Better Dividend Stock: AGNC Investment vs. Federal Realty

Key Points

AGNC Investment has a huge 14% dividend yield.

Federal Realty has a significant dividend streak, spanning more than 50 years.

If you need reliable income to fund your retirement, you should look deeper than dividend yields.

- 10 stocks we like better than AGNC Investment Corp. ›

One of the big problems investors face is confirmation bias. Confirmation bias is essentially seeing only the positive aspects you want to see and ignoring the negative aspects of an investment. For dividend lovers, that often manifests itself in a myopic focus on dividend yields. That's the significant risk to consider when evaluating AGNC Investment (NASDAQ: AGNC). Comparing it to Federal Realty Investment Trust (NYSE: FRT), a far more reliable dividend stock, will help clarify the point.

AGNC trumps Federal Realty on yield

If all you consider is dividend yield, you'll pick AGNC Investment over Federal Realty every day of the week. AGNC Investment's yield is a huge 14% or so. Federal Realty's yield is a much less exciting 4.5%. Before you decide that AGNC Investment is the better real estate investment trust (REIT), consider some additional yield facts.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

The average REIT has a yield of roughly 3.9%, using Vanguard Real Estate Index Fund ETF as a proxy for the sector. Federal Realty's yield is lower than what you'd get from AGNC, but it is notably higher (15%, to be precise) than what you would collect from the average REIT. Also, Federal Realty's yield, while not the highest it has ever been, is toward the high end of the stock's yield range over the past decade. Thus, it looks historically attractive for the REIT.

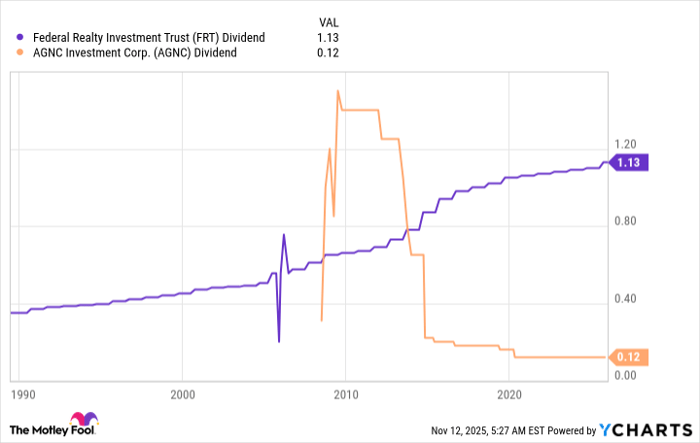

Then there's the dividend itself to consider. Federal Realty's dividend has been increased every single year for 58 consecutive years. That makes the REIT a Dividend King. It is the only REIT to have upped its dividend for 50 or more years in a row. Federal Realty is a foundational investment if you are trying to live off the income your portfolio generates. AGNC Investment's dividend has been trending lower for more than a decade. And historically speaking, it has been highly volatile, rising and falling over time (though mostly falling).

FRT Dividend data by YCharts

AGNC is a unique investment

The primary difference between these two REITs lies in their objectives. Federal Realty is relatively straightforward; it acquires strip malls and mixed-use development properties. Its stated mission is "to deliver long-term, sustainable growth through investing in communities where retail demand exceeds supply." The board of directors determines the dividend policy, but clearly, the growth focus here includes the dividend.

AGNC Investment is a mortgage REIT (mREIT), which is a more complex business model. It buys mortgages that have been pooled together into bond-like securities. Interest rates, housing market dynamics, and mortgage repayment trends all play a role in the value of its mortgage securities, which are, effectively, the value of the business. In many ways, AGNC is run similarly to a mutual fund, which is noteworthy because the company's stated goal is "favorable long-term stockholder returns with a substantial yield component." That is, basically, total return.

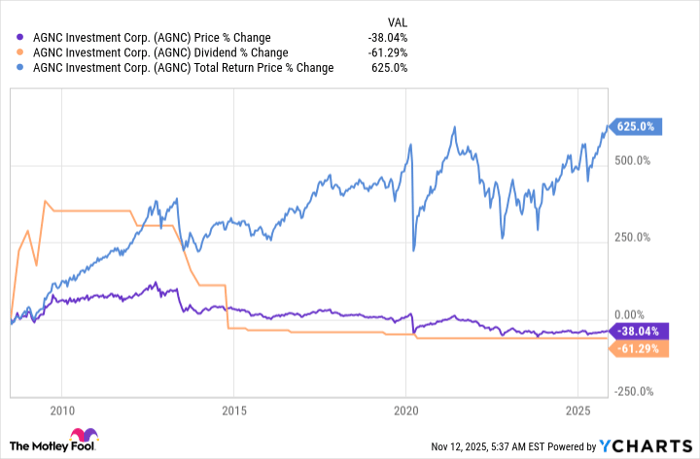

There's nothing wrong with focusing on total return, but that performance metric requires the reinvestment of dividends. From a total return perspective, AGNC Investment has performed very well as a business. However, if you used the dividends to pay for living expenses, you would have been left with less income and less capital, since the price of the stock has largely tracked the dividend over time.

AGNC data by YCharts

Most dividend investors are likely seeking stocks with large yields backed by reliable and hopefully growing dividends. That's not what AGNC has to offer, but it is what Federal Realty is currently providing. Stretching for yield with AGNC and ignoring the basic facts of the business could be a big mistake.

Go with Federal Realty if you need income

If your goal is total return, then by all means buy AGNC Investment. That's what the mREIT is trying to achieve, and your goals and the company's goals will align well. If what you really want is dividend income that you can spend, however, Federal Realty's lower yield will be far more attractive. But don't discount Federal Realty's yield; it is historically attractive and higher than average for a REIT.

Should you invest $1,000 in AGNC Investment Corp. right now?

Before you buy stock in AGNC Investment Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AGNC Investment Corp. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Reuben Gregg Brewer has positions in Federal Realty Investment Trust. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.