Have $500 to Put to Work? Start With This Global ETF for Instant Diversification

Key Points

The Dimensional International Value ETF invests in undervalued stocks of developed countries.

Over the past year, the actively managed fund has outperformed passively managed funds.

The ETF also pays an attractive 3.1% dividend -- a nice bonus for investors who hold it.

- 10 stocks we like better than Dimensional ETF Trust - Dimensional International Value ETF ›

In investing, the benefits of diversification can never be overlooked. While it's perfectly OK to have a favorite stock, maintaining a well-rounded portfolio means you'll never find your finances falling off a cliff just because a single company or sector unravels.

That's one of the reasons why I like exchange-traded funds. Most of these hold baskets of stocks that provide instant diversification in a single asset. And you can always find an ETF that's just right for you -- there are about 4,300 of them available on U.S. exchanges.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

So, let's consider ETFs that will diversify your portfolio in a number of ways -- first, by getting you exposed to hundreds of stocks; and second, by exploring global markets (as it's way too easy to get overly exposed to companies that are located just in the U.S.)

Image source: Getty Images.

With a $500 initial investment, you can get multiple shares of an outstanding international fund that is absolutely killing it this year. And as an added bonus, it also pays an attractive dividend. Meet the Dimensional International Value ETF (NYSEMKT: DFIV).

About the DFIV ETF

There are a lot of international ETFs, such as the Vanguard Total International Stock ETF or the iShares Core MSCI Total International Stock ETF. Both are solid choices that are passively managed, duplicating the holdings of a specific index.

Not so with the Dimensional International Value ETF. This fund is actively managed by Dimensional Fund Advisors, a global investment management firm headquartered in Austin, Texas. It opened DFIV as a mutual fund in 1999 and then converted it into an ETF in 2021.

The stocks held in DFIV's portfolio are chosen with intention -- and they tend to get changed relatively often. As of its most recent update, the DFIV ETF had a 16% annual turnover in its holdings, while the Vanguard Total International Stock ETF's turnover was only 3%.

Currently, the fund holds 541 stocks, chosen to generate income while reducing federal income taxes on the returns by buying and selling stocks in a manner that minimizes the realization of net capital gains. The fund focuses on large foreign companies in developed nations only, excluding stocks from China, Taiwan, Brazil, and other emerging markets. And it looks for companies that fund managers believe are undervalued compared to their competitors.

The fund's current makeup includes 21.7% of its holdings from Japan, while 12.9% are from the U.K., 11.3% are Canadian companies, and 9% are in Germany.

|

Top 5 Holdings |

Portfolio Weight |

Sector |

|---|---|---|

|

Shell PLC |

3.0% |

Energy |

|

Toyota Motor |

2.1% |

Consumer cyclical |

|

Banco Santander |

2.0% |

Financial services |

|

TotalEnergies |

1.8% |

Energy |

|

HSBC Holdings |

1.2% |

Financial services |

Source: Dimensional Fund Advisors. Weightings as of Nov. 28, 2025.

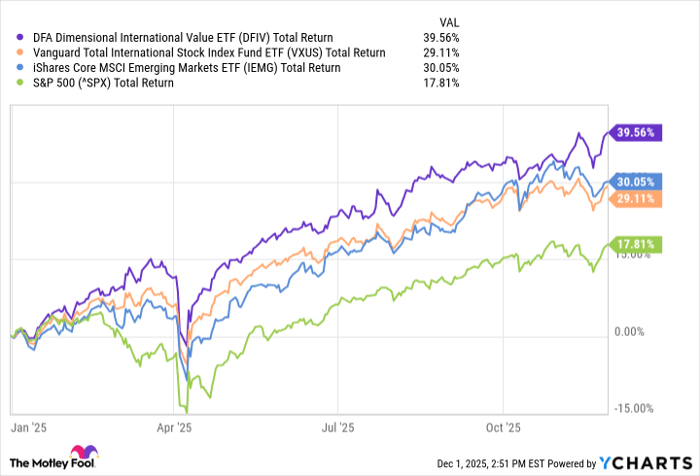

Its performance so far this year has been impressive, with a total return of 40%. That's substantially better than either the Vanguard or iShares passively managed funds, or the S&P 500. And that's what you want from an actively managed fund -- returns that are better than you could get with a passive indexing strategy.

DFIV Total Return Level data by YCharts.

Of course, the downside to active funds is that they are more expensive. The expense ratio of the Dimentional ETF is 0.27% -- pricey compared to the 0.05% fee of the Vanguard ETF or the 0.09% fee of the iShares ETF. But considering that on this scenario's initial investment of $500, that fee comes out to only $1.35 a year, it's cheaper than a cup of coffee at most places.

Why invest in the Dimensional International Value ETF?

While I really like the fund's performance and intentionality, I'm also a big fan of any fund that pays me to hold it. The DFIV ETF boasts a dividend that currently yields 3.1% -- money that you can either reinvest into the ETF to accelerate the growth of the holding, deploy into another investment, or use to cover your everyday expenses.

But the best way to invest in ETFs or any funds is to not only reinvest your returns, but also keep investing. By investing as little as $50 per month in this fund and reinvesting your dividends, you could easily grow your initial $500 into $9,000 in just 10 years.

That's an outstanding way to put a little money aside and let it work for you over the long term. With the DFIV ETF, you don't need a lot to start diversifying your portfolio into international markets. You just need consistency, time, and patience.

Should you invest $1,000 in Dimensional ETF Trust - Dimensional International Value ETF right now?

Before you buy stock in Dimensional ETF Trust - Dimensional International Value ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dimensional ETF Trust - Dimensional International Value ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $589,717!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,111,405!*

Now, it’s worth noting Stock Advisor’s total average return is 1,018% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 1, 2025

HSBC Holdings is an advertising partner of Motley Fool Money. Patrick Sanders has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard Total International Stock ETF. The Motley Fool recommends HSBC Holdings. The Motley Fool has a disclosure policy.