The Smartest Growth Stock to Buy With $500 Right Now

Key Points

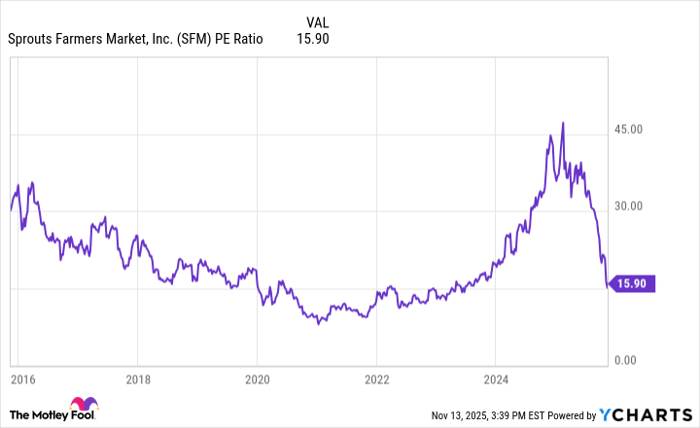

Sprouts Farmers Market is a cheap stock again after its Q3 earnings drop.

The company can keep expanding its natural grocery chain and return cash to shareholders.

The stock now trades at a P/E ratio of 16.

- 10 stocks we like better than Sprouts Farmers Market ›

Today, it feels like all the market can focus on is technology and artificial intelligence (AI). But that is only a small sliver of the public companies available to investors in the stock market, with most of them trading at premium valuations and therefore unappealing to value investors anyway.

Contrarians should look beyond AI to cheaper sectors of the market, where you can find growth stocks trading at reasonable prices.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

One promising stock in a current drawdown is Sprouts Farmers Market (NASDAQ: SFM). Here's why the grocery store chain is a cheap-looking growth stock that is a smart buy for investors with $500 right now.

Image source: Getty Images.

An organic positioning in grocery

Sprouts Farmers Market has its roots in Southern California and Arizona as a health-focused grocery chain. Instead of high stacked aisles of national consumer brands, Sprouts focuses on an open layout of its stores, putting produce and bulk goods in the center of the action, while serving niche consumer packaged goods brands that lean toward dietary-specific categories.

Staying within this niche has allowed the company to succeed in the competitive grocery space that is dominated by huge players such as Walmart and Costco. It targets the exact opposite of a big-box customer -- more educated, higher income, and focused on health -- that shops at a Sprouts Farmers Market store for their everyday grocery needs. Instead of the big name brands, shoppers can find hundreds if not thousands of items from small farmers and food product companies, making it a new adventure every time you visit a location.

This positioning has allowed the brand to expand nationally. It now has 464 stores, and management believes it can target more than 1,000 stores eventually in the United States alone. With store count growth and recent healthy comparable-store sales growth measuring revenue growth from existing locations, Sprouts has grown its revenue by a cumulative 141% in the last 10 years.

Improved management and capital returns

Before the COVID-19 pandemic, Sprouts was struggling with compressing profit margins. It decided to bring in a new leadership team, helmed by former leader of U.S. grocery for Walmart, Jack Sinclair. By improving its supply chain, reducing store theft, and eliminating heavy discounts through physical mail advertisements, Sprouts has greatly improved its profit margins. Over the last 12 months, operating margin hit a record 7.84%.

With strong store-level unit economics, Sprouts Farmers Market generates a lot of cash even as it reinvests into expanding its store count. Over the last 12 months, it generated $458 million in free cash flow. Management has smartly used this cash flow to repurchase its own stock, bringing shares outstanding down by 36% in the last 10 years. This has been a boost to earnings per share (EPS), which has grown by an astonishing 522% in the last 10 years alone.

SFM PE Ratio data by YCharts

Why Sprouts Farmers Market is a cheap growth stock today

After guiding for a slowdown in same-store sales growth, Sprouts Farmers Market stock slipped more than 20%. The stock has quickly fallen 54% from all-time highs. This slowdown in same-store sales growth can be explained by the fact that last year's comparable-store sales growth came in at record highs above 10%, creating a tough comparison to 2025. Over the long term, Sprouts expects same-store sales growth in the low single digits.

Sprouts stock is cheap today and a great growth stock to buy simply because it can keep replicating its formula of the last 10 years. It can expand its store presence in the United States, steadily grow revenue at existing stores, expand its profit margin at greater scale, and plow cash flow into share buybacks. With a current price-to-earnings ratio (P/E) of 16, this stock looks like a much better buy than the high-flying AI names with nosebleed earnings multiples. Consider buying Sprouts stock with $500 and holding for the long haul.

Should you invest $1,000 in Sprouts Farmers Market right now?

Before you buy stock in Sprouts Farmers Market, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sprouts Farmers Market wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale and Walmart. The Motley Fool recommends Sprouts Farmers Market. The Motley Fool has a disclosure policy.