If You'd Invested $1,000 in the Technology Select Sector SPDR Fund (XLK) 10 Years Ago, Here's How Much You'd Have Today

Key Points

Stocks in the Technology Select Sector SPDR Fund (XLK) include Nvidia and Microsoft.

These stocks now consume a large portion of the broader benchmark S&P 500 index.

They are responsible for driving the market higher over the past three years.

- 10 stocks we like better than Select Sector SPDR Trust - The Technology Select Sector SPDR Fund ›

I don't need to tell investors that tech stocks have widely outperformed over the past decade. While it may have begun with software, the market has now rapidly shifted its attention to artificial intelligence, which is evolving at a lightning-fast pace.

The "Magnificent Seven" now consume a large portion of the broader benchmark S&P 500 index and are a driving force behind the index's collective earnings and performance over the past three years.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Nvidia.

Chip companies and data companies specifically designed to run AI applications have seen their stocks melt up in recent years. While valuations have come into question, even in the event of a significant pullback, tech investors are still likely to have performed well in the long term. If you'd invested $1,000 in the Technology Select Sector SPDR Fund (NYSEMKT: XLK) 10 years ago, here's how much you'd have today.

Crushing the broader market

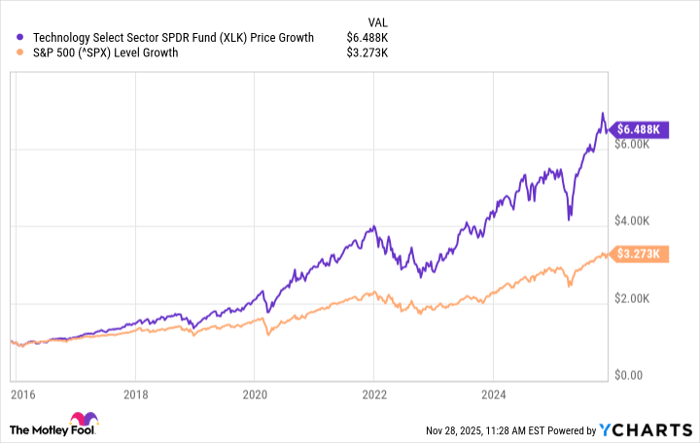

The XLK holds dominant positions in most of the major tech and AI stocks one would expect, including Nvidia, Apple, Microsoft, and Broadcom, among others. As a result, the XLK has hammered the S&P 500 over the past decade.

XLK data by YCharts

As you can see, an investor who allocated $1,000 of capital to the S&P 500 a decade ago would have over $3,270 today, representing a total return of 227%, which is still quite strong. However, had that investor put their money in the XLK, they would have close to $6,500 for a total return of 545%.

Should you invest $1,000 in Select Sector SPDR Trust - The Technology Select Sector SPDR Fund right now?

Before you buy stock in Select Sector SPDR Trust - The Technology Select Sector SPDR Fund, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Select Sector SPDR Trust - The Technology Select Sector SPDR Fund wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $580,171!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,084,986!*

Now, it’s worth noting Stock Advisor’s total average return is 1,004% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 24, 2025

Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.