Brockman has positions in Vanguard Admiral Funds-Vanguard S&P 500 Growth ETF. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.