President Donald Trump Wants to Give Low- and Middle-Income Americans a $2,000 Tariff Stimulus Check -- but It Would Come With Unintended Consequences

Key Points

Despite numerous policy changes under President Trump and his administration, the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite have all rallied to record highs in 2025.

In a post on Truth Social, President Trump outlined an informal plan to provide at least a $2,000 stimulus payment to taxpayers -- sans high earners -- funded by tariffs.

The short-term benefits of Donald Trump's proposal would be heavily outweighed by the damage it may cause to the U.S. economy.

- 10 stocks we like better than S&P 500 Index ›

In less than seven weeks, when the stock market crosses the finish line for 2025, we're likely to look back on another phenomenal year for Wall Street. The widely followed S&P 500 (SNPINDEX: ^GSPC), ageless Dow Jones Industrial Average (DJINDICES: ^DJI), and growth stock-dominated Nasdaq Composite (NASDAQINDEX: ^IXIC) have all rallied to multiple all-time highs this year.

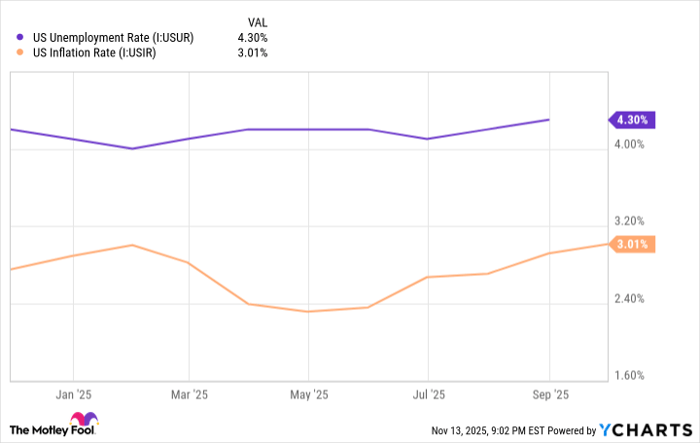

What makes these eyebrow-raising gains even more impressive is that they occurred amid a modestly climbing unemployment rate, a recent uptick in the prevailing rate of inflation, and the longest federal government shutdown on record, which officially came to an end on Nov. 12.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

However, President Donald Trump may not be done exerting his policy influence over the U.S. economy and equity markets.

President Trump delivering remarks. Image source: Official White House Photo by Shealah Craighead, courtesy of the National Archives.

Last week, the president dangled an informal tariff stimulus check proposal that had social media message boards, along with some taxpayers, buzzing with excitement. However, what Donald Trump may not realize is that his potential plan to put more money into the pockets of American citizens would come with several unintended consequences.

President Trump wants to dole out $2,000 tariff stimulus checks

Since taking office for his non-consecutive second term, President Trump and his administration have enacted some meaningful changes. For example, the Social Security Administration has become leaner following layoffs, and the clawback rate tied to Social Security overpayments was raised to 50% from the 10% it stood at during Joe Biden's presidency.

Trump also oversaw the passage of his flagship tax and spending law, the "big, beautiful bill." This legislation made the individual tax brackets under Trump's prior tax and spending law, the Tax Cuts and Jobs Act, permanent. It also introduced a handful of short-term tax breaks for select workers receiving overtime pay and tips.

However, the president's most profound mark might be his tariff and trade policy. In early April, he unveiled a sweeping 10% global tariff rate and announced higher "reciprocal tariffs" on dozens of countries that have adverse trade imbalances with the U.S.

Now, President Trump aims to put cash directly into the hands of Americans via a tariff stimulus check. The post below on social media platform X (formerly Twitter) provides a snapshot of Trump's Truth Social post from Nov. 9 outlining his proposal.

BREAKING: President Trump announces that he will be paying a "tariff dividend" of at least $2,000 per person.

-- The Kobeissi Letter (@KobeissiLetter) November 9, 2025

Stimulus checks are officially back. pic.twitter.com/Dt4UgHVMrT

The thesis behind a tariff stimulus check is simple: It puts money into the pockets of the public, which would, presumably, flow to American businesses. This should bolster economic activity and potentially prop up a recently weaker job market. We witnessed similar tactics play out during the COVID-19 pandemic in the form of fiscal stimulus checks from the federal government.

While the prospect of most taxpayers receiving up to $2,000 might sound tantalizing on paper, this (as of now) informal proposal would come with some potentially dangerous consequences.

Image source: Getty Images.

Donald Trump's tariff stimulus can make things worse in a variety of ways

To begin with, it's unclear whether enough tariff revenue is being brought in for the president to make good on his proposed payment of "at least $2,000 a person" to qualifying individuals.

Although we don't yet know the qualifying factors of this loose proposal, custom duties revenue totaled about $195 billion in fiscal year 2025 for the U.S. government (the fiscal year ends on Sept. 30). With tariffs expected to raise only in the neighborhood of $200 billion annually for the federal government over the next decade, according to an analysis from the Budget Lab at Yale, the cost to pay this stimulus could be more than the tariff revenue collected in a given year.

The second issue, which might be the most concerning of all, is the potential for tariff stimulus checks to reignite the prevailing rate of inflation. A rapid increase in M2 money supply during the COVID-19 pandemic sent the prevailing rate of inflation soaring to a four-decade high of 9.1% in October 2022.

A January 2023 published study on the Federal Reserve Bank of St. Louis' website ("Demand-Supply Imbalance during the COVID-19 Pandemic; The Role of Fiscal Policy") details the effects of COVID-19 fiscal policy on consumption and price stability. This analysis suggested that fiscal stimulus during the pandemic boosted the prevailing rate of inflation by "about 2.6 percentage points." More than likely, we'd witness similar inflationary pressures from a tariff stimulus check.

Another very real concern if President Trump were to move forward with this proposal is what happens six to 18 months later when the stimulus checks have been spent or tucked away? This stimulus would, in all likelihood, provide a short-term boost to U.S. economic activity and employment, but the snap-back could prove problematic.

The U.S. unemployment rate and U.S. inflation rate have both been creeping higher. US Unemployment Rate data by YCharts.

With the assumption that tariff stimulus checks would increase the prevailing rate of inflation, which is already happening with Trump's tariff and trade policy, we could witness the puzzle pieces for stagflation falling into place. This is a scenario where inflation and unemployment are rising while economic growth remains stagnant or is contracting. Stagflation is a nightmare scenario for the Federal Reserve because there's no easy way to fix it.

Last but certainly not least, Donald Trump's tariff stimulus check overlooks the elephant in the room: America's ballooning national debt. It's already unclear whether tariff revenue can reduce the annual federal deficits that are driving up U.S. national debt. If the president were to use up some or all of the annually collected tariff revenue for a stimulus payout, it would make the U.S. debt situation that much more precarious.

While President Trump's informal plan may be well intentioned, it would likely cause far more problems over the long run than it would resolve in the short term.

Should you invest $1,000 in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.