1 Unstoppable Growth Stock to Buy and Hold for Years

Key Points

Taiwan Semiconductor will see growth regardless of who has the best AI model or most advanced GPU.

The company is launching a new technology that could address one issue from the massive AI buildout.

The stock is cheap considering its rapid growth rate.

- 10 stocks we like better than Taiwan Semiconductor Manufacturing ›

Finding top growth stocks and holding them while they capture their market opportunity is a fairly simple investing strategy that has worked for decades. The key is to identify a major growth trend and invest in a company that's a leader in that area.

There are few bigger trends in the stock market right now than artificial intelligence. AI hyperscalers are spending hundreds of billions of dollars to build out their computing capacity, and several companies are beneficiaries of that trend.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

One example is Taiwan Semiconductor (NYSE: TSM), the world's largest chip foundry. Also known as TSMC, the company is slated to make a ton of money from this buildout. It's one of my top growth stocks to buy and hold right now, and investors should scoop up shares before it goes on another monster run.

Image source: Getty Images.

Taiwan Semiconductor's market position makes it a top winner of the AI boom

Several companies are competing to provide the most powerful computing hardware for AI applications. So far, the primary winner has been Nvidia with its dominant line of graphics processing units (GPUs) designed specifically for AI workloads. However, Broadcom and AMD are also making big strides with each offering compelling alternatives in the high-performance computing space.

Regardless of which processor ultimately powers the AI industry, the chips likely trace back to Taiwan Semiconductor. There isn't a lot of competition at the cutting edge of chip production, mainly because TSMC has beaten out so many competitors thanks to its superior manufacturing capabilities. That doesn't look to be changing anytime soon, and with the company launching a new chip node, that trend is continuing.

One emerging problem in the AI buildout is energy consumption. It's no secret that AI data centers are energy hogs that are driving up energy prices around the U.S. Furthermore, there may come a time when data centers aren't able to come online due to a lack of energy on the grid.

There are several ways around this problem, and TSMC has one of its own. Its new 2 nanometer (nm) process node, which is entering production right now, offers 25% to 30% less energy consumption when configured to run at the same performance levels as previous generation 3 nm chips. These are significant performance gains, and they should allow AI hyperscalers to build data centers to expand compute capacity while reducing the growth in energy use.

With TSMC launching products that will help address one of the biggest obstacles to the AI buildout, I'm quite bullish on its future. And with chip demand so high, the company's revenue is rising rapidly, yet the stock doesn't trade for as high a premium as many of its fast-growing peers in the semiconductor industry.

Taiwan Semiconductor's stock doesn't carry a premium price tag

During Q3, TSMC's revenue rose 41% year over year in U.S. dollars. That places it among the fastest growing companies in the AI arms race, yet it trades at a price tag that is in line with the broad market.

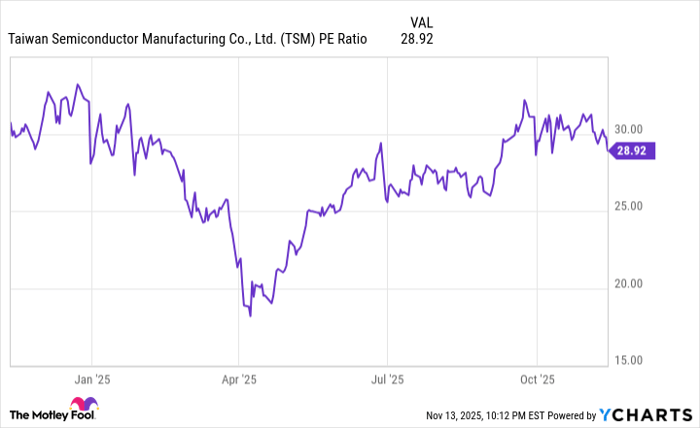

With a price-to-earnings ratio of 29, TSMC represents only a small premium to the S&P 500, which trades at 28 times earnings. That is very attractive given the growth it's reporting quarter after quarter.

Data by YCharts.

Taiwan Semiconductor is supplying the advanced chips needed by AI hyperscalers. For investors who are bullish on rising chip demand over the next few years, TSMC is a top candidate for a buy-and-hold stock.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Keithen Drury has positions in Broadcom, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.