The Good, the Bad, and the Ugly From Earnings Season

Key Points

Tariff costs are trending lower, and the U.S. administration is extending relief.

Tesla is in a major transition moving towards AI, robotics, and self-driving vehicles.

Gross profit was the big difference between earnings at two young automakers.

- These 10 stocks could mint the next wave of millionaires ›

The automotive industry has seen its share of speed bumps this year. The electric vehicle (EV) industry is facing a whipsaw effect for demand as people rushed to buy EVs before the $7,500 U.S. federal tax credit expired at the end of September, leaving a lull in demand during the fourth quarter. Meanwhile, all automakers are dealing with the effects of tariffs and trade policy changes. Amid all the chaos, the automotive industry had some intriguing takeaways during earnings season.

Tariffs cost less than anticipated

Easily one of the biggest developments of the year was the implementation of tariffs on imported vehicles and automotive parts in the U.S. Decisions in the automotive industry reflect strategies that are developed over years, and the implementation of tariffs added costs and required automakers to consider how and where they design, produce, and assemble vehicles. General Motors (NYSE: GM), for example, decided to invest $4 billion in its U.S. manufacturing plants to increase domestic production capacity.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: General Motors.

The implementation of tariffs was expected to add billions to costs, but the good news is that while it still had a significant effect, it was less than originally feared. General Motors now expects tariffs to cost the company between $3.5 billion to $4.5 billion, or $500 million less than originally estimated. Meanwhile, crosstown rival Ford Motor Company (NYSE: F) halved its tariff cost estimate, from $2 billion down to $1 billion.

The broader takeaway for investors is that the administration appears willing to help give additional tariff relief to automakers, which is welcomed.

Valuation based on the future

Tesla (NASDAQ: TSLA) has had a rollercoaster year, with its share price initially spiraling lower due to backlash from CEO Elon Musk's political ambitions, and declining sales and profits. Then it rebounded significantly, driven by hype for its potential lucrative future in artificial intelligence (AI), robotics, and robotaxis. That said, investors have to realize Tesla's current valuation is based in another world. It has a price-to-earnings ratio of 294 times and a market capitalization of $1.4 trillion, which is more than General Motors and Ford combined 10 times over.

Perhaps furthering the hype, Musk appeared with Optimus robots in front of investors recently and pumped up the future of Tesla. "I think it's going to be the biggest product of all time by far," Musk said, according to Automotive News. "Things do get kind of wild from an economic standpoint because with AI and robotics you can actually increase the global economy by a factor of 10 or maybe 100."

Musk also recently had his potentially lucrative 10-year $1 trillion pay package accepted by shareholders with a 75% approval.

Not all EVs are alike

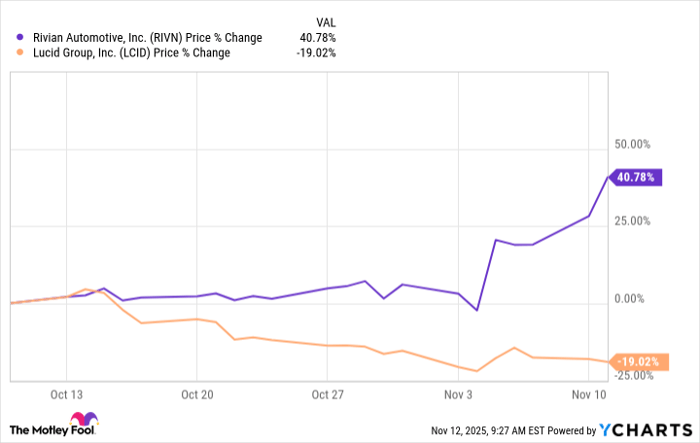

Rivian (NASDAQ: RIVN) and Lucid (NASDAQ: LCID) are both young EV makers trying to carve out their piece of the growing EV pie. Investors can be forgiven for being a little confused by both automakers' earnings reports. On one hand, Lucid has posted seven consecutive quarters of record deliveries, while Rivian has seen stagnating deliveries as the company waits for its next vehicle launch in 2026. On the other hand, Rivian's stock has soared over the past month while Lucid has spiraled.

RIVN data by YCharts.

Rivian topped estimates on both the top and bottom lines with adjusted loss per share of $0.65 on revenue of $1.56 billion compared to estimates of an adjusted loss of $0.72 per share on revenue of $1.5 billion. But the key number that sent shares soaring was Rivian's gross profit of $24 million, compared to estimates calling for a $38.6 million loss per FactSet. Gross profit is a key indicator of Rivian's ability to eventually reach profitability.

Lucid, despite its recent momentum with record deliveries, missed estimates on both the top and bottom lines. It had an adjusted loss of $2.65 per share on revenue of $336.6 million, compared to estimates of an adjusted loss per share of $2.27 on revenue of $379.1 million.

What it all means

The automotive industry has navigated choppy waters when it comes to tariff implementation and trade policy changes, and the administration has shown willingness to extend tariff relief. Both General Motors and Ford now expect their tariff costs to come in below initial fears. Tesla investors have to revisit their investment thesis, because the company is transitioning to a tech-centric company dipping its toes into AI, robotics, and robotaxis. Young EV makers are complicated, and you can't only look at production and deliveries, as Lucid and Rivian made clear with their recent momentum and results.

All in all, while EV makers will have a bumpy couple of quarters, the broader automotive industry is humming along nicely for investors.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $493,221!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $51,823!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $599,784!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, available when you join Stock Advisor, and there may not be another chance like this anytime soon.

See the 3 stocks »

*Stock Advisor returns as of November 10, 2025

Daniel Miller has positions in Ford Motor Company and General Motors. The Motley Fool has positions in and recommends Tesla. The Motley Fool recommends General Motors. The Motley Fool has a disclosure policy.